Our daily roundup of retirement news your clients may be thinking about.

Discussing financial and retirement goals with adult family members can help seniors avoid falling victim to elder fraud, according to this article on USA Today. They should also consider designating joint agents, reviewing the security features on their financial accounts, and having their names removed from credit card solicitations. Keeping more of their retirement savings in their 401(k) is also a good strategy to reduce the risk of elder fraud. “[R]etirees shouldn’t trust overblown claims by advisors who say they can outdo employer-sponsored plans, as these statements are typically too good to be true,” says an expert.

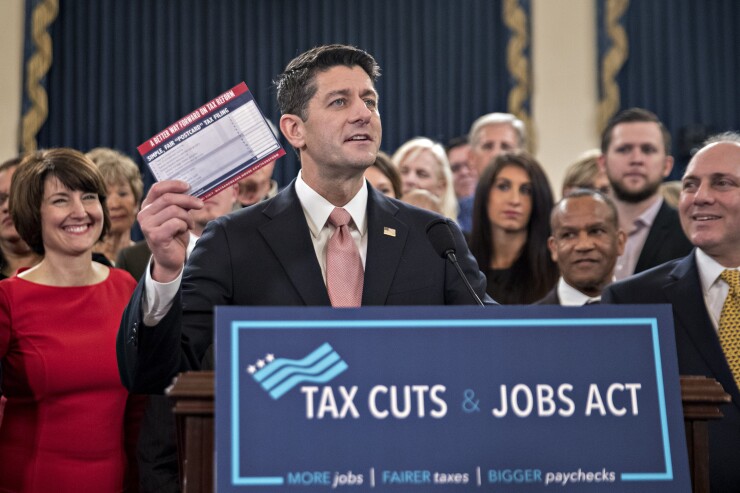

Clients may expect a lower tax liability because of the new rates under the new tax law, especially those who were in the 25% bracket under the old law, according to this article on Kiplinger. Under the new law, clients who were in that bracket can see their tax rate drop to 22% for income from $12,000 to $165,000. This allows clients to increase their income with minimum tax burden. One way to get additional income is to do a Roth conversion, which will be subject to income taxes but will boost their after-tax income in retirement.

401(k) participants can take withdrawals before the age of 59 1/2 without facing a 10% penalty if they meet certain requirements, according to this article on Motley Fool. However, they will still face income tax on the withdrawn amount. Early withdrawals will also mean ending up with a smaller nest egg.

Retirement accounts such as IRAs have default arrangements in case one of the children designated as beneficiary dies before the account holder's death, according to this article on MarketWatch. The "per capita" default arrangement will direct the deceased child's inheritance to the other surviving child, while the "per stirpes" arrangement allows the deceased beneficiary's dependents to receive the inherited assets. IRA investors are advised to study the terms if the default arrangement conforms to their wishes or hire an attorney to draft a custom beneficiary designation.

A federal appeals court reversed a lower court's decision that upheld the fiduciary rule issued by the Department of Labor for financial professionals providing advice on retirement accounts, according to this article on The New York Times. “That times have changed, the financial market has become more complex, and I.R.A. accounts have assumed enormous importance are arguments for Congress to make adjustments in the law, or for other appropriate federal or state regulators to act within their authority,” the court ruled. “A perceived ‘need’ does not empower D.O.L. to craft de facto statutory amendments or to act beyond its expressly defined authority.”