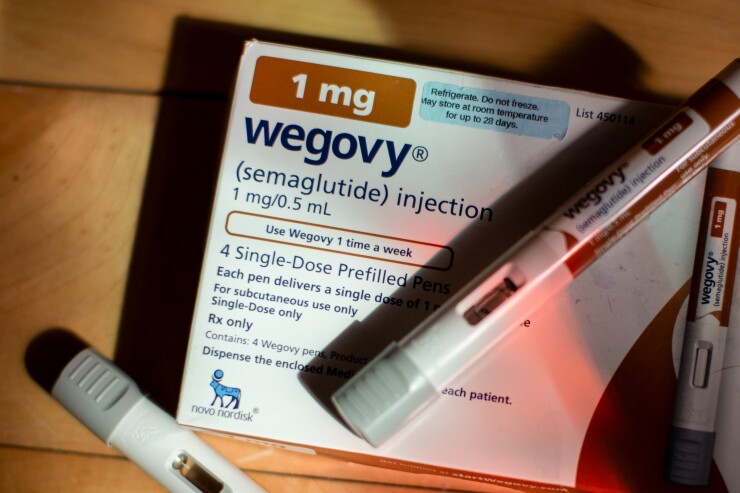

CVS Health's drug benefits unit is trying to entice health insurance plans to cover Wegovy, Novo Nordisk's pricey weight-loss shot, for more patients by allowing them to charge copays as high as $200.

It's the latest move by pharmacy benefit managers, which negotiate drug prices on behalf of health plans, to deal with the surging demand for weight-loss medicines. The copay option would take effect starting next year.

The drugs are expensive, so insurers have pushed back against covering them. That's left patients facing list prices that top $1,000 a month, though manufacturers have set up discount programs.

Read more:

This move by Caremark, the CVS drug benefits manager unit, could save insurers money because patients would

CVS's new copay option follows on the heels of a similar move by Cigna Group's drug benefits business when it announced that weight-loss drug out-of-pocket spending would be capped at $200.

Since July, CVS has also limited coverage of Eli Lilly's Zepbound, instead favoring Wegovy, allowing it to get a better price on the drug from Novo. That move saved some of CVS's health plan clients 10-15% on weight-loss drug spending in total, according to Joshua Fredell, a senior vice president at Caremark.

CVS also negotiated

"If Lilly provides more affordable pricing for Zepbound in the future, we may add it back to our standard formulary templates," CVS spokesperson David Whitrap said. "We encourage them to do so."

Read more:

If Zepbound returns to the standard formulary, which covers between 25 and 30 million people, it would also be eligible for the $200 copay, Whitrap said.

Choosing Wegovy over Zepbound has been frustrating for some patients. Hundreds of thousands of patients were affected, according to CVS. The vast majority of patients whose health plan use CVS's standard formulary were switched over. Now 97% of

Overall for 2026, CVS expects to save health plans $4.5 billion based on new rebates it negotiated from drug companies, which translates to savings of just under $138 per patient, Fredell said. Whitrap declined to say whether Aetna health insurance plans, which are also owned by CVS, would