The Great Recession took its toll on the finances of all generations of workers and some are still trying to recover, according to the Transamerica Center for Retirement Studies report “Perspectives on Retirement: Baby boomers, Generation X and Millennials,” which was based on the 17th annual Transamerica Retirement Survey.

A high percentage of baby boomers, Gen Xers and millennials feel insecure when it comes to believing they can save enough for retirement.

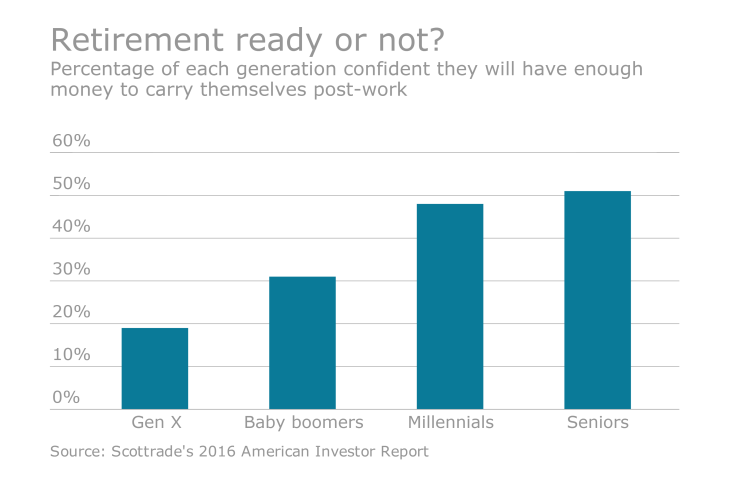

The survey found that 45% of baby boomers are expecting a decrease in their standard of living in retirement and a whopping 83% of Generation X workers believe their generation will have a harder time achieving financial security than their parents’ generation. Only 18% of millennials are confident they will have a secure retirement.

See also:

This insecurity leads to numerous opportunities for plan sponsors to engage employees in planning and investment opportunities as well as calculating savings goals or looking at their overall budget, says Catherine Collinson, president of the Transamerica Center for Retirement Studies.

“If people can’t save enough, there are still things they can do from a planning perspective and getting educated,” she says.

The baby boomers are in a precarious position: Two-thirds of them are planning to work past age 65, already are working past retirement age or don’t plan to retire, yet few have a backup plan if retirement happens unexpectedly.

“They are pretty vulnerable,” Collinson says.

Baby boomers expect a phased transition to retirement, moving from full-time to part-time.

“Their vision of retirement includes both leisure and working, and yet few employers have business practices in place to support this,” Collinson says. “If they did, it could solve a number of problems.”

See also:

Business practices could help baby boomers achieve a smooth transition to retirement. From the employer perspective, it could facilitate better workforce management, knowledge transfer and transition planning. When baby boomers retire, they take a lot of institutional knowledge with them, she explains. Plus, she adds, it would be great if employers found a way to tap that knowledge base before they leave the workforce.

Sixty-seven percent of boomers say they are staying healthy so they can continue working. What was confounding about the survey results, Collinson says, was that baby boomers expect to work longer and retire later but only 56% say they are focused on performing well at their current job and only 40% are keeping their job skills up to date.

She believes that Generation X is in the most precarious positon of all the working generations. While this generation was the first one to grow up with a 401(k) plan for their entire working career, many are not contributing enough to their plan for a secure retirement, and 30% of Gen X retirement plan participants say they have taken out a plan loan or early withdrawal to pay off debt or unplanned major expenses.

When asked about their financial priorities, Gen Xers are more likely to say paying off credit card debt is a priority but they don’t have an emergency fund.

“I would say they have more [retirement confidence] than millennials but they are still a bit younger and are just getting started with careers and families,” Collinson says. “For Gen X, this is an important time in their life where financial security is key. It’s important they are hunkering down to focus on retirement. It will be here faster than they think.”

Generation X doesn’t garner the media attention that baby boomers and millennials receive and they are an underserved market and an untapped opportunity, Collinson says.

“As boomers retire, Gen X will also play an important role in succession planning for employers,” she says. “They bring work experience, institutional knowledge and they are obvious candidates for the knowledge transfer that will need to take place when their baby boomer counterparts retire.”

They have to keep their job skills up to date to avoid being passed over for younger, more tech-savvy employees.

Collinson says that there is a misconception out there that Generation X is not technologically savvy but this generation was the first one to grow up with computers.

“They are likely to be a lot more tech savvy than the media or society is giving them credit for,” she says.

Seventy-two percent of millennials, who have access to a 401(k) plan at work, say they participate in that plan and contribute about 7% of annual pay. Thirty percent say they contribute more than 10% of pay to their retirement account. Even with those high numbers, 72% say they don’t know as much as they should about retirement investing and, of those currently participating in a plan, one in four say they are not sure how their retirement savings are invested, according to Transamerica.

The majority of millennials say they would like more information and advice from their employers about how to achieve their retirement goals.

The good news is that saving for retirement was the No. 1 priority for 57% of individuals surveyed, followed by 44% who felt day-to-day expenses were the top priority. Thirty-nine percent said that paying off consumer or credit card debt was their top priority.

Gen Xers and millennials had the highest response rate when it came to prioritizing debt repayment. They were also more likely to say that just getting by covering living expenses was a top financial priority.