Employers are looking to move beyond wellness programs that focus solely on obesity, diabetes and exercise to a holistic well-being approach that focuses on emotional and fiscal health.

The overall well-being of employees — from student debt relief programs for millennials to work-life balance — is spurring employers to look for new vendors that offer more than traditional wellness programs. These were the findings of a recent trend study of 114 benefit consultants of 33 consulting firms conducted by Shortlister, an HR solutions firm.

In its “

The reason for this wellness to well-being migration is beneficial on the part of employers: To attract new talent, especially Millennials, and retain the best employees.

“People are looking at how they can get their employees engaged, productive and happier at work. How do you take those things and get them to merge together? How do you provide resources to your employees to make them happier so that they have a more balanced life?” says Joe Miller, president of Shortlister.

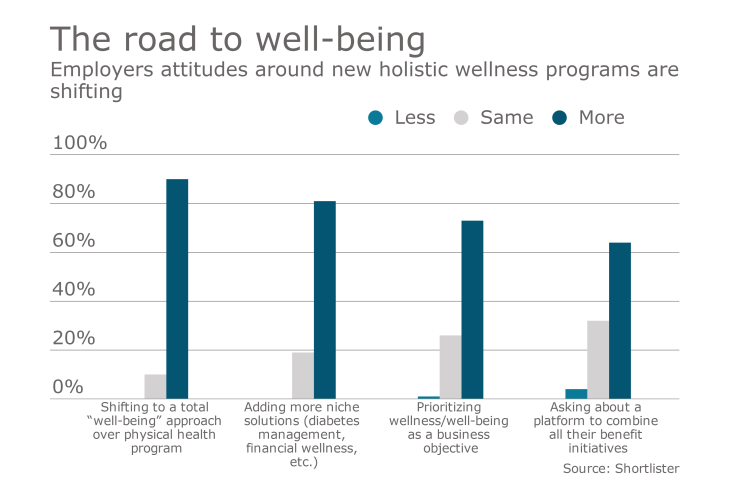

The study found that 73% of respondents are prioritizing wellness/well-being as a business objective, while 26% are taking the same measures as last year. However, 48% of respondents say that they are unlikely to hire a third-party administrator for well-being programs while 43% expressed interest in a TPA for well-being.

Loyalty appears to be strong. The survey found that 57% are staying with the same wellness vendor while 34% are moving to a new one.

The wellness sector responds

As a wellness professional for the past 10 years, Miller says that the wellness industry landscape has undergone profound changes in the last four years.

“More people are looking at stress resilience programs and financial wellness programs and how they can get these to their clients and employees,” says Miller. “What I see happening is really the whole field of engagement where traditional wellness and these aspects not directly related to wellness are starting to merge.”

Vendors are starting to tailor their offering to employers that are curious about well-being programs. For example, vendors are moving away from offering a cookie-cutter approach to well-being and expecting that the end user will not notice the similarities.

“Vendors are starting to specialize a lot more and a few of the more progressive vendors are starting to be more of a communications hub and link to all the different resources that employees have at their disposal. So, if you've got diabetes and I have depression for example, there are different resources for each of us,” says Miller.

Clarity is key, says Miller. “How do we take the benefits we provide to you and not make this confusing? Maybe [employees currently use] something that has different logins or that you need to get into seven different websites that have four different messages being provided — it's just been too much and too confusing.”

When asked if employers are offering well-being offerings to their workers in lieu of bonuses and pay raises, Millers says this is a push that started with newer Silicon Valley companies that offered enticing benefits to lure workers away from other, more established technology firms.

“That’s where they are looking to attract and retain the best employees and to keep up with the best companies that are out there. Now you really have to start doing these things,” says Miller. “A lot of what's driving it is more millennials in the work force and the fact that when they're looking at jobs they are looking for flexible work hours, positive work environments and the kinds of things they all have. This drives into the financial wellness aspect of it.”