-

Financial advisers often urge clients to delay Social Security to maximize benefits, but new research suggests early claiming may be a rational choice.

January 9 -

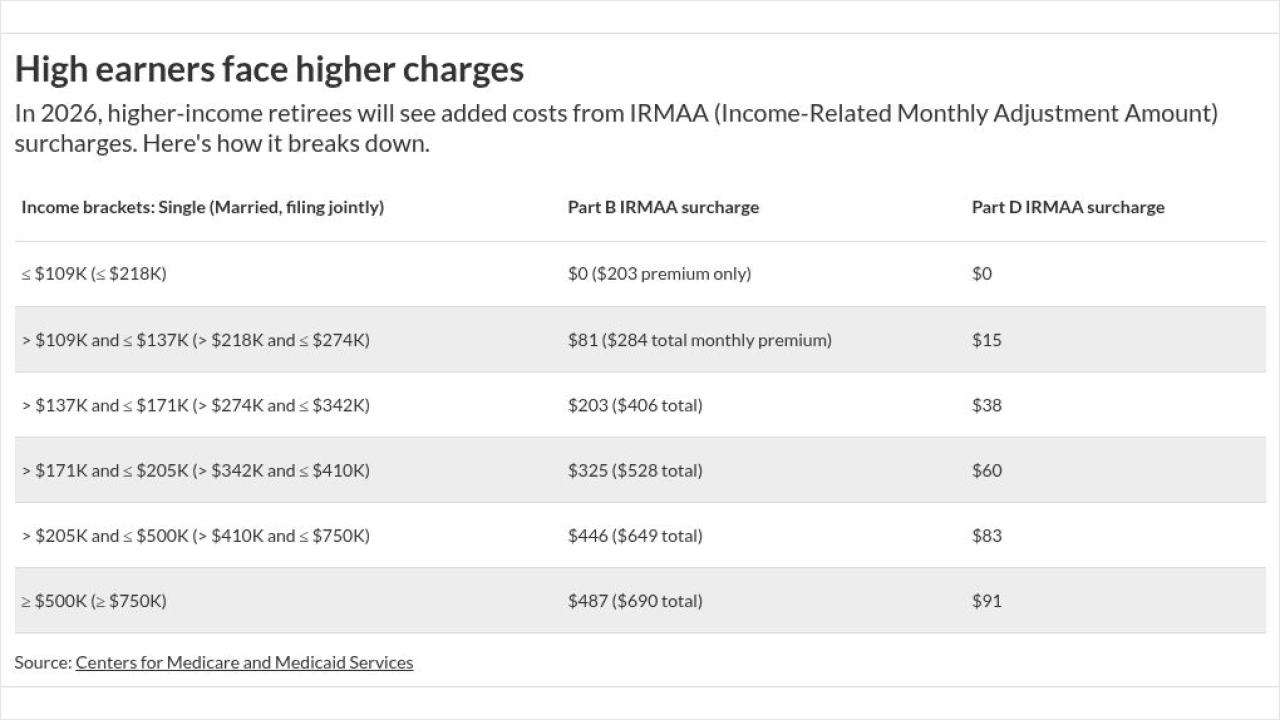

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

A Schroder's expert says new data speaks volumes about the importance of building a solid nest egg before leaving the workforce.

November 18 -

The Social Security Administration announced its cost-of-living adjustment for beneficiaries — a figure advocates say fails to address the reality for most seniors.

October 27 -

The Congressional Budget Office estimates that about 750,000 employees will be furloughed at a cost per day of $400 million in lost compensation.

October 1 -

From aggressive tax strategies to early retirement, well-intentioned decisions can unintentionally reduce Social Security benefits.

September 3 -

Retired women find themselves leaning on Social Security as a primary source of income at greater rates than men.

August 20 -

A provision in Trump's tax and budget law gives seniors 65 and older a new deduction that offsets Social Security taxes for most retirees. While it helps many keep more money, it also accelerates the program's insolvency.

July 8 -

Retiree income in the U.S. lags far behind the national median for household earnings, but these top cities are bucking the trend, according to a new SmartAsset study.

May 28 -

A new study from the Center for Retirement Research found that older remote workers are working longer than their in-office counterparts.

May 15 -

The majority of employees feel confident about their retirement savings, though are fearful of cuts to Social Security.

April 29 -

As inflation cools, Social Security's annual cost-of-living adjustment is projected to decline in 2026. Seniors say the benefit bump won't be enough.

March 21 -

The sharp reversal of Biden-era policy that capped overpayment recovery at 10% of a person's monthly benefit is expected to recover $7 billion over 10 years.

March 13 -

A client's immediate health needs make saving their accounts until they're 65 or over a difficult endeavor, and the accounts carry some highly specific rules.

January 27 -

The vast majority of seniors surveyed about Social Security's COLA say the number should be as much as five times higher than the government is forking over this year.

January 3 -

Having missed out on yesterday's pensions and today's 401(k) features, the latchkey generation is woefully unprepared for retirement. Here's how advisors can help.

December 16 -

Just before the year ends, Congress may pass the Social Security Fairness Act. Here's what's in the bill and who it's for.

December 6 -

Six out of 10 retirees leave the workforce earlier than they planned, according to a new Transamerica study. Here's why — and how advisors can help.

November 27 -

With inflation figures falling, retirees can expect a 2.5% increase in 2025. Here's how planners are guiding clients through the impact of that slight bump.

October 15 -

According to a recent Cerulli study, more than half of retired 401(k) participants say Social Security is their primary source of income. At the same time, only 6% of millennials predict they will rely on those funds when they finish their careers.

October 2