-

A plan sponsor’s thoughtful choices about plan features may go a long way toward easing the financial burden of retirement saving.

March 29 Schwab Retirement Plan Services

Schwab Retirement Plan Services -

Less volatility, lower litigation risk and greater simplicity are reasons for embracing this strategy, says adviser Robert Lawton.

March 29 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

A majority of baby boomers polled by Bankers Life Center for a Secure Retirement say that the economy has yet to fully recover from the 2007 financial meltdown.

March 29 -

State efforts to get more workers to save are the target of lawmakers who say the auto-IRA programs burden employers and skirt the rules.

March 29 -

A new study finds that workers struggle with expenses, making it “critically important” for employers to provide financial wellness and education.

March 28 -

A Roth IRA would come ahead of a traditional IRA if employees move to a higher tax bracket in retirement.

March 28 -

Young employees highly value financial advice but are not receiving enough of it, according to Corporate Insight.

March 28 Corporate Insight

Corporate Insight -

A Roth IRA would come ahead of a traditional IRA if clients move to a higher tax bracket in retirement.

March 28 -

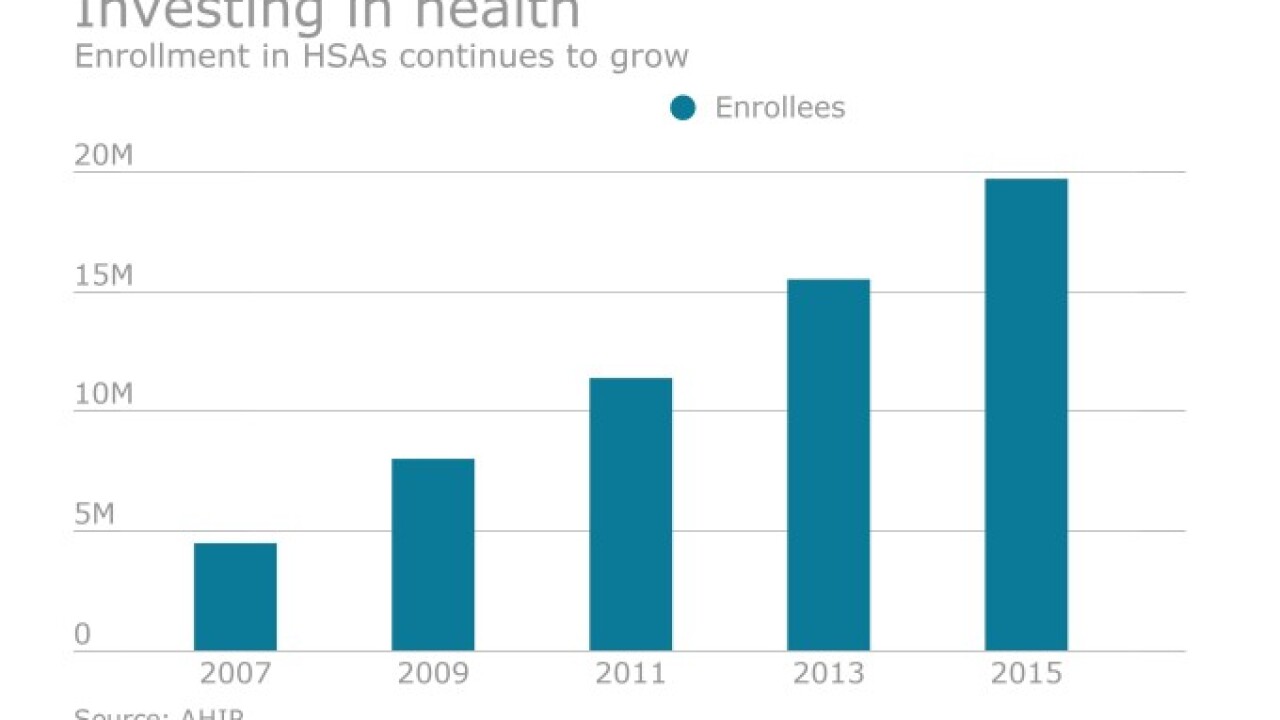

Health savings accounts are becoming vastly more important for employees because they not only help with medical savings, but put workers on a better track for retirement, experts say.

March 28 -

Brokers must bridge the gap between prepping clients for retirement and keeping them satisfied for the years after employment.

March 27