-

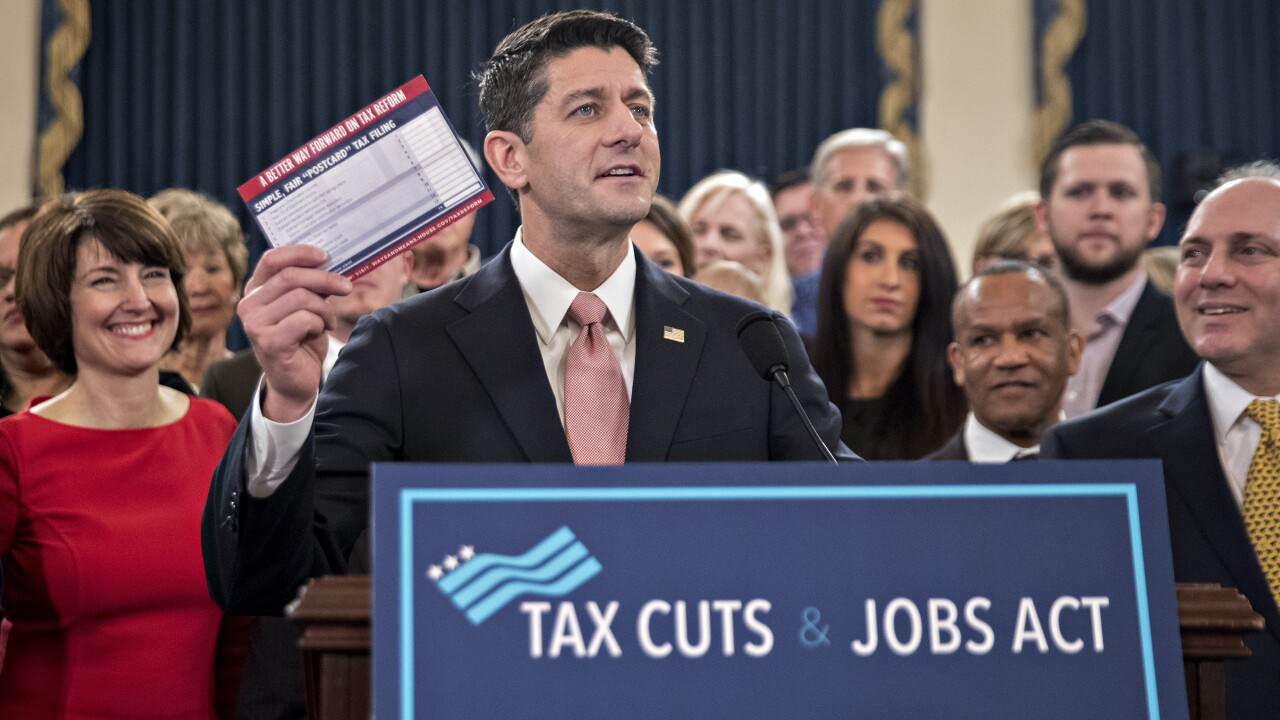

People looking to retire but wanting to keep a part-time gig will benefit from a new law that gives a 20% deduction for “pass-through entities.”

April 5 -

Employees should look into filing for Social Security as soon as they retire to generate extra income and allow their spouse to delay and grow their retirement benefit.

April 4 -

Sometimes the strategy can eliminate a domino effect of other expensive tax problems down the road, Ed Slott writes.

March 27 -

Employees may expect a lower tax liability because of the new rates under the new tax law, especially those who were in the 25% bracket under the old law.

March 19 -

Employees should consider limiting their traditional 401(k) savings, as the plans provide taxable distributions that can boost their tax bill in retirement

March 7 -

Taxation of retirement plan distributions and Social Security benefits remains unchanged under the new tax law, but retirees are likely to see an increase in after-tax income.

February 20 -

Workers who are looking for new investments may want to invest in small-cap dividend payers,

February 15 -

As long as their earnings won't exceed the limit set by the Social Security Administration, they will not lose their benefits.

February 7 -

Retirees who consider taking withdrawals from their 401(k) and other similar plans should account for the tax impact before making a decision.

January 31 -

Workers have an option to stash their bonus in their 401(k), but doing it may not be a good idea.

January 22