-

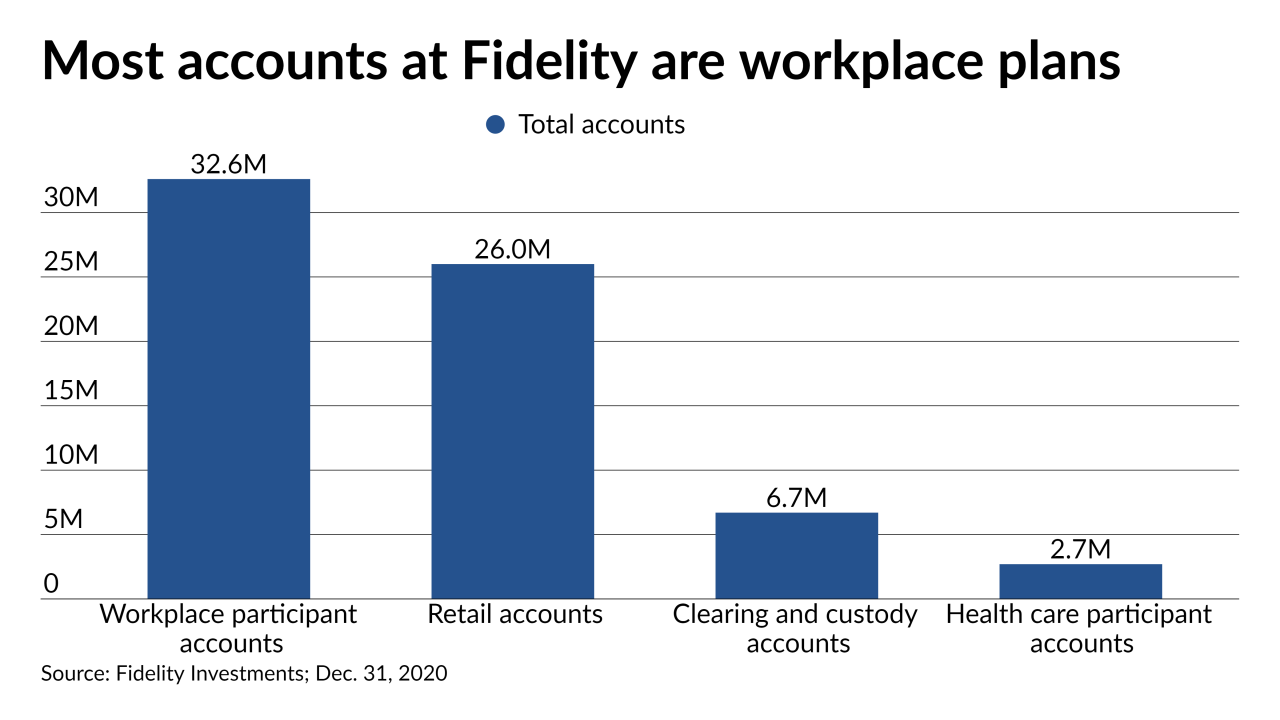

The company has experienced “dramatic increases” in new customers, call and trading volumes.

April 7 -

Some seniors are missing out on a potential 20% tax deduction, and “no one is talking about what a wonderful retirement planning technique" it is, says an expert.

May 14 -

Seniors in this position may face a tax bill and possibly a penalty if they dip into their 401(k) prematurely, says an expert.

May 10 -

A market correction only becomes a real risk if investors act and make buy or sell decisions to alleviate mental anguish today at the expense of tomorrow, says an expert.

May 6 -

Working longer and taking on a part-time job are two of the simple strategies for workers to curb the impact of a market correction. But there are other tips to consider as well.

January 10 -

Taking these steps can help clients insulate themselves from some of the market volatility that we've been experiencing recently, says one expert.

January 8 -

This strategy enables retirees to restrict their application to spousal benefits and allow their benefit to grow until they reach 70.

January 4 -

There can be benefits in enrolling simultaneously, but there are also incentives to consider in waiting on Social Security instead of claiming benefits at 65 when Medicare kicks in.

December 31 -

Clients should turn to their own timeline before making any changes to their portfolio during a market correction.

November 6 -

The wealth in retirement accounts could shrink by that much due to annual defaults on 401(k) loans. The projected loss is about 2.7% of the $7.8 trillion in retirement accounts.

October 12 -

These loans can be a good option in some cases, but they're not a cheap way to borrow money so senior citizens with good credit may have cheaper alternatives.

September 20 -

When the financial clouds are gathering, your clients have preparations to make. Top of the list: reduce risk.

August 22 -

Although volatile markets mean opportunities for some investors, most clients will be better off ignoring market corrections if they are investing for the long term.

August 13 -

Working longer can be a great decision, as it will allow seniors to keep themselves healthy as well as allow them to delay filing for Social Security benefits.

May 23 -

People looking to retire but wanting to keep a part-time gig will benefit from a new law that gives a 20% deduction for “pass-through entities.”

April 5