In the emerging private health insurance exchange market, some blue-chip companies are pioneering their way through a space that was seen as transformative just a few short years ago. The expectation was that it would become a mainstream offering across active employee populations. But most of corporate America is still on the sidelines, waiting to see what transpires.

Meanwhile, a growing portion of small and midsize firms are reaping the benefits of more nimble technology platforms that simplify shopping for coverage, administering plans, containing costs and achieving better outcomes. However, lobbyists and small-business owners alike are frustrated by what they see as regulatory limits and market inefficiencies.

When it comes to strategic objectives, experience and plan design, there are probably “more similarities than differences” between the use of private exchanges among small vs. large employers, believes Paul Fronstin, director of the Employee Benefit Research Institute’s Health Research and Education Program. Common pursuits include controlling costs, expanding choice and making premiums more transparent.

Where they largely differ, due to budget constraints, is smaller employers gravitating toward a single-carrier exchange and large employers adopting the multi-carrier model or self-insuring their risk, Fronstin says.

Another key contrast is employee engagement in the decision-making process. “I can see the smaller businesses really getting a turnkey solution where they don’t need to do much, whereas a larger business may get much more involved in things like picking the plans that are available, plan design and contracting,” says Fronstin.

Indeed, product designs and off-the-shelf rates have become standardized in the small and midsize group market, notes Jonathan Rickert, CEO of Array Health, an independent provider of private insurance exchange technology that targets this space.

Waiting game

Since the private exchange market is now brimming with a conservative estimate of at least 150 players, “employers are taking a longer time to assess which exchange is right for them,” notes Barbara Gniewek, a principal in the healthcare practice of PwC who oversees the Private Exchange Evaluation Collaborative. The group’s mission is to provide unbiased information to employers.

Once there is greater movement among well-known companies, she believes, there will be “an uptick” in adoption, which could take place within the next 12 to 18 months.

“Larger business may get much more involved in things like picking the plans that are available, plan design and contracting.”

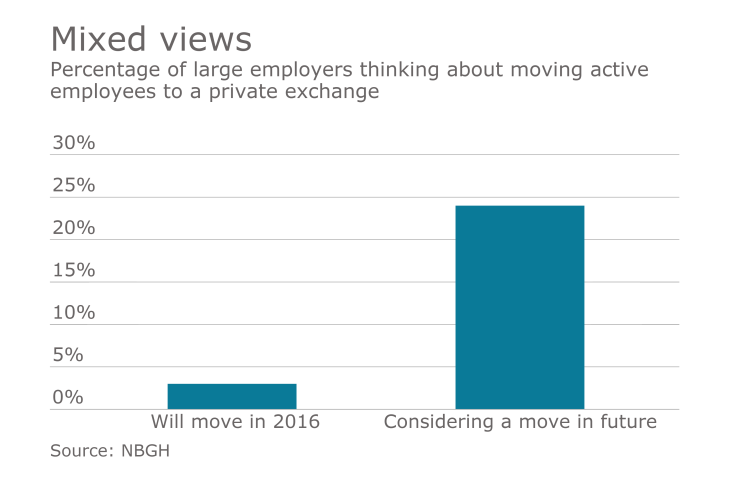

But most large employers aren’t looking at a private exchange for their active populations at this time, according to surveys by the National Business Group on Health. Steve Wojcik, the group’s VP of public policy, says interest among members is largely confined to the retail or hospitality sector. About 25% to 30% of them, however, are considering it somewhere down the road.

“This is a relatively new development as an option for large employers, so I think they want to see a proven track record of value, both in terms of lower costs and increased affordability,” he says. Other areas of interest include administration and customer service.

Bruce Sherman, medical director, population health management, for the RightOpt private exchange offering for Buck Consultants at Xerox, understands the reluctance to embrace this new model, but he’s bullish about the prospects.

“I think we need more evidence of the measurable value before there will be a greater employer uptake of private exchanges,” he says, “but I’m personally convinced that this is a path that the marketplace has begun and I think will continue to grow and evolve and mature.”

Trickle-down market

Employers of all sizes have been cautious about switching to private exchanges. Fronstin believes EBRI’s prediction of about 10 million to 13 million enrollees by 2020 is in line with the market reality.

There are a number of possible explanations for what could be perceived as slow growth. One is that most employers would rather see how the trend turns out than to be trailblazers, Fronstin says, adding that “most major trends in benefits didn’t happen overnight.”

Another reason is that many larger employers don’t need a private exchange to offer their employees more choices – a key feature of this healthcare delivery system. Conversely, it’s this very issue that Fronstin believes will draw smaller firms to private exchanges.

“There was a lot of confusion as to what the pricing would be.”

At roughly 8 million enrollees in various private exchanges, the midsize segment of 100 to 2,500 employees is fueling much of that growth, Rickert explains. A huge selling point is simplicity. Employers are hoping to make the daily management of qualified life events and the annual renewal process much easier, largely by replacing complex legacy systems with flexible and user-friendly platforms.

“These private exchanges have gotten so sophisticated now that what a midsize group sees is very similar to what a larger group sees,” he notes. “What’s been really fun to watch for the last couple of years is seeing the quality of the user experience improve dramatically for even the smallest of employers.”

Unlevel playing field?

But there are other considerations to weigh when assessing the impact of private exchanges in this sector. One Washington insider sees an uneven playing field. A major barrier to adoption among small businesses is that the IRS has prevented them from using private exchanges in the way larger businesses do, according to Kevin Kuhlman, manager of legislative affairs at the National Federation of Independent Business. The culprit: barring stand-alone health reimbursement arrangements (HRAs) for active employee populations.

“There are some insurer exchanges and some broker exchanges, but not the same opportunities as the large, third-party administrator exchanges,” he notes.

Still, he’s optimistic that there could be legislative relief if enough small businesses sound off to members of Congress “about the negative impact of the HRA prohibition.” Without such a change, he believes, interest in private exchanges will continue to be tepid.

Most employers on the active-employee exchanges Gniewek works with “aren’t offering just a straight HRA,” which is more popular on the retiree side. “It’s much more offering a myriad of high-deductible plans, more with HSA options,” she says. More than half of employers are now offering HDHPs and a significant percentage are doing it as a full replacement, Gniewek notes.

Several years into the Affordable Care Act, there still aren’t many affordable options for the small-business community. For example, using a Small Employer Health Options Program in transitioning to plans that are fully compliant with the ACA would likely increase costs between 20% to 40%, Kuhlman observes.

One unhappy customer

The experience of shopping for coverage has jaded Paul Downs, the owner of a small business in Bridgeport, Pa., who has blogged about it in the New York Times. “I think that I am typical of many smaller employers who offer healthcare primarily in order to do a good thing for their employees,” he says. Some of the 20 people at Paul Downs Cabinetmakers, Inc. have worked with him for decades.

Like other small-business owners, he’s at the mercy of whatever products are offered locally. A longtime customer of Independence Blue Cross “because they’re just basically the cheapest one in this market,” Downs decided on a private exchange option called Blue Solutions that was being rolled out in late 2012.

Private benefit exchanges expect massive growth in the next few years. These executives from all parts of the industry are leaders in the space, forecasting trends and serving as ushers for what some are calling a new era of health care.

He says the 10 plans from which small-business employees initially could choose were cut in half during Blue Solutions’ second year of operation. Moreover, he claims, “most of the features that made it sort of employee-friendly never appeared. And at the same time, there was a lot of confusion as to what the pricing would be and how the agents would communicate what the choices were. I actually ended up writing a pretty complicated spreadsheet of my own that allowed me to evaluate the choices that we gave to my people.”

Brett Mayfield, vice president of sales for Independence Blue Cross says that group customers with up to 50 employees are offered 43 Blue Solutions plans that meet the requirements of the ACA. “Employers have the option of selecting up to three separate plans for their employees to choose from,” he said in a statement. “We make every effort to offer the same plans year-after-year, along with a consistent network of hospitals and healthcare professionals — the largest in our region. However, each year we must also evaluate our plans to ensure they comply with the ACA, which may result in some changes for our customers.”

And, when issues do arise, “we do everything we can to get to the best resolution possible,” said Mayfield. “It’s our priority to move quickly, resolve all issues, and deliver the best possible customer experience within the regulations of the ACA.”

On the large employer side of the market, exchange solutions often have the luxury of budgets and resources to pursue deeper innovation. Sherman credits RightOpt’s use of strategic clinical data with forming two critical building blocks for effective health care consumerism: individual well-being and engagement. He characterizes the exchange as an integrated platform whose tools and resources help people improve lives.

“We really went to a much more consumer-oriented approach with our employees,” reports Peter Dowd, SVP of HR at Xerox, a RightOpt customer with nearly 100,000 employees worldwide.

That effort included a commitment to paying a large portion of employee healthcare costs, but with more of an emphasis on personal responsibility. The company recognized years ago that it needed to think in a “much more holistic way in terms of the expectations that we set with our employees” rather than simply shift costs, he explains. With the help of lifestyle coaching and advocacy, the hope is to drive productivity and overall business success.

“I made a brave choice, and I’ve put a ton of hours into explaining that to my employees.”

Of about 70,000 RightOpt enrollees, 38,000 are employees and 32,000 are dependents. Although RightOpt is owned by Xerox, Big Blue wasn’t its first client, nor was it sold on the premise of the private exchange early on.

Dowd, who has been with Xerox for more than 27 years, says the company finally came on board after developing a better understanding of the model and its capabilities. The tipping point was about five or six years ago when Xerox sought more meaningful ways to mitigate its skyrocketing employee healthcare costs.

“We’re working with the RightOpt team on getting more hard analytics on the outcomes that we’re beginning to see as a result of having had this kind of program in place for a few years,” Dowd says.

Given the choice between offering a flawed private exchange option, which has consumed too much of his valuable time, and not offering healthcare coverage at all, Downs faced a Faustian dilemma. “I’m in this deteriorating environment where I made a brave choice, and I’ve put a ton of hours into explaining that to my employees,” he says, noting how 39 different plans were reviewed this year. The bottom line, he says, is that it’s important to leverage pretax dollars for his employees.

As a small-business owner, Downs is frustrated that he lacks the power to bargain with insurance companies, regardless of whether coverage is offered on or off a private exchange. “It’s just ridiculous that there is no real choice in this market,” he says.