- Partner Insights from Nutrium

- Partner Insights from Maven

- Sponsor Content from Collective Health

- Sponsor Content from Collective Health

- Sponsor Content from Collective Health

Most workers say they are satisfied with their jobs, but a new survey finds rising anxiety about the labor market, AI-driven job losses and financial stress.

-

A new J.P. Morgan report finds most Americans haven't calculated retirement needs, but small, consistent changes in saving can make a big difference.

March 6 -

The company's offerings cover a wide range of needs from fertility to eldercare, leading to recent recognition by Best Place for Working Parents.

March 5 -

-

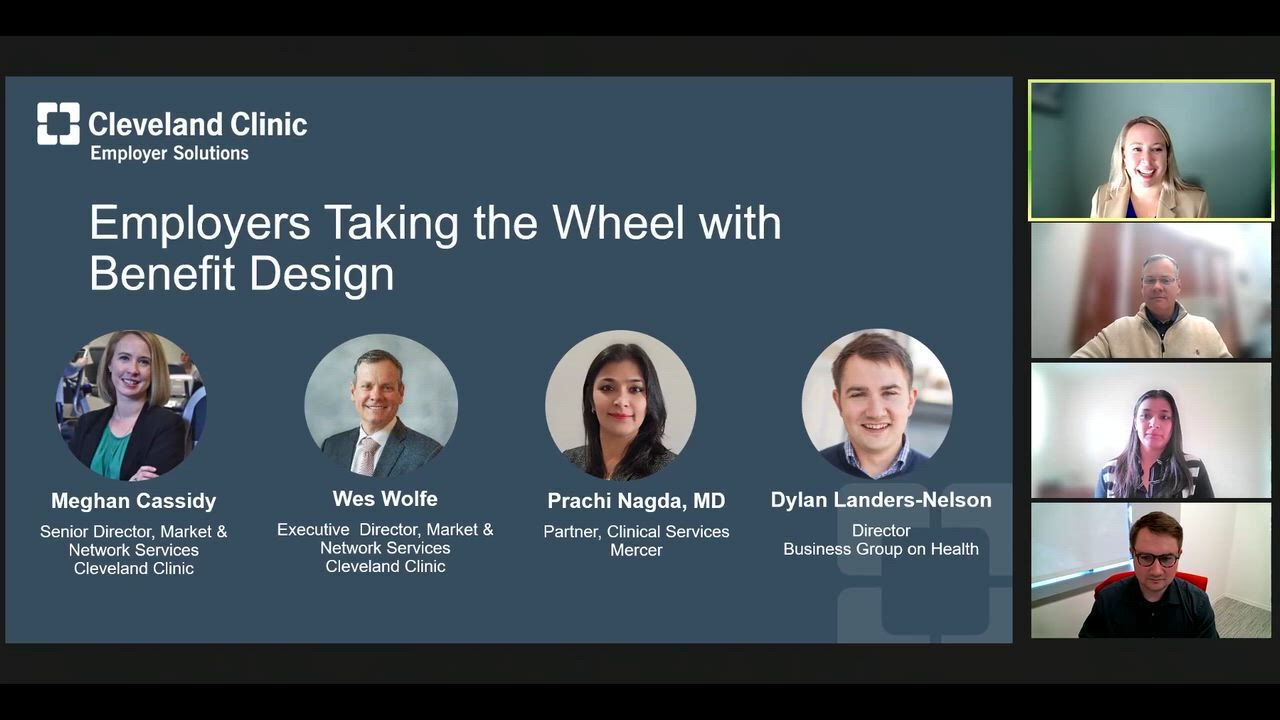

Benefit design levers to improve quality, strengthen employee experience, and create greater financial predictability.

7h ago -

Centers of Excellence models can strengthen quality, control cost variability, and elevate your benefits strategy.

7h ago

An executive from Bright Horizons shares how benefits like paid child care and flexibility can help new parents ease back to work.

-

Benefit design levers to improve quality, strengthen employee experience, and create greater financial predictability.

7h ago -

Centers of Excellence models can strengthen quality, control cost variability, and elevate your benefits strategy.

7h ago -

EBN and Best Companies Group teamed up to rank the top HR teams setting the bar for their industry.

March 3 -

From career decisions to benefits advice, employees need to be reminded that their gut instincts and expert human advice should not be overlooked.

March 2 -

NoPlex is specifically designed to keep daily routines more organized and achievable for people who need extra support.

February 27 -

Gen Z and millennials turn to tech for tool navigation, while Gen Z and baby boomers want a more hands-on approach.

February 26 -

Depending on their extension details, benefit leaders should encourage employees to spend down their flexible savings accounts and submit claims for reimbursement.

February 26