-

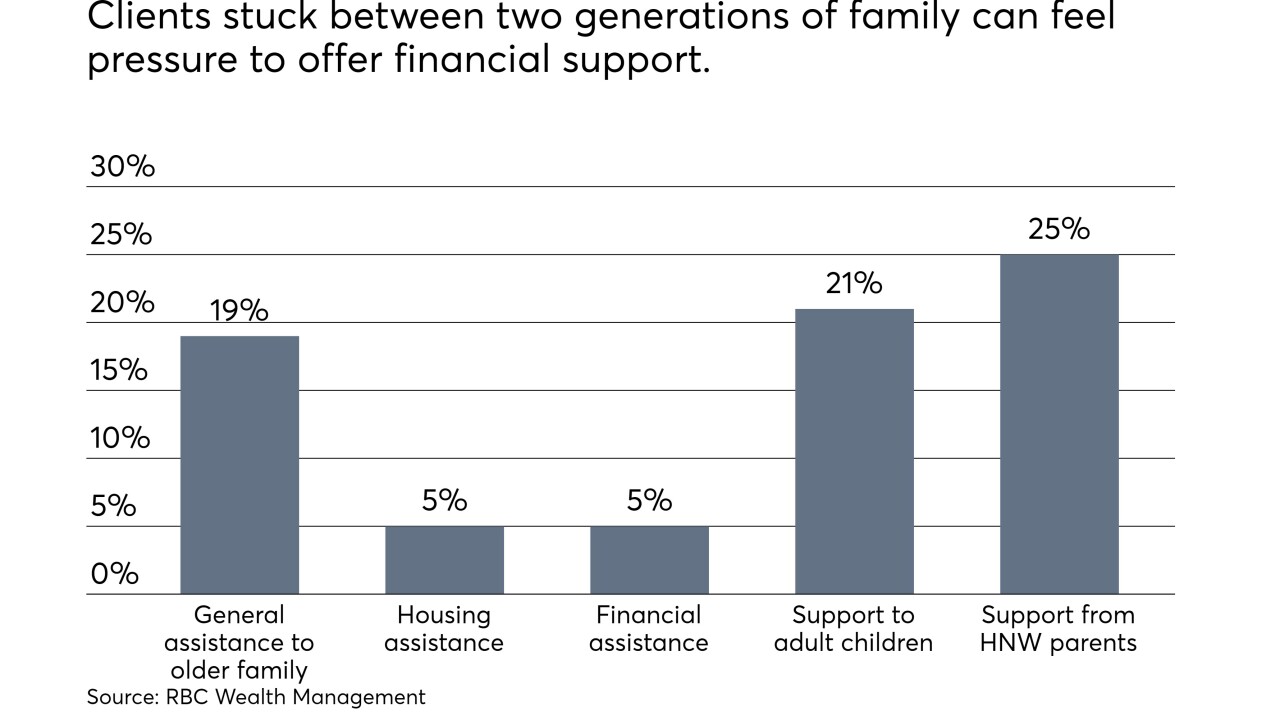

The sandwich generation is struggling to save for its own needs, and when you add in family demands, it paints a "grim picture," an expert says.

February 27 -

Retirement plans may decline to offer delayed RMDs, plan loans, stretch and hardship distributions and a host of other legally sanctioned tax maneuvers.

February 27 -

Although the test is complicated and misunderstood, eliminating it could “do more harm than good,” according to an expert.

February 25 -

The cap on state and local tax deduction under the tax law may prompt more employees to direct their retirement savings to their 401(k)s than to build home equity.

February 21 -

Although more taxpayers are expected to use the standard deduction, they can still claim the tax deduction for IRA contributions.

February 20 -

Although earnings in a deferred annuity will not be included in an investor's adjusted gross income, future withdrawals from the annuity could trigger a bigger tax bill.

February 15 -

Companies often fail to implement the unique FICA tax rules applied to NQDC plans and this can create confusion.

February 14 Foley & Lardner

Foley & Lardner -

One approach to determine a retirement withdrawal rate is to set a fixed percentage of their portfolio every year, says an expert. But there are other strategies, as well.

January 30 -

Clients will be able to contribute more to these accounts in 2019 because of changes in tax law, but choosing a plan is still no easy decision.

January 15 -

The new year is expected to be a turning point that will help more workers secure their retirement.

December 24