Financial incentives don’t govern employee plan participation as strongly as does finding the plans most tailored to their needs, according to a national benchmarking study from Wells Fargo Insurance.

Consequently, employers could realize savings by cutting off contributions to those plans, and drive bigger behavior changes by building a holistic culture of wellness through C-suite-level behavior.

“These were the biggest surprises to us from the study,” says Dan Gowen, national practice leader with Wells Fargo Insurance’s Employee Benefits National Practice.

The company analyzed more than 1 million employee lives at 1,000 U.S. employers in its 2016 Benefit Analytics and Benchmarking Study.

Also see: “

The study found no relationship between the amount of employer-funded HSA dollars and the percentage of employees enrolled in a plan. Furthermore, the study also observed no relationship between the size of a financial incentive opt-out and the percentage of eligible participants who waived it.

“Cash or cash-equivalent savings were not driving behavior,” Gowen says. “By putting some incentives into that HSA account, it’s not going to ultimately drive people to select that plan.”

Shifting expectations

The behavior might be attributable to a generational shift in the workforce to employees who expect to pay more for their health benefits, or to have less of their costs covered, and who are choosing instead to make a smaller monthly contribution to health savings accounts, Gowen says. Alternatively, he adds, individuals may be willing to shoulder greater risk in exchange for that lower upfront cost.

Therefore, companies that focus on implementing wellness initiatives from the top down, and that more closely align their benefit offerings with insurer incentives, are likely to drive more significant premium savings.

“Those types of activities that fall into that culture of health, whether it’s smoking cessation programs, fitness centers, walking trails, really does have an impact on the premium that the employer pays for those medical plans,” Gowen says. “It’s also providing additional resources to help employees understand all the different things that might impact their health [and] taking advantage of the resources that the insurers offer.”

Better supporting activities that directly affect employee behavior in the form of offerings like “walking or biking trails, smoke-free environments, and lactation rooms,” reduces employer healthcare costs, the study noted. Workplaces with onsite clinics also pay a 2–2.5% lower premium on average, Gowen says.

Also see: “

Employers can realize additional savings with greater buy-in from company executives, which should inform decision-making in workplaces that have “struggled to get that C-suite-level support,” he says.

“While it seems that we all should have known this, encouraging executives within the C-suite to support wellness and build it into the culture of the organization [is critical],” Gowen says.

Taking steps to “weave in a culture of health” into the company mission and vision statements can help “really show that this isn’t lip service,” he says. The study found that less than one-fifth of all employers have a documented strategic wellness and disease management plan.

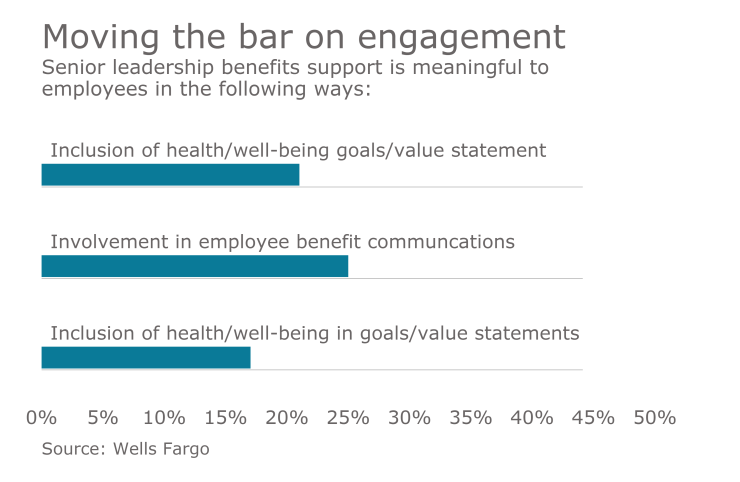

Only 45% of respondents said their executives offered visible support of wellness programs, whether through “active participation in benefits programs, endorsement of benefits plans to their board of directors, involvement in employee benefits communications, and inclusion of employee health and well-being in organizational goals and value statements,” according to the study.