Elijah returned to Financial Planning in 2025 after working as a summer intern with FP in 2023. He earned an undergraduate degree from Berea College in Berea, Kentucky, and a master's degree in data journalism from Northeastern University in Boston. His work has been published in Bloomberg News, The Boston Globe, The Texas Tribune, WCVB, WBUR, The Drive and Autoblog.

-

The Labor Department is siding with plan sponsors in a growing wave of ERISA lawsuits challenging how forfeited 401(k) funds are used.

January 12 -

Financial advisers often urge clients to delay Social Security to maximize benefits, but new research suggests early claiming may be a rational choice.

January 9 -

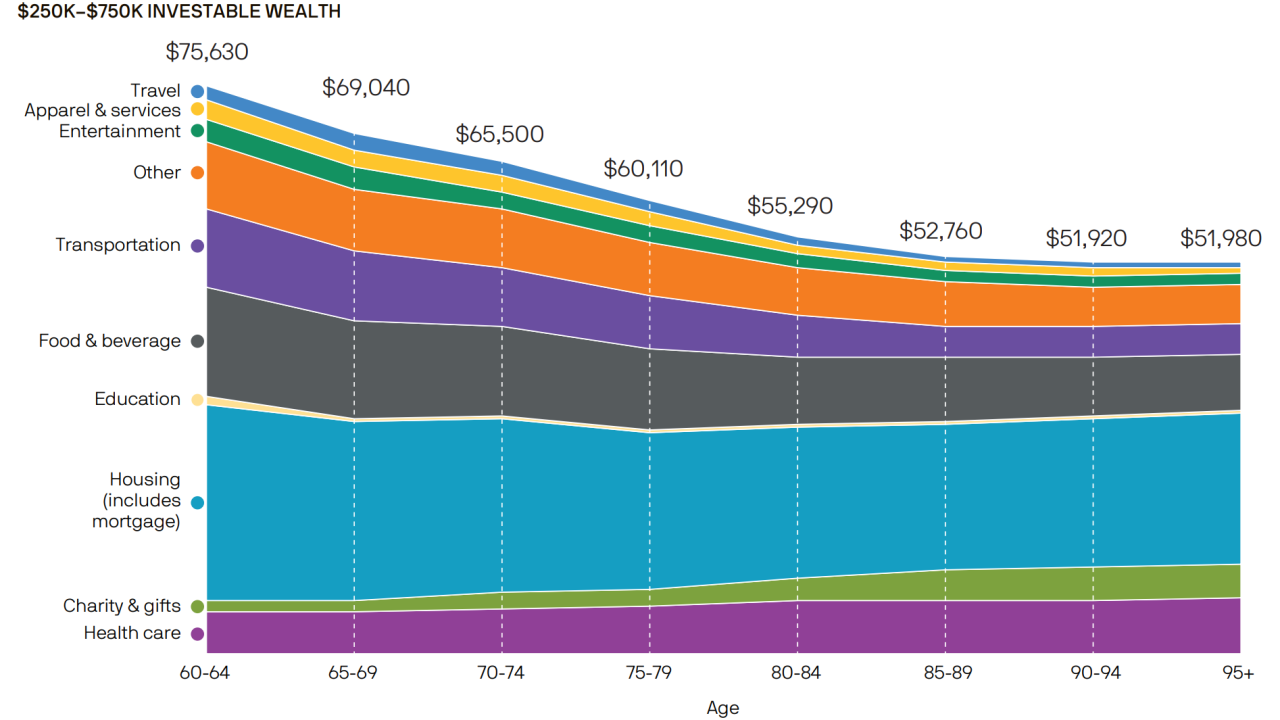

Popular retirement withdrawal strategies like the 4% rule assume a steady rate of spending for retirees. But new research from J.P. Morgan shows that premise is often disconnected from reality.

December 29 -

New research highlights a widening planning gap among child-free savers, with lagging estate and long-term care planning exposing unique risks.

December 22 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found.

December 18 -

Researchers found that potentially traumatic childhood experiences, including physical abuse and parental separation, have lasting financial consequences, shaping workers' savings and retirement security decades later.

December 5 -

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

Generation Z is favoring Roth accounts like no generation before, new Fidelity research shows.

November 21 -

Companies with 10 or more workers would have to contribute at least 50 cents per hour worked to each employee's retirement account.

November 14 -

The Social Security Administration announced its cost-of-living adjustment for beneficiaries — a figure advocates say fails to address the reality for most seniors.

October 27 -

Rising costs and competing financial priorities are making it harder for younger workers to save for retirement.

October 13 -

Even with the money to retire early, FIRE clients often face unexpected challenges around mindset, more than finances.

October 1 -

As 401(k) balances continue to grow, advisers say it's crucial that employees are educated on how to effectively manage their portfolios.

September 25 -

With retirement pressures mounting, Gen Xers and baby boomers are increasing IRA contributions in a bid to catch up, according to a new Fidelity study.

September 10 -

From aggressive tax strategies to early retirement, well-intentioned decisions can unintentionally reduce Social Security benefits.

September 3 -

Trump's One Big Beautiful Bill Act opened HSA access to millions, but big gaps remain. Here's what financial advisors need to know.

August 27 -

Retired women find themselves leaning on Social Security as a primary source of income at greater rates than men.

August 20 -

A 65-year-old retiring in 2025 can expect to spend $172,500 on health care expenses throughout retirement, according to Fidelity.

August 7 -

A majority of married Americans say that a divorce would derail their retirement plan, a new Allianz Life study found.

July 31 -

Even after accounting for income, Black Americans still trail in retirement savings, according to a recent EBRI study.

July 9