-

Expect clients to take steps, such as maximizing automatic services, that will encourage positive behaviors to help individuals reach their financial goals.

March 1 T. Rowe Price Retirement Plan Services

T. Rowe Price Retirement Plan Services -

If the client makes a mistake, they are advised to take the RMD as soon as they discover it so they can ask the IRS for a waiver of the penalty.

February 28 -

Those who signed up in the past year will get a smaller pension than they would under the old system, but they can expect additional benefits from the tax-advantaged Thrift Savings Plan.

February 27 -

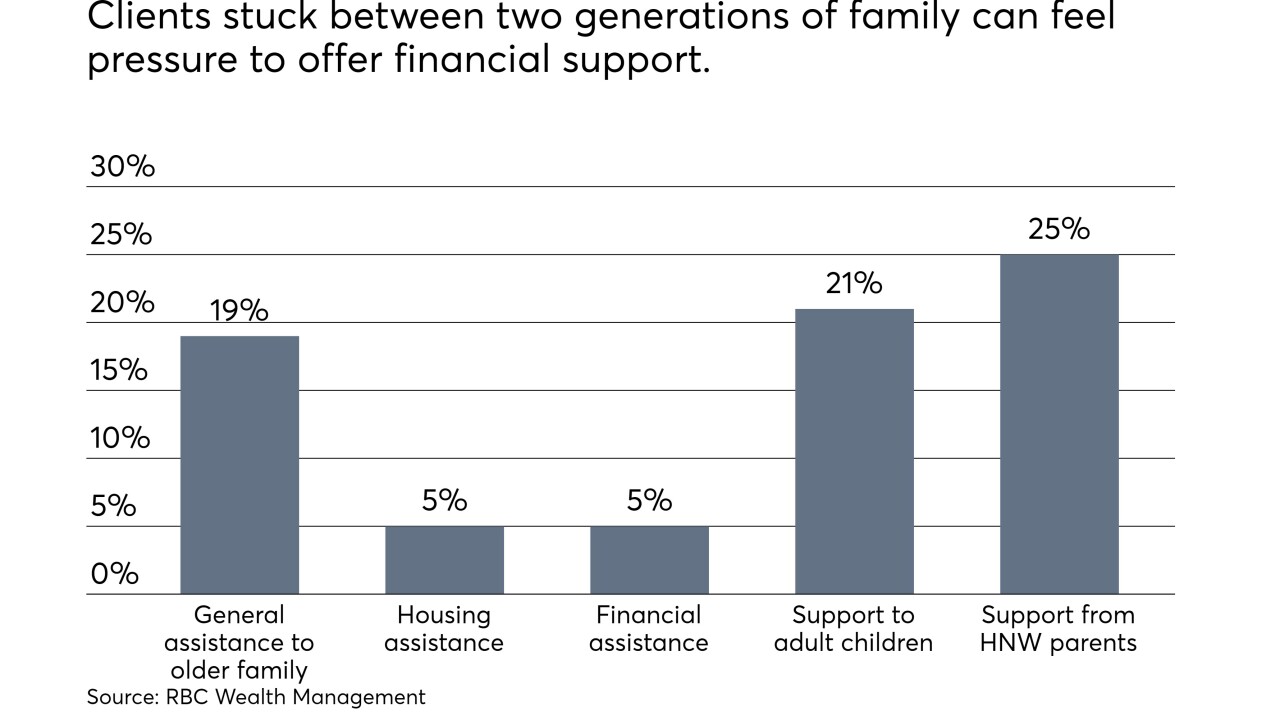

The sandwich generation is struggling to save for its own needs, and when you add in family demands, it paints a "grim picture," an expert says.

February 27 -

Expect employers to take steps, such as maximizing automatic services, that will encourage positive behaviors to help individuals reach their financial goals.

February 26 T. Rowe Price Retirement Plan Services

T. Rowe Price Retirement Plan Services -

Although the test is complicated and misunderstood, eliminating it could “do more harm than good,” according to an expert.

February 25 -

The cap on state and local tax deduction under the tax law may prompt more employees to direct their retirement savings to their 401(k)s than to build home equity.

February 21 -

Although more taxpayers are expected to use the standard deduction, they can still claim the tax deduction for IRA contributions.

February 20 -

Retirees who opt to file at a much later date can earn delayed retirement credits that could boost their benefits by as much as 32%.

February 19 -

Although earnings in a deferred annuity will not be included in an investor's adjusted gross income, future withdrawals from the annuity could trigger a bigger tax bill.

February 15