-

To qualify for this feature, clients should have reported a minimum amount for at least 11 years.

March 6 -

For many workers, moving assets from old 401(k)s into a traditional IRA may not be a smart move. One reason: IRAs often don’t offer stable value or guaranteed fund investment options as do most 401(k)s.

March 5 -

If the client makes a mistake, they are advised to take the RMD as soon as they discover it so they can ask the IRS for a waiver of the penalty.

February 28 -

Those who signed up in the past year will get a smaller pension than they would under the old system, but they can expect additional benefits from the tax-advantaged Thrift Savings Plan.

February 27 -

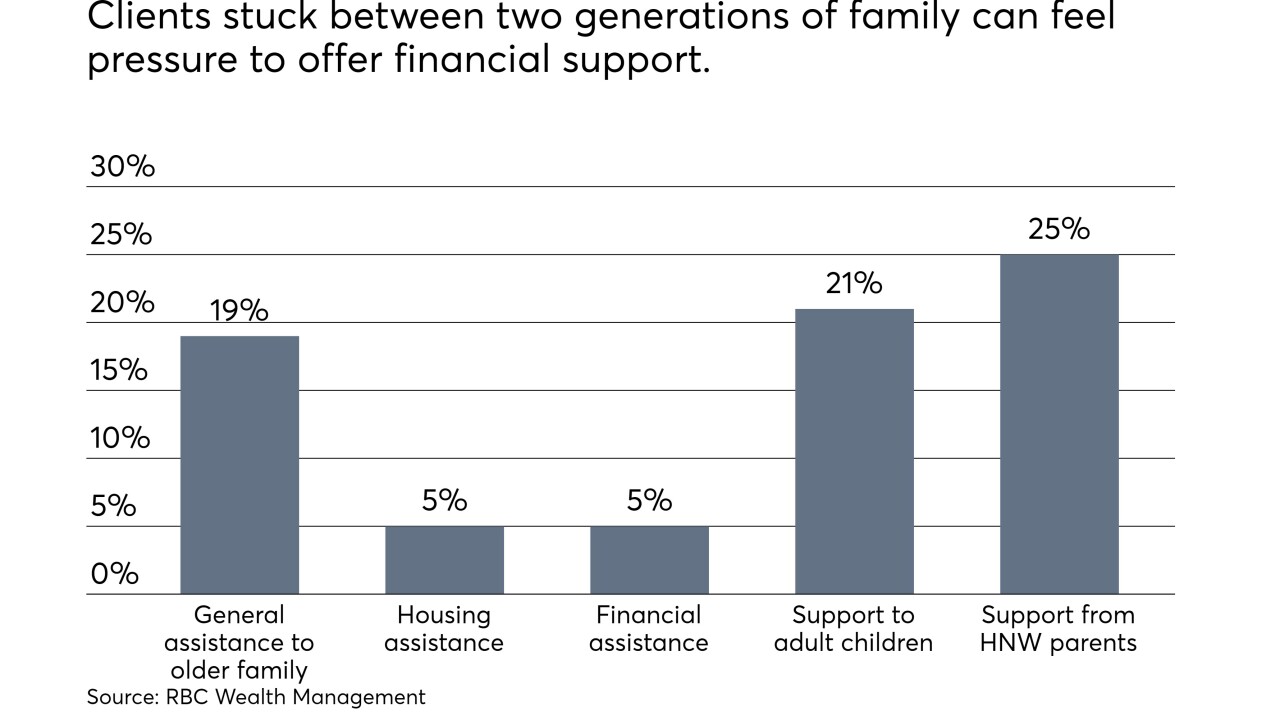

The sandwich generation is struggling to save for its own needs, and when you add in family demands, it paints a "grim picture," an expert says.

February 27 -

Although the test is complicated and misunderstood, eliminating it could “do more harm than good,” according to an expert.

February 25 -

Although more taxpayers are expected to use the standard deduction, they can still claim the tax deduction for IRA contributions.

February 20 -

Retirees who opt to file at a much later date can earn delayed retirement credits that could boost their benefits by as much as 32%.

February 19 -

It would raise enough new revenue to more than restore long-term balance of the program.

February 13 -

Even middle-class households who have health insurance are at risk, as a researcher points out that they are the ones who filed for the most bankruptcies.

February 13