-

Nearly half of large companies offer some type of program, yet just over one-third of workers say they have access to one, highlighting a disconnect between available benefits and employees’ understanding of them.

April 14 -

Helping clients understand the pension and benefit plans of seller organizations is an important part of any acquisition.

April 14 -

As fiduciary awareness grows, collective investment trusts, which often have lower fees than mutual funds, are poised for growth.

April 14 -

Many older workers in this generation simply aren't savings enough; auto-enrollment retirement programs are listed among the potential solutions.

April 13 -

As employers structure their workplace programs, here are three strategies to consider that can better equip employees with the tools they need to succeed.

April 12Lincoln Financial Group -

Despite the efforts of the retirement industry, many baby boomers haven't taken to the variety of savings products available, according to the latest research.

April 12 -

A majority of this generation expects most of their post-work income to come from Social Security, finds new research, placing added responsibilities on employers to consider implementing auto-enrollment and auto-escalation.

April 11 -

Understanding the pension and benefit plans of seller organizations is an important part of any acquisition, yet many companies report having less time to complete this due diligence.

April 10 -

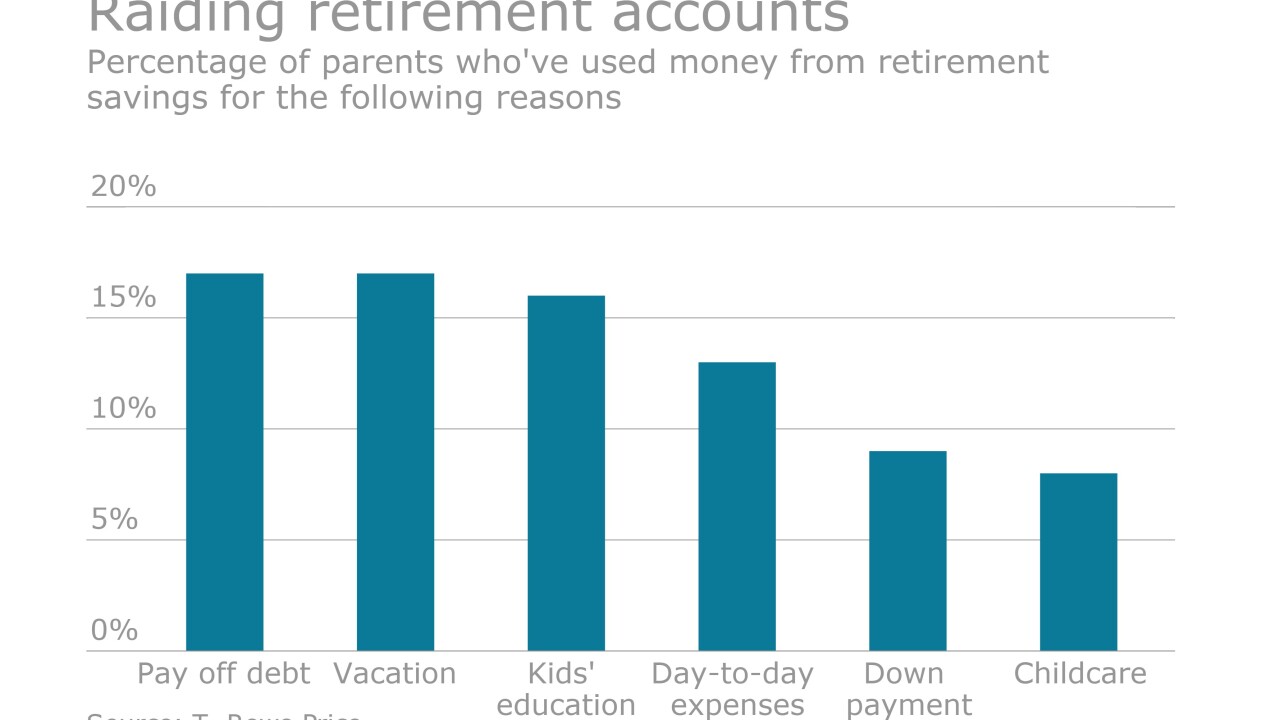

Employers and advisers are urged to increase financial education so employees understand the pros and cons of tapping into their 401(k) plans for purposes such as paying off credit card or student loan debt.

April 8 -

Volatility fears are one reason many members of this generation haven’t taken to the variety of retirement savings products available.

April 8