Much ink gets spilled every year on the state of Americans' retirement security. Recent

The problem, however, is that these headlines obscure reality. Most of the savings rates that are shared publicly are based solely on people who are

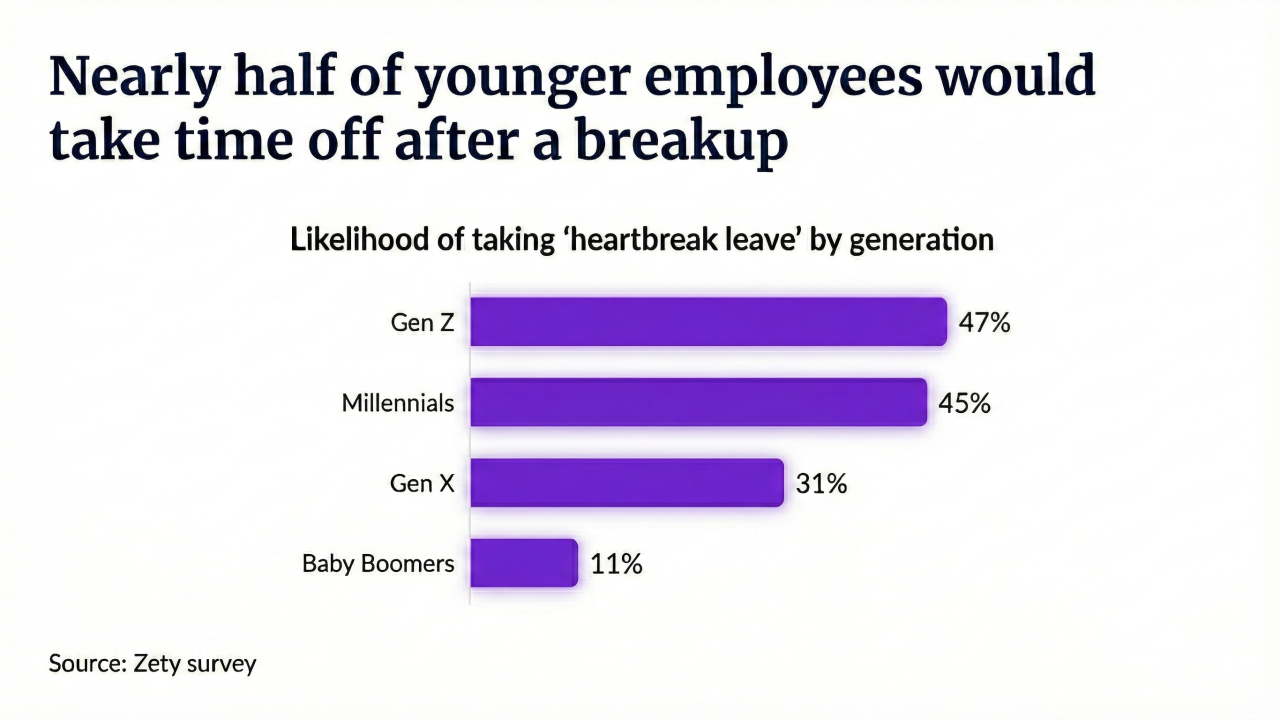

Nearly

At its core, the

Read more:

This unresolved tension is coming to a head as the first generation dependent on defined contribution retirement plans enters retirement age (nearly 11,000 Americans turn 65 every day). In a post-pension world, this 40 year experiment with the 401(k) has resulted in a very mixed bag for Americans.

There are many parts of the retirement savings ecosystem that have to be addressed by policymakers to help Americans have a secure retirement — from how a living wage is calculated (the ability to afford essential expenses) to Social Security. However, there are also some basic changes that employers can undertake themselves to improve access to retirement savings plans.

Five financial health design principles for retirement plans

A few simple, common-sense changes on the

- Eliminating waiting periods to expand 401(k) access: Shortening waiting periods for 401(k) enrollment i

s a proven strategy to increase participation and improve long-term financial security for workers . For many lower-income or frontline workers, this earlier access can be a critical step toward achieving greater financial stability, enabling them to build savings gradually, take advantage of compounding interest, and benefit from a more secure retirement. As an example,Target expanded access to the company's 401(k) plans by reducing waiting periods , allowing employees to save sooner.

- Expanding access to part-time workers: Part-time and seasonal employees frequently lack access to employer-sponsored retirement plans. Expanding eligibility to these groups is a critical step employers can take to enhance overall workforce financial security. For instance,

Starbucks offers 401(k) benefits to part-time employee s who work at least 240 hours over three consecutive months, with a dollar-for-dollar company match on the first 5% of their eligible pay.

Read more:

- Auto-portability: This refers to automating the transfers of retirement account balances when employees change jobs. There are roughly

16 million orphaned retirement accounts and the vast majority of those are held by low to moderate income workers. By simplifying and automating rollovers into new plans, auto-portability minimizes the risk of cashing out or abandoning accounts, preserving savings and avoiding rollover penalties. New fintechs, such asManifest , automate this process with no costs to employers, making auto-portability a no-brainer.

- Unconditional employer contributions: Most retirement plans have contribution schemes that are conditional upon the employee making contributions. These matching formulas, however, often benefit high-income earners and widen the gaps for lower- and middle-income households. One way employers can address this is to provide an unconditional match, regardless of the employee making contributions. For example, auto-enrolling workers with a guaranteed 3% match can allow workers to start building savings (employers could still have an additional matching formula based on employee contributions).

As a practical matter, this can help workers start on their retirement journey even if they are living paycheck to paycheck, and help close

Read more:

- Offering financial guidance to support retirement readiness: Personalized financial guidance can help improve workers' retirement readiness — particularly when paired with support for short-term financial needs. Recent estimates find that holistic financial advice

could unlock more than $4,000 of value per year for households . Many employers also provide retirement planning programs to help older workers make informed decisions, such as the optimal age for retirement.

While these changes won't solve all the challenges facing America's workforce, these financial health-design principles can help make meaningful progress on closing the gap so that every worker in the U.S. has a secure retirement.