-

Many plan sponsors and participants don’t trust the federal government to keep its vow to allow tax-free distribution of Roth 401(k) balances. But taxing balances would not produce enough revenue, so the government is unlikely to go that route.

March 2 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

Brokers and clients should educate workers about the need to accumulate enough savings.

March 2 -

Enrollment meetings are a great way to help employees start to prepare.

March 1 Ascension Benefits & Insurance Solutions

Ascension Benefits & Insurance Solutions -

Why many organizations are turning their attention to employees’ post-career earning requirements.

March 1 -

Since 401(k) plans were never designed to be the sole source of retirement income for workers, it may be time to upgrade them so they serve a more similar purpose to DB plans.

February 29 -

The DOL reported that 67.2% of employee benefit plans investigated in 2015 resulted in financial penalties or other corrective actions. Are your clients ready?

February 26 Pavilion Advisory Group Inc

Pavilion Advisory Group Inc -

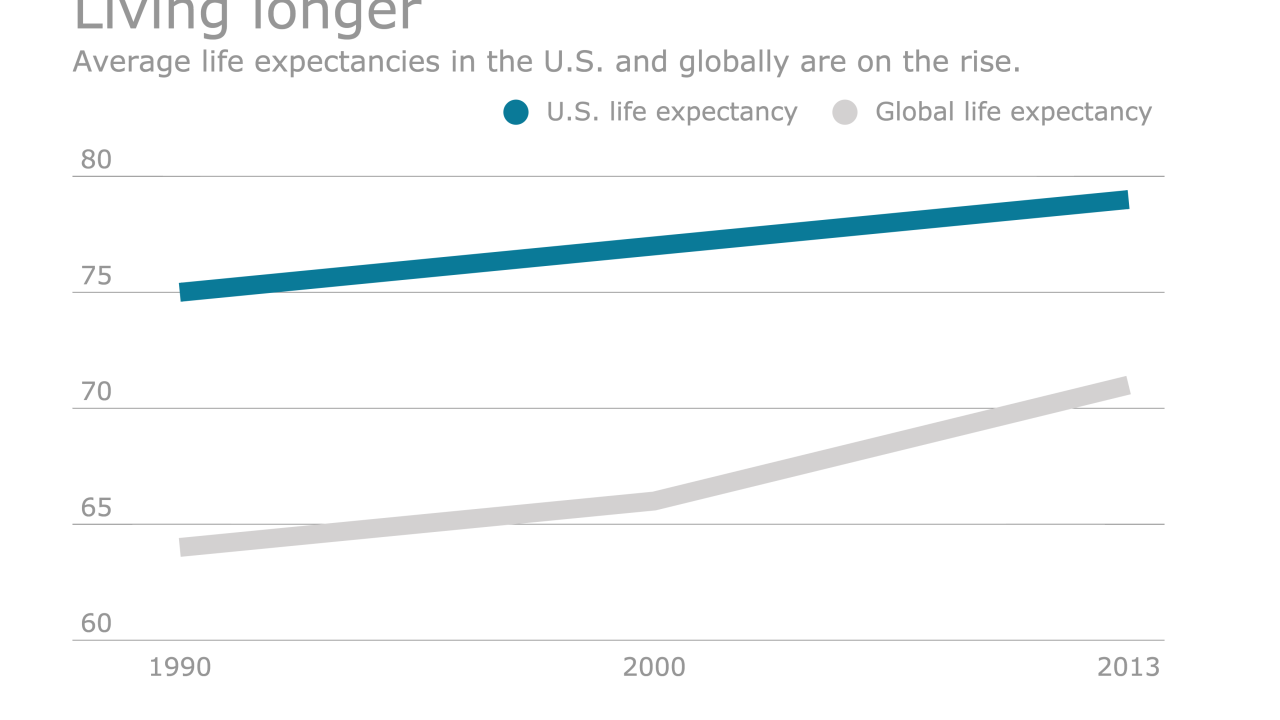

Companies have an important role to play in helping educate workers about the need to accumulate enough savings to last for what could be a 30-year retirement.

February 26 -

The DOL reported that 67.2% of employee benefit plans investigated in 2015 resulted in financial penalties or other corrective actions. Are your clients ready?

February 25 Pavilion Advisory Group Inc

Pavilion Advisory Group Inc -

From the effect of interest rates on plan liabilities to lump-sum windows and more, here are seven ways employers can get the most out of their DB plans.

February 25 Principal Financial Group

Principal Financial Group -

Large employers, while somewhat out of touch with employees’ retirement savings needs, are beginning to pay a lot of attention to their ultimate income requirements in retirement.

February 25