-

With high medical prices causing many workers to contribute less to their 401(k)s, plan sponsors should encourage employees to consolidate savings in their current-employer plan to help them in their post-work years.

July 10 Portability Services Network and Retirement Clearinghouse

Portability Services Network and Retirement Clearinghouse -

Companies would welcome the elimination of 'costly and time consuming' provisions including the employer mandate, the Cadillac tax and reporting requirements.

July 10 -

As more sectors of the workforce adopt high-deductible plans, employers should ensure employees are aware of income-protecting voluntary benefit choices.

July 9 -

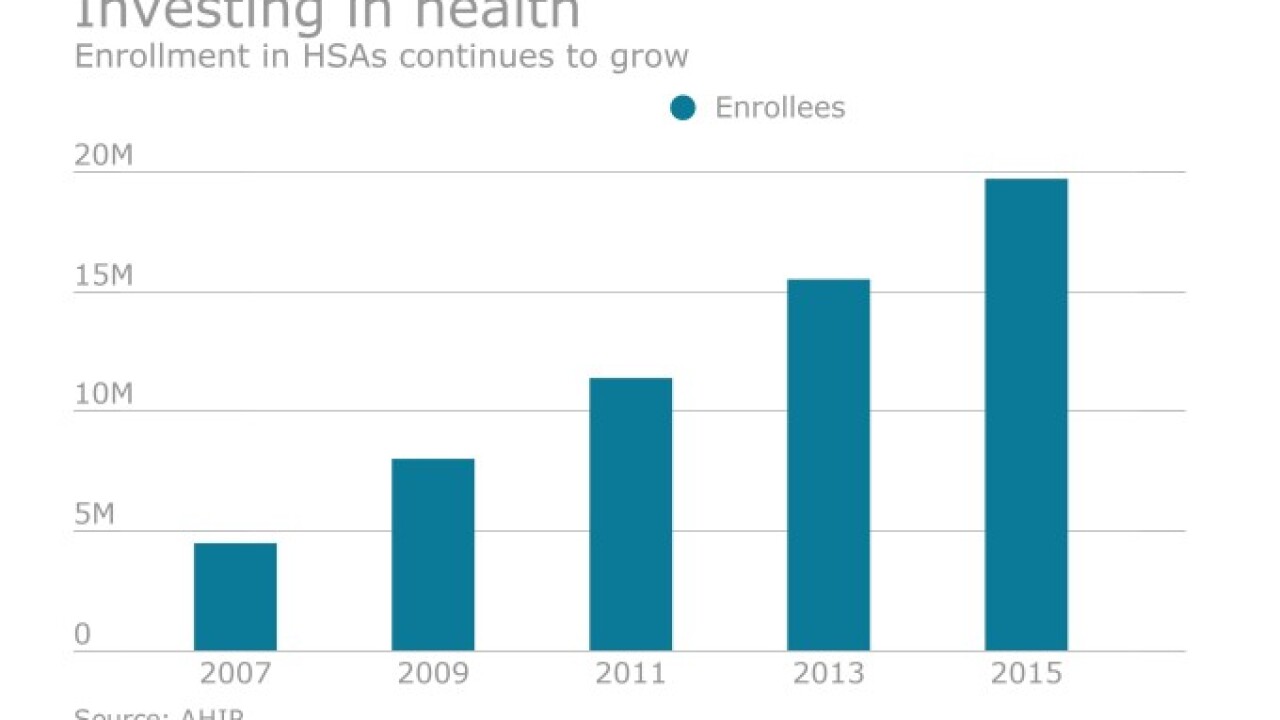

With nearly half of retirees saying medical costs is their biggest concern, employers are beefing up voluntary benefits and promoting HSAs to help employees prepare for their post-work years.

July 5 -

Healthcare continues to vex Republicans, with the demands of conservatives, moderates, the Senate parliamentarian and the public at large seemingly incapable of being reconciled.

July 5 Bloomberg View

Bloomberg View -

As more sectors of the workforce adopt high-deductible plans, advisers should ensure employees are aware of income-protecting voluntary benefit choices.

July 4 -

With nearly half of retirees saying medical costs is their biggest concern, employers are beefing up voluntary benefits and promoting HSAs to help employees prepare for their post-work years.

July 4 -

Employers can adopt health reimbursement accounts to start building a self-insurance plan.

July 3 Corporate Synergies

Corporate Synergies -

The importance of increasing plan member payment contributions is cited as a driving factor in stemming rising costs by benefit insurance brokerage and consulting firm EPIC.

July 2 -

Morningstar recently evaluated 10 of the largest health savings account providers in the country to see how they stacked up in helping employees pay for current and future medical expenses.

June 30