-

CalSavers program argues that state plans will encourage more workers to save for retirement.

March 1 -

If the client makes a mistake, they are advised to take the RMD as soon as they discover it so they can ask the IRS for a waiver of the penalty.

February 28 -

Those who signed up in the past year will get a smaller pension than they would under the old system, but they can expect additional benefits from the tax-advantaged Thrift Savings Plan.

February 27 -

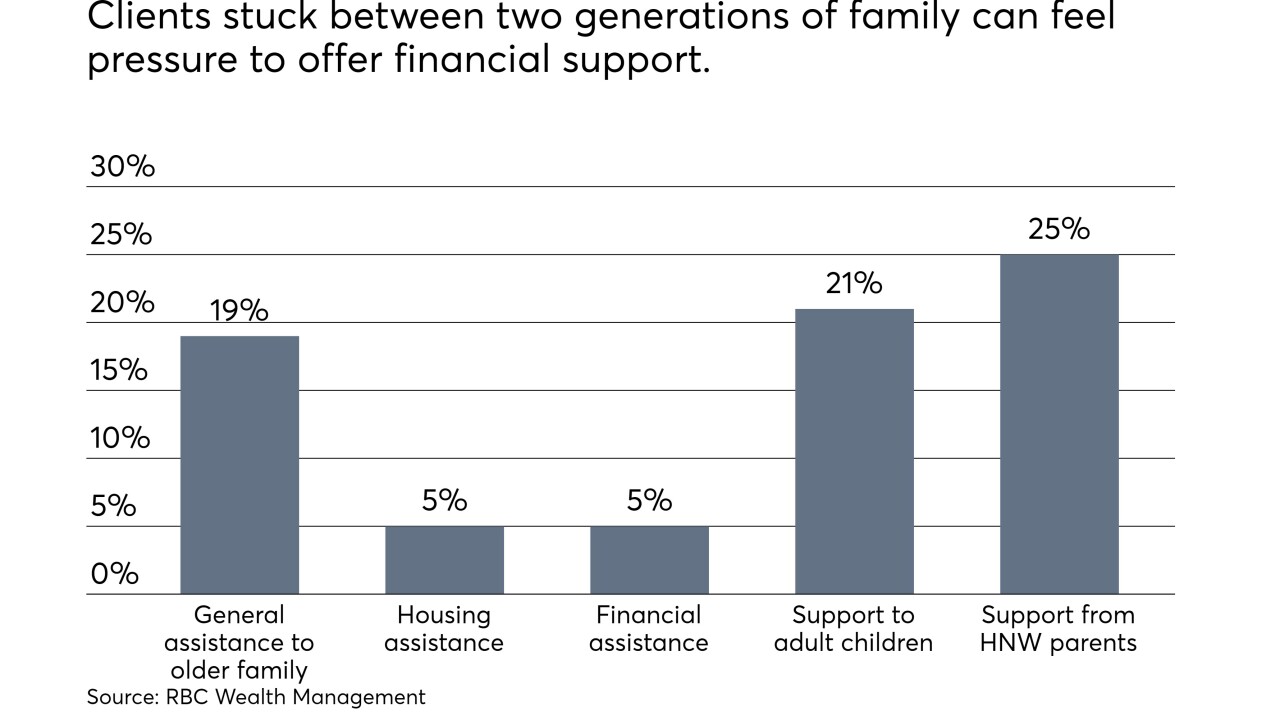

The sandwich generation is struggling to save for its own needs, and when you add in family demands, it paints a "grim picture," an expert says.

February 27 -

Retirement plans may decline to offer delayed RMDs, plan loans, stretch and hardship distributions and a host of other legally sanctioned tax maneuvers.

February 27 -

Expect employers to take steps, such as maximizing automatic services, that will encourage positive behaviors to help individuals reach their financial goals.

February 26 T. Rowe Price Retirement Plan Services

T. Rowe Price Retirement Plan Services -

Although the test is complicated and misunderstood, eliminating it could “do more harm than good,” according to an expert.

February 25 -

The cap on state and local tax deduction under the tax law may prompt more employees to direct their retirement savings to their 401(k)s than to build home equity.

February 21 -

Traditional financial literacy programs may be ignoring the fact that for many employees, money is deeply emotional.

February 21 Sum180

Sum180 -

Clients and advisers hold a key role for many millennials who just aren’t saving enough money.

February 20 LegalZoom LifePlan

LegalZoom LifePlan