-

The partner who first reaches 62 should consider delaying Social Security until the age of 70, and they should continue contributing to the retired spouse’s IRA if possible.

May 2 -

Plan sponsors need to improve employees' well-being by actively encouraging roll-ins.

May 2 Portability Services Network and Retirement Clearinghouse

Portability Services Network and Retirement Clearinghouse -

The partner who first reaches 62 should consider delaying Social Security until the age of 70, and they should continue contributing to the retired spouse’s IRA if possible.

May 2 -

Wellness programs are key to helping employees change money behaviors that are negatively impacting their ability to save for retirement.

May 1 -

To build a strong portfolio, investors should consider blue-chip stocks that pay high dividends.

May 1 -

Retirement plan sponsors need to focus on both risk mitigation and risk transfer now that the IRS has terminated its determination letter program at the beginning of the year.

May 1 Willis Towers Watson

Willis Towers Watson -

To build a strong portfolio, investors should consider blue-chip stocks that pay high dividends.

May 1 -

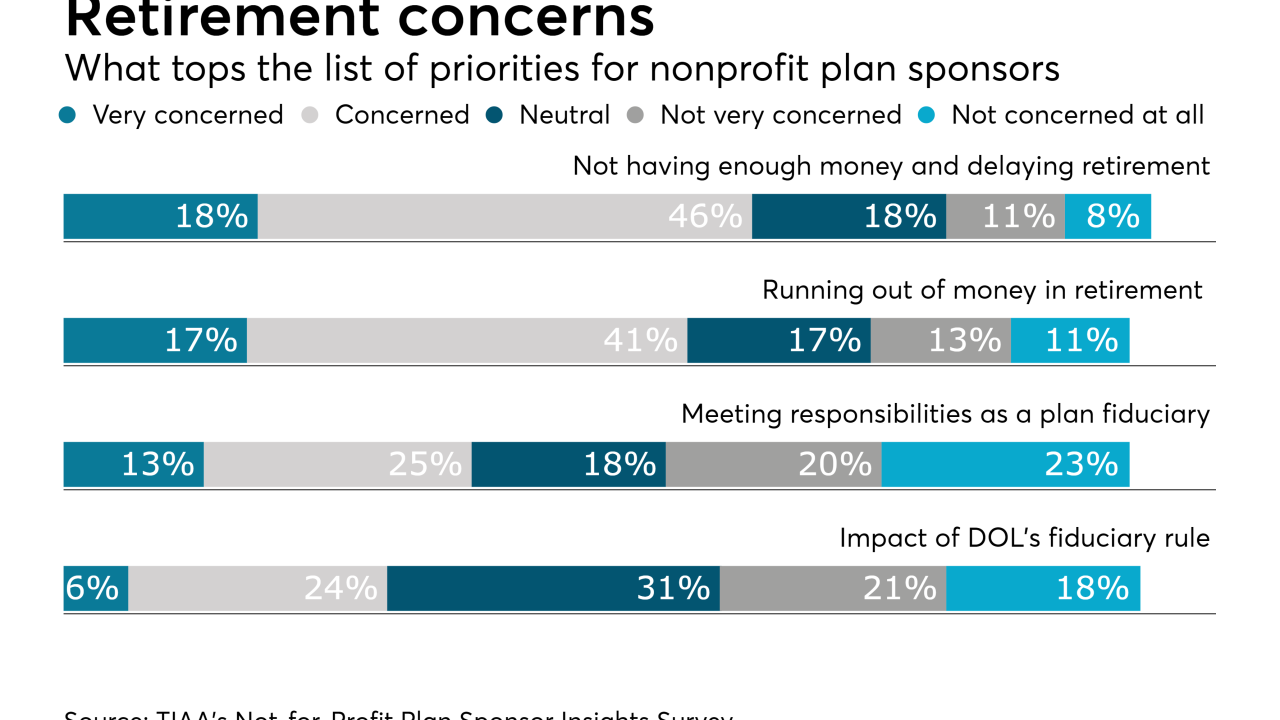

More than half of not-for-profit companies say ensuring workers are ready for the golden years remains a top priority in the immediate future’

April 28 -

Employees should opt for simpler annuities, which tend to be less expensive than those with more complicated terms.

April 28 -

Clients should opt for simpler annuities, which tend to be less expensive than those with more complicated terms.

April 28