From tighter budgets to less healthy lifestyles, millennials have little in common with their predecessors. Having recently surpassed baby boomers as the largest generation of the workforce, the needs of these younger individuals are now more important than ever.

Processing Content

Modern benefit technology and strategies must be quickly implemented to best position employers to deliver successful programs to this increasingly influential group. So, how can employers address the evolved priorities of the millennial demographic?

Understanding millennial perspectives

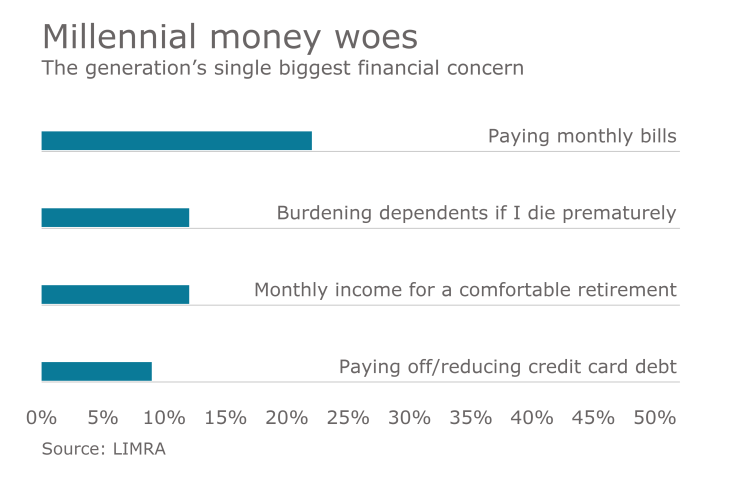

Firstly, it is critical to recognize the needs of the millennial. We know that financial concerns rank high for this generation. We also know millennials demonstrate less concern for their long-term health with Pew Research data showing more than triple the rate of obesity in young adults since the 1970s, and mental health in lower income adolescents becoming increasingly prevalent. Furthermore, alcohol, tobacco and substance use unfortunately remains high.

That said, a recent study found millennials rank health benefits highest against other employer offerings, specifically seeking out companies with programs such as on-site health clinics. With this in mind, benefit advisers must equip employers with lower-cost options that tend to their riskier, short-term mindsets.

While millennials share many unifying attributes, what makes this generation even more complex is that the needs of the older and younger millennials can vary so greatly. For instance, a single 22-year-old will likely seek out a high-deductible health plan since they are unlikely to anticipate major immediate health needs and want to keep monthly expenses down as a priority. While they may not anticipate it, mental health conditions are of greater concern for these younger individuals with more instances of depression among the 18 to 25 age group. Unfortunately, with mental illness and physical disease closely linked, this age group could be taking on too much risk. Only time will tell.

On the other end of the age spectrum, a 38-year-old single mother — a status more common among millennials — might lean towards a lower deductible plan that will offer better coverage options for her children. Her children could be engaging in risky hobbies, such as sports, and therefore be more susceptible to broken bones and other costly injuries. Purely due to age, she will also be more likely to have diagnosed health conditions. In the long term, this more prudent health plan could end up saving her costs. Needless to say, there are numerous demographics to consider.

Building a modern benefit strategy

To implement a successful and engaging benefit program, strategies must not only consider financial and health priorities, but also an employee’s preferred means of communication. As a highly digitally-savvy generation, millennials are much more responsive to technologically-advanced enrollment and benefit management programs. Accustomed to online sign-ups, this generation now demands an intuitive, personalized experience that aligns with their retail consumer expectations.

Millennials are the future of the workplace and benefit advisers must educate and equip their clients to meet the health, financial and technological needs of this increasingly modern workforce.