Contributing columnist Ed Bray continues his list of the biggest 25 benefit trends for 2014. To read Part 1 of his list click

Just you. The benefits workload these days would be daunting to an entire department of people and theres a good chance the benefits department is only you. If thats the case, be sure to align yourself with good internal and external resources to help you get the job done and keep your sanity (e.g., health & welfare broker, legal counsel, IT, finance, payroll, communications). Plus, become active in your local HR/benefits organization. It will provide an opportunity to talk shop with your peers, including learning new ideas.

Know and Learn what the new benefits strategy lingo means. Over the next year, you are going to hear more about private exchanges, low-cost/skinny plans,

Mt. Rushmore of benefits. Strategy, implementation, compliance, and communications these are the four words that are going to keep you up at night in 2014. Start preparing yourself, your staff, and senior management for what these concepts mean to your company.

Now is the time. Get ready for the long-term impact of the ACA on your organization. According an IFEBP survey, 90% of organizations (up from 69% in 2012) have moved beyond a wait-and-see approach and 52% of organizations are beginning to develop tactics to deal with the implications of ACA reform.

Open and proactive employee communication. Disseminating complex benefits information to employees continues to be challenging. Based on MetLifes 2013 Study of Employee Benefit Trends, employers who have been successful in effectively communicating to their employees use the following tactics: Provide written confirmation of benefits choices made during enrollment; offer guidance and suggestions for appropriate adjustments to coverage in response to life events such as marriage or the birth of a new baby; make a variety of communication channels available, such as one-on-one meetings, benefits fairs and websites, plus ongoing information and education.

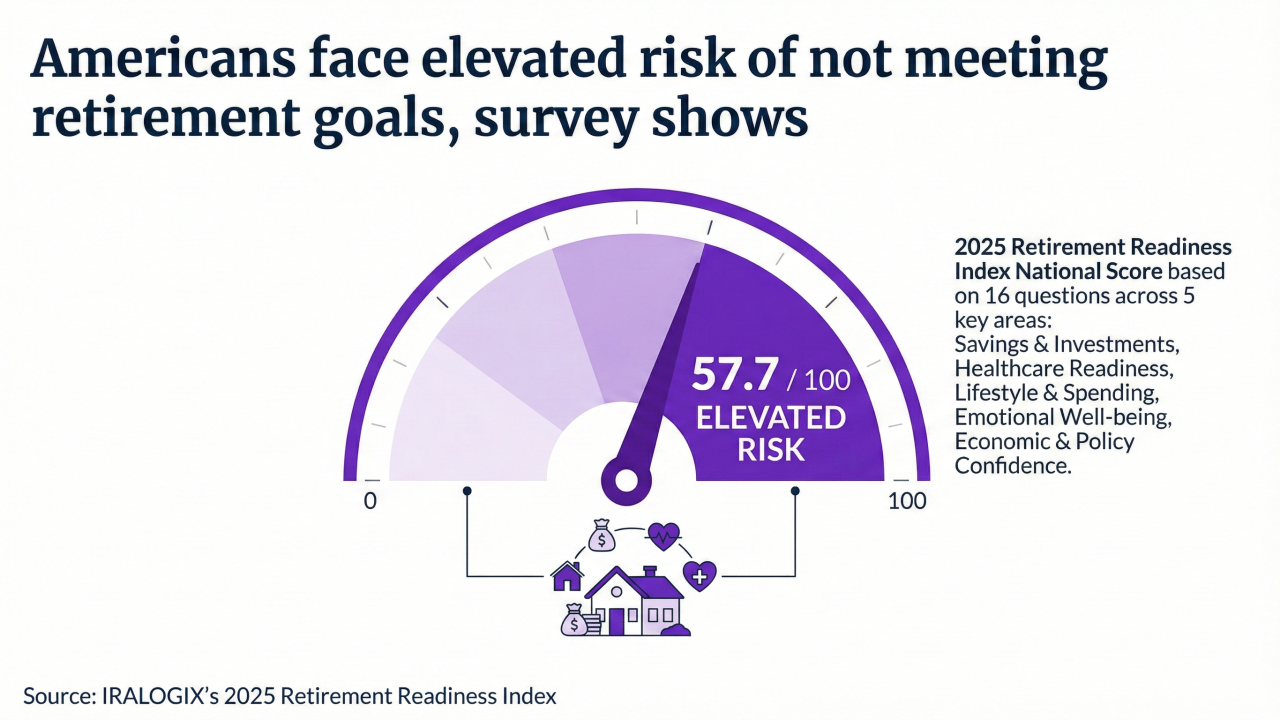

Personalized employee retirement guidance and advice. Employees are asking for more assistance with their retirement plan and organizations are listening. Makes sense as the baby-boomer generation is getting close to retirement and the younger generations are starting to get serious about saving. According to the 2013 SHRM Employee Benefits Research Report, there has been an increase in the number of organizations offering one-on-one investment advice (53% of organizations offer it, up from 38% in 2009) and specific retirement-preparation advice (43% of organizations offer it, up from 35% in 2009).

Questions on the horizon. Employees are confused and rightfully so. On a daily basis theyre hearing about things like play-or-pay, health marketplaces/exchanges, and federal subsidies, which prompts all kinds of questions: Are we going to continue to receive health insurance? Whats an exchange? Should I buy my insurance on the exchange? Can I get a subsidy on the exchange? You may not be in the best, or even appropriate, position to answer all of these questions but you will want to learn where to point your employees to get answers.

Review your funded status. Consider developing a list of pros and cons of being fully insured or

Satisfy same-sex marriage compliance. With the June 26, 2013, U.S. Supreme Court ruling strikingdown Section 3 of

Think about outsourcing. Odds are employee benefits is one of the top costs in your organization yet you are spending much of your workday managing/handling administrative tasks. Wouldnt it be nice to analyze data and focus on developing solutions to mitigate the rising cost of benefits? Its possible. Learn the cost of

Upward trend in health savings accounts. More employers are asking employees to become wiser health care consumers through consumer-directed health plans with HSAs. According to Americas Health Insurance Plans, nearly 15.5 million Americans were covered by HAS-eligible insurance plans in January 2013, an increase of nearly 15% since 2012.

Very important look-back measurement periods. Although 2015 seems like the distant future, employers have already started taking action to ensure compliance with the

Wise health care consumers. Teach youremployees to make smart benefit decisions. HR alone cannot be responsible for cost management. Examples include educating employees on the value of generic prescription drugs, using in-network providers, calling 24-hour nurse advice lines, and visiting urgent care facilities.

X-pect more from your health and welfare broker/consultant. At a minimum, your broker/consultant should be providing easily accessible compliance, communications and underwriting resources as part of their core services.

Your moment in the sun. The employee benefits function has taken center stage and is now being called in front of CEOs and CFOs to provide information, answer questions and explain the implications of benefits legislation on the organization. Take advantage of this moment to show them that you have the passion, capabilities, and know-how to develop successful short- and long-term benefit strategies for the organization.

Zzzzzzz time. Make sure you take a nice vacation and get some sleep at some point in 2014. You deserve it.

Ed Bray, JD, MBA, is senior vice president, compliance for Ascension Benefits & Insurance. He can be reached at