-

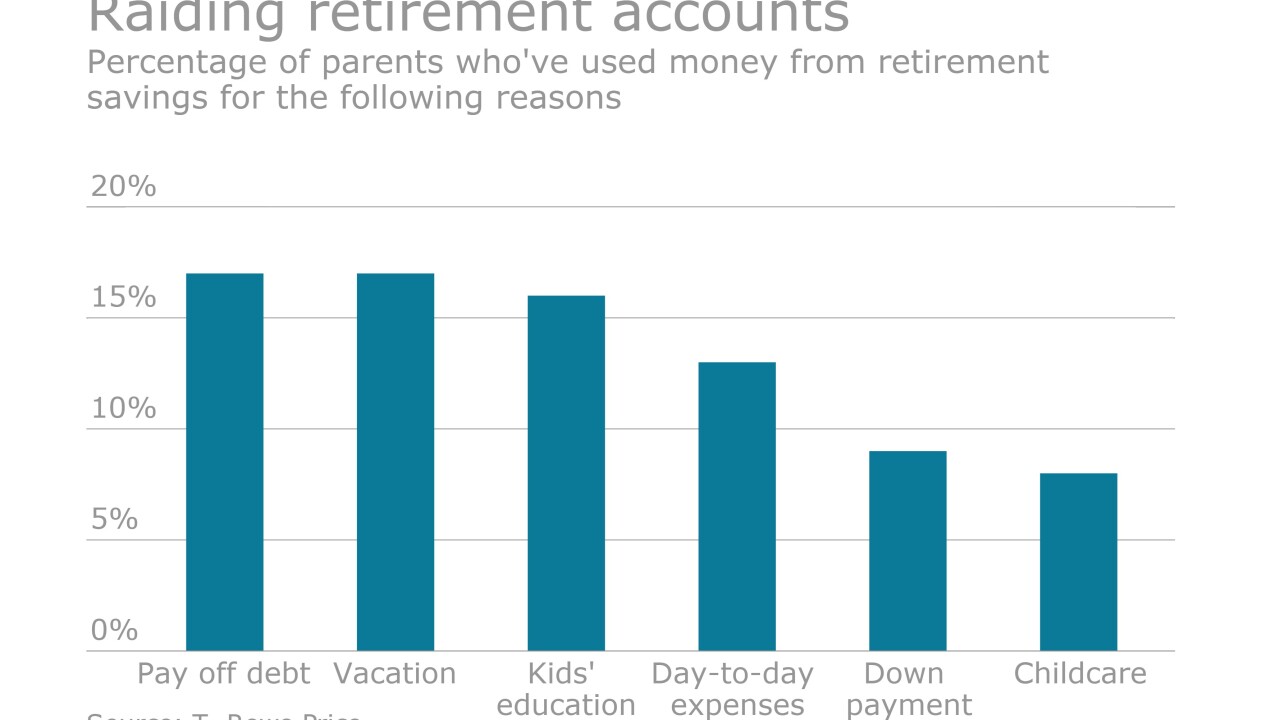

Employers and advisers are urged to increase financial education so employees understand the pros and cons of tapping into their 401(k) plans for purposes such as paying off credit card or student loan debt.

April 8 -

Retirement plan advisers must rethink how they work and get paid, according to benefits attorneys and industry insiders.

April 8 -

Retirement plan advisers must rethink how they get paid, which could lead to a leveling of costs for plan sponsors.

April 8 -

Volatility fears are one reason many members of this generation haven’t taken to the variety of retirement savings products available.

April 8 -

Top DOL official counters that the new regulations will result in “major reform," while not ruling out additional government action.

April 7 -

Under the DOL’s new standard, all retirement plan advisers — and not just some — will have to put their clients’ interests ahead of their own.

April 7 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

In light of the DOL’s new rule, some advisers will have to define a new relationship with employers and may ask for additional fees.

April 7 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

Plan sponsors and advisers are still able to provide generic facts about retirement savings and 401(k) plans without being subject to the DOL’s new rule.

April 7 -

Employee benefit brokers weigh in on how the new regulation will impact their business and that of their employer clients.

April 7 -

Employees are uneasy about their finances and employer clients that prioritize benefits education are at a competitive advantage, new MetLife research finds.

April 7