-

A new policy roadmap urges employers and lawmakers to expand retirement access and lifetime income options.

January 22 -

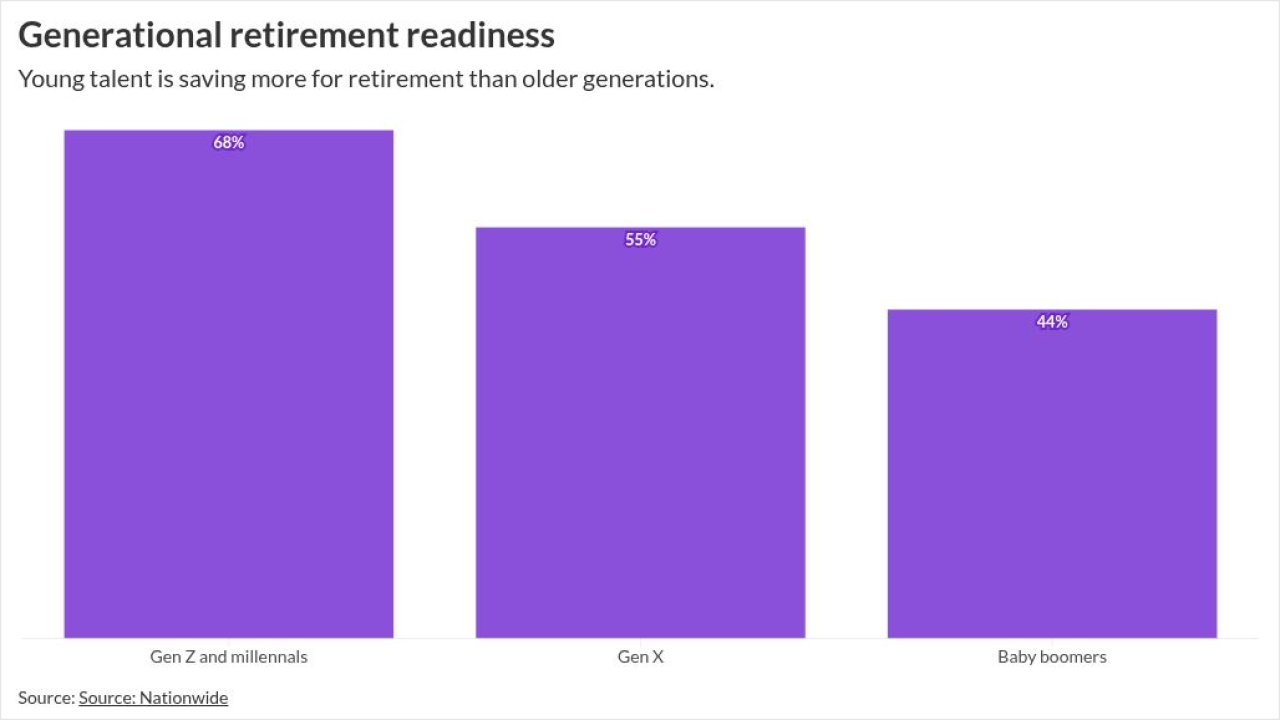

A new report from Nationwide reveals the generational differences when it comes to retirement strategies

January 20 -

-

-

Benefit leaders can help by refreshing workers on financially-beneficial offerings, promoting liquid savings and connecting them with education resources.

January 15

-

The opportunity ahead is about building the same kind of thoughtful, documented, process-driven governance in health care that transformed retirement plans.

January 14 Fiduciary In A Box

Fiduciary In A Box -

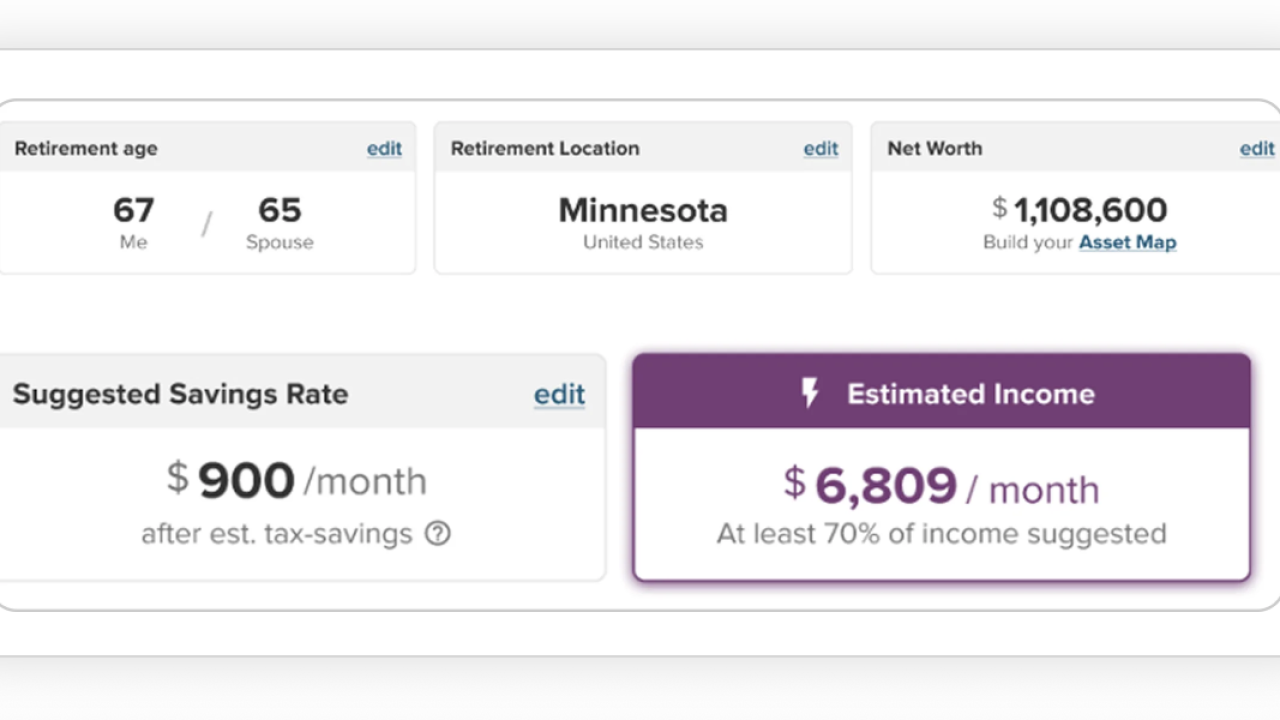

The solution helps employees navigate the complex retirement process with clearer guidance and personalized insights.

January 13 -

The Labor Department is siding with plan sponsors in a growing wave of ERISA lawsuits challenging how forfeited 401(k) funds are used.

January 12 -

Financial advisers often urge clients to delay Social Security to maximize benefits, but new research suggests early claiming may be a rational choice.

January 9 -

Employees at every income level can benefit from offerings that help them set aside savings, without impacting retirement prospects.

January 6 -

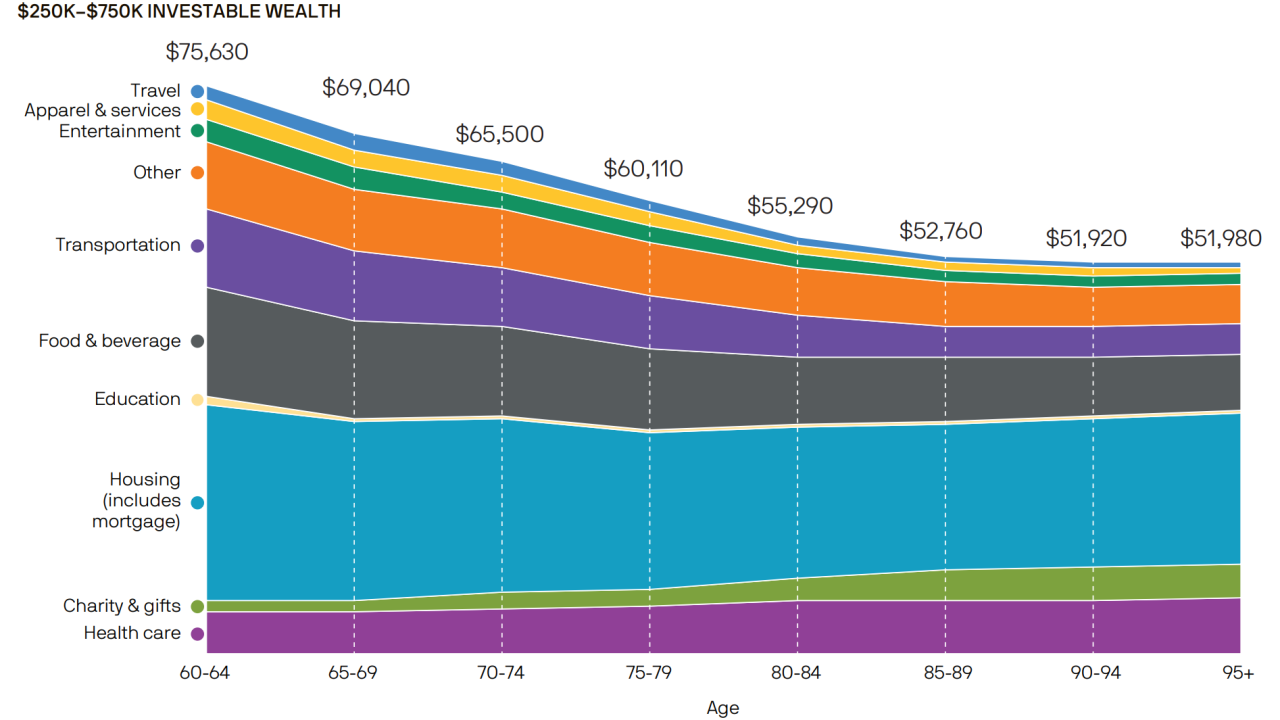

Popular retirement withdrawal strategies like the 4% rule assume a steady rate of spending for retirees. But new research from J.P. Morgan shows that premise is often disconnected from reality.

December 29 -

Abbott has contributed $10 million toward employees' 401(k)s, even while workers pause their contributions to pay off debt.

December 23 -

New research highlights a widening planning gap among child-free savers, with lagging estate and long-term care planning exposing unique risks.

December 22 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found.

December 18 -

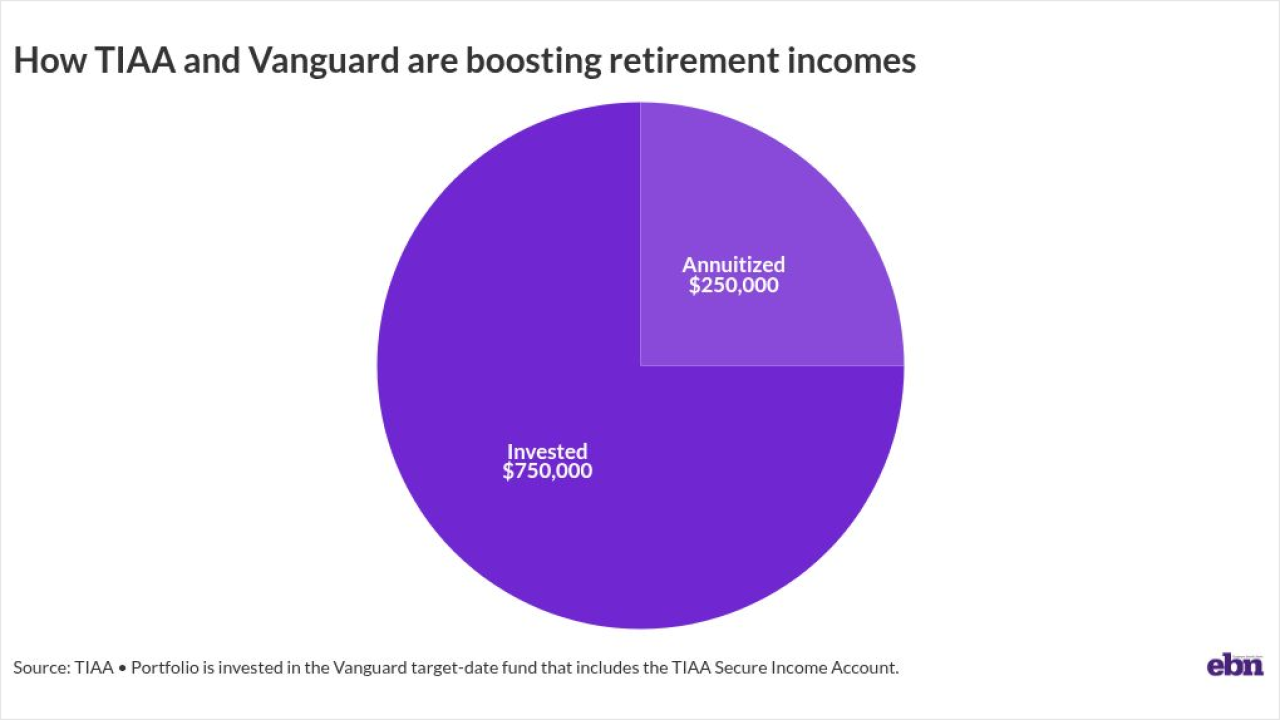

Vanguard and TIAA's collaboration embeds guaranteed lifetime income directly into workplace savings plans.

December 10 -

Transamerica Institute CEO says employers can help women prepare for retirement by addressing the challenges that undermine their ability to save.

December 9 -

Researchers found that potentially traumatic childhood experiences, including physical abuse and parental separation, have lasting financial consequences, shaping workers' savings and retirement security decades later.

December 5 -

Mindful of cumbersome rules and the potential for blended-family feuds, advisers can help take the lead on keeping the peace for benefit plan participants.

December 2 -

Trump Accounts for every child born in the U.S. from 2025 to 2028, the Saver's Match Program and auto portability represent a historic opportunity to move the needle.

November 26 Portability Services Network and Retirement Clearinghouse

Portability Services Network and Retirement Clearinghouse -

Facing high turnover, particularly among Gen Z, U.S. employers are expanding basic retirement benefits into full-scale financial counseling to cultivate appreciation and security among staff.

November 25