-

-

-

The Labor Department is siding with plan sponsors in a growing wave of ERISA lawsuits challenging how forfeited 401(k) funds are used.

January 12 -

Financial advisers often urge clients to delay Social Security to maximize benefits, but new research suggests early claiming may be a rational choice.

January 9 -

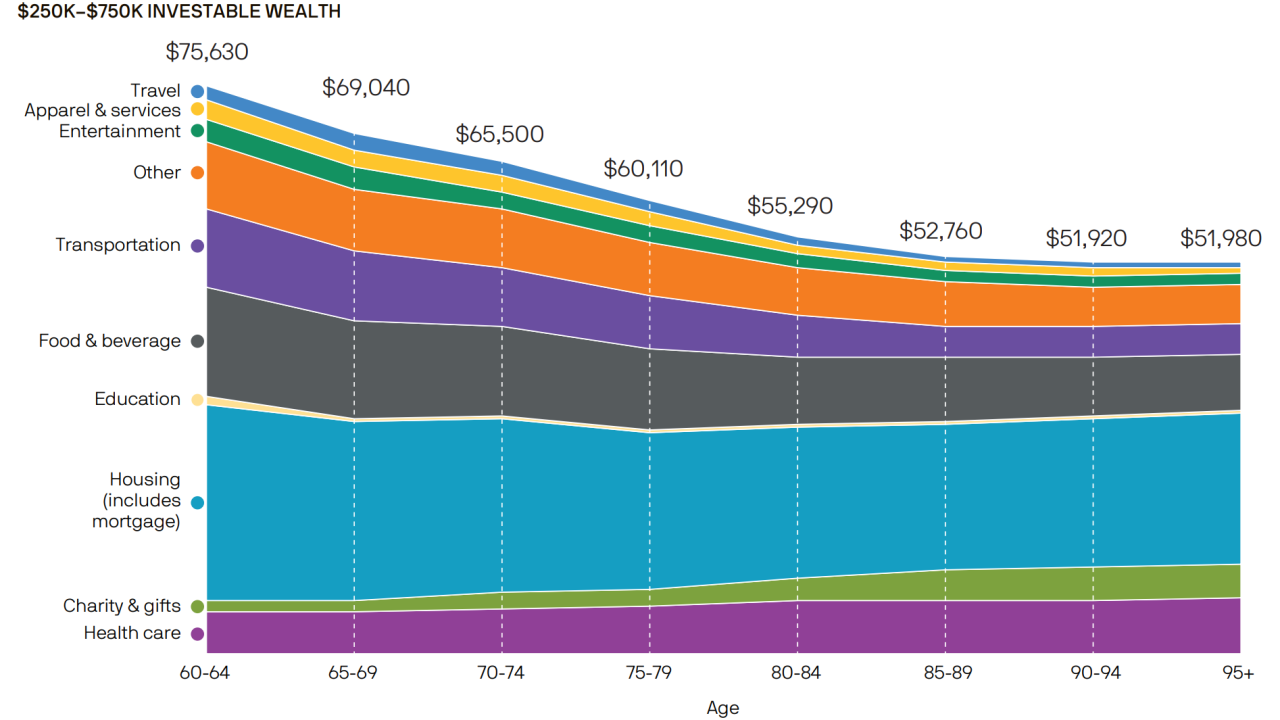

Popular retirement withdrawal strategies like the 4% rule assume a steady rate of spending for retirees. But new research from J.P. Morgan shows that premise is often disconnected from reality.

December 29 -

New research highlights a widening planning gap among child-free savers, with lagging estate and long-term care planning exposing unique risks.

December 22 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found.

December 18 -

Researchers found that potentially traumatic childhood experiences, including physical abuse and parental separation, have lasting financial consequences, shaping workers' savings and retirement security decades later.

December 5 -

Mindful of cumbersome rules and the potential for blended-family feuds, advisers can help take the lead on keeping the peace for benefit plan participants.

December 2 -

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

Generation Z is favoring Roth accounts like no generation before, new Fidelity research shows.

November 21 -

The country's second-largest bank has unveiled a digital platform for retirement decisions — not on how to save, but how to disburse those savings in a steady, sustainable way.

November 17 -

Companies with 10 or more workers would have to contribute at least 50 cents per hour worked to each employee's retirement account.

November 14 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 11 -

Without comprehensive financial planning benefits at their disposal, employees will remain unprepared for the future.

November 10 -

The Social Security Administration announced its cost-of-living adjustment for beneficiaries — a figure advocates say fails to address the reality for most seniors.

October 27 -

New Vanguard research finds workers with access to defined contribution plans are twice as likely to reach retirement goals.

October 21 -

A new survey from financial services organization TIAA polled 1,000 adults and found that nearly half don't make enough money to save.

October 20 -

Rising costs and competing financial priorities are making it harder for younger workers to save for retirement.

October 13 -

Even with the money to retire early, FIRE clients often face unexpected challenges around mindset, more than finances.

October 1