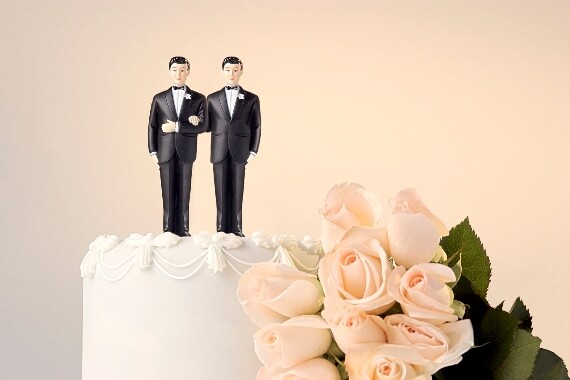

Top 7 legal cases of 2012

December 3, 2012 2:06 PM

Thoughts on the future can help employers get a jump on what will set them apart, starting now.

Keith Giarman, president at DHR Global, explains how employers can better approach the RTO debate.

Employment lawyers argue the decision may create issues for DEI programs that support underrepresented groups in the workplace.

Experts from MomsRising and DoSomething.org break down what the latest abortion bans mean for businesses and the nation.

40% of Americans suffer from GI conditions. A reassessment of treatment can help improve their quality of life.

Despite troublesome headlines, 66% of businesses have actually increased their commitment to inclusion efforts over the past year.