Due to the Affordable Care Acts employer mandate, benefit experts argue that employers across the country should consider skinny plans the barebones, minimum essential health coverage option in order to cover their full-time workforce, and not break the bank.

In lieu of paying the ACAs hefty fines, such as the $2,000-per employee nuclear penalty, McDermott Will & Emery attorneys say that employers are pondering a calculated gamble by offering skinny plans to satisfy the ACAs employer mandate.

Also See:

And it may be the go-to option for companies as large and mid-size employers will have to cope with the health care law over the next two years. McDermotts legal benefit experts say skinny plans allow employers to send employees to the exchanges to attain the minimum essential coverage.

Susan Nash, co-chair of McDermotts health and welfare plan affinity group, explains there is a lot of cost benefit analysis going on now by employers that are considering paying penalties or providing benefits.

The basic plans with preventive care benefits, cited as an option that has to be affordable and of minimum value for full-time employees, may help to satisfy the coverage requirement. While some are considering subtracting spousal benefits or adding surcharges, other options have been to send retirees and Medicare-eligible employees to private and public health exchanges with the added help of health reimbursement accounts.

So the traditional indemnity plan is being reanalyzed at this point by a lot of employers. Nash says.

Also See:

With the skinny plan option under consideration, Nash explains that these employers may be subject to smaller tax on a per person basis. She adds that simply cutting of health coverage is not in the stars for most companies, however.

We have not seen a lot of employers simply abandoning their medical plan offerings, and so I dont see employers intentionally saying were not going to provide any medical coverage, Nash explains. But, with about 170 million people currently receiving health insurance from their employers, Nash explains that some employers are opting for skinny plans or similar types of options that give some coverage, but not as comprehensive as in the past.

Meanwhile, right now, data is not available to support the appeal of skinny plans to employers, says Paul Fronstin, director of the Employee Benefit Research Institutes health research and education program.

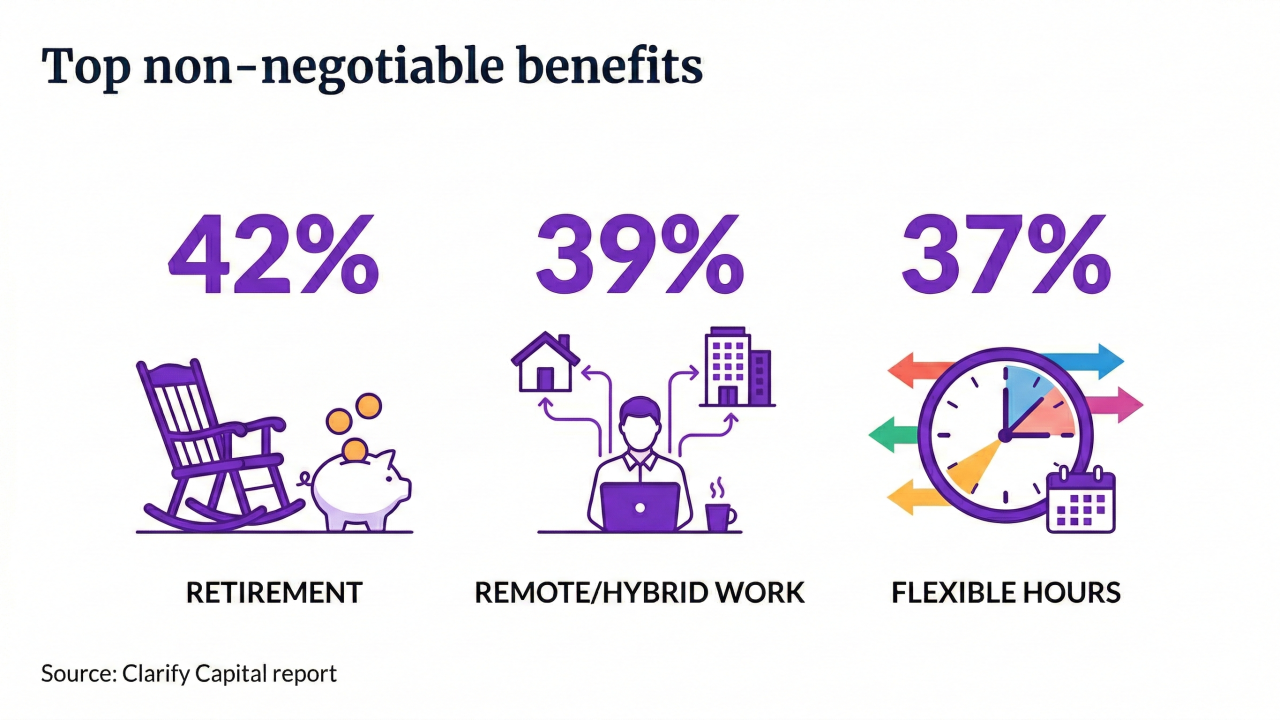

I dont know that there were that many employers doing that in the past clearly there were some, he tells EBN. But the question that I have is, why would an employer go in that direction if it hadnt already done that? Youve had employers offering health benefits on the voluntary basis throughout history they didnt have to, but they did so that they could be competitive to the labor market.

Remaining competitive through an essential benefits package may be a value that employers will have to consider. While noting firm size and cost may be driving a push for health plan coverage changes, Fronstin is reticent to predict drastic changes to employer-sponsored health coverage.

When you have a law come along, the risk is that it sets the floor and everyone migrates to the floor when they werent at the floor in the past, but I dont see any evidence that its going to happen, says Fronstin. [Also,] I dont see any evidence that its not going to happen.