-

Under the DOL’s new standard, all retirement plan advisers — and not just some — will have to put their clients’ interests ahead of their own.

April 7 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

In light of the DOL’s new rule, some advisers will have to define a new relationship with employers and may ask for additional fees.

April 7 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

Plan sponsors and advisers are still able to provide generic facts about retirement savings and 401(k) plans without being subject to the DOL’s new rule.

April 7 -

Employees are uneasy about their finances and employer clients that prioritize benefits education are at a competitive advantage, new MetLife research finds.

April 7 -

Retirement plan industry experts are greeting the Department of Labor’s plans, which will force employers to be more cautious when hiring advisers, with a mix of caution and optimism.

April 6 -

Employees are uneasy about their finances and organizations that prioritize year-round benefits education are at a competitive advantage, finds MetLife’s Annual Employee Benefit Trends Study.

April 4 -

Plan sponsors can improve the health of their plans and participants’ retirement outcomes by embracing roll-ins, yet the process remains difficult and costly for workers.

April 4 Portability Services Network and Retirement Clearinghouse

Portability Services Network and Retirement Clearinghouse -

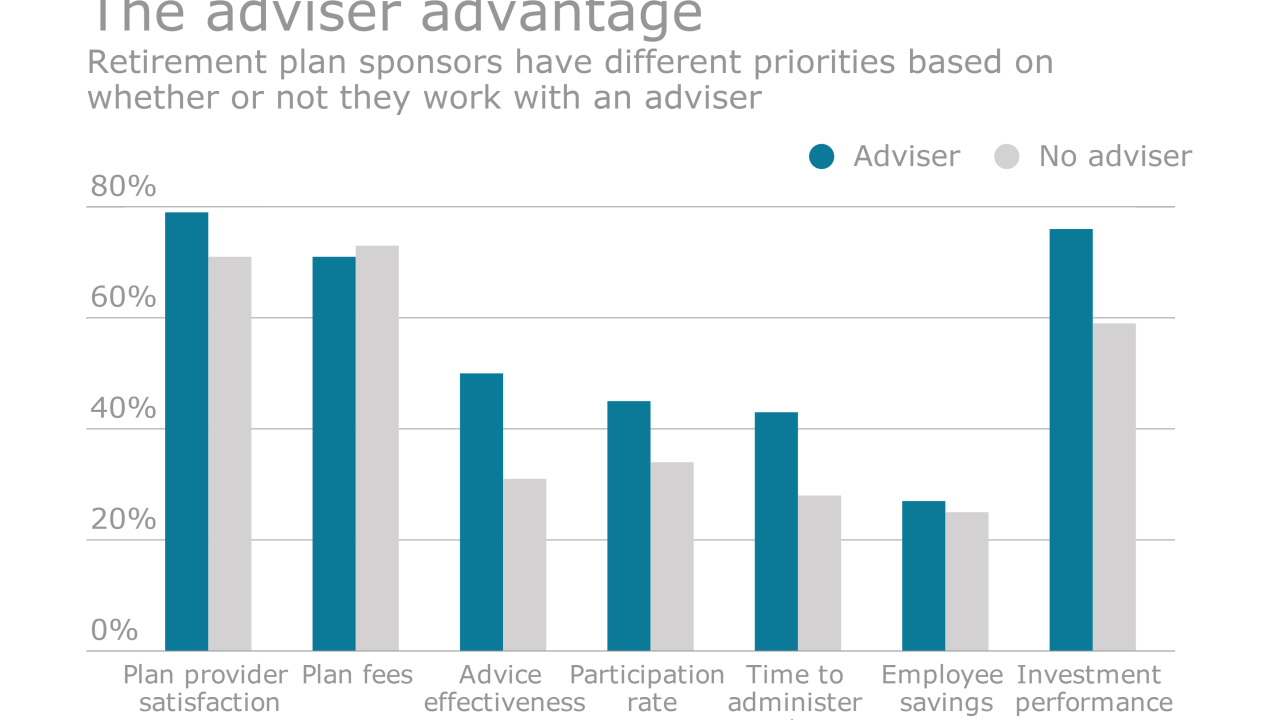

While benchmarking 401(k) plan investments and fees is important, new research suggests employers and their advisers aren’t doing enough to measure workers’ retirement readiness.

April 4 -

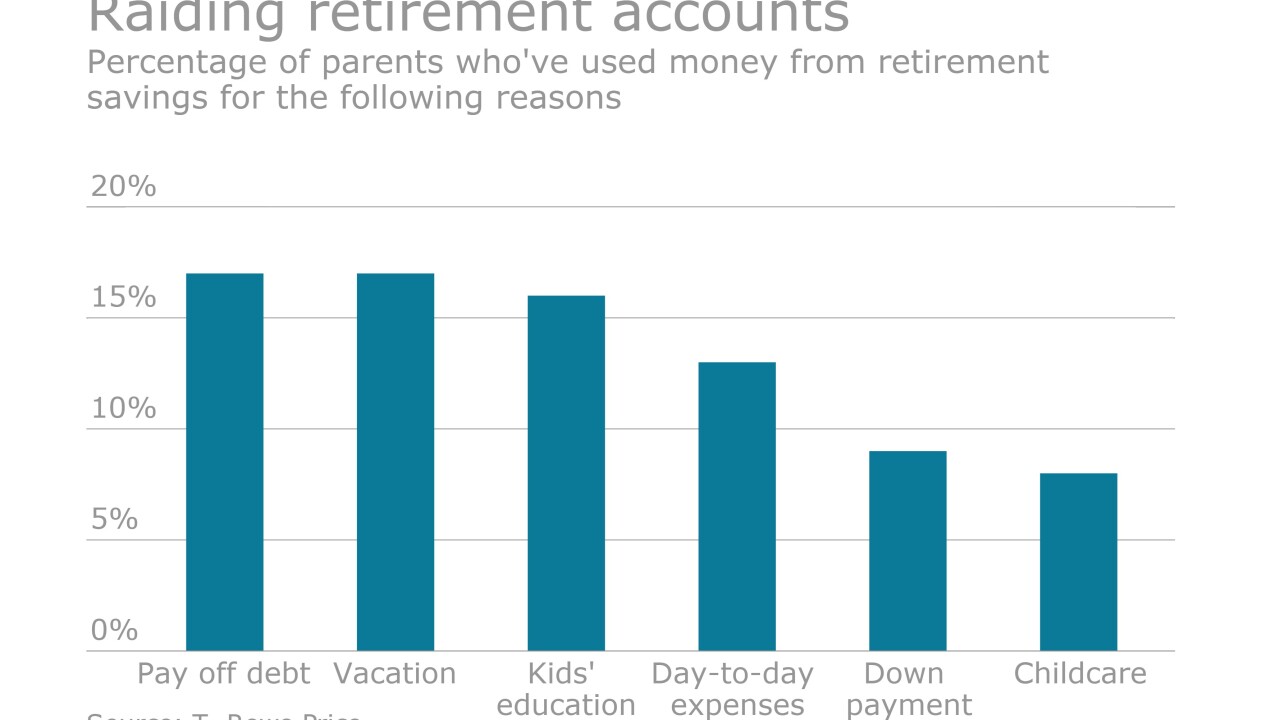

Plan sponsors are urged to increase financial education so employees understand the pros and cons of tapping into their 401(k) plans for purposes such as paying off credit card debt.

April 3 -

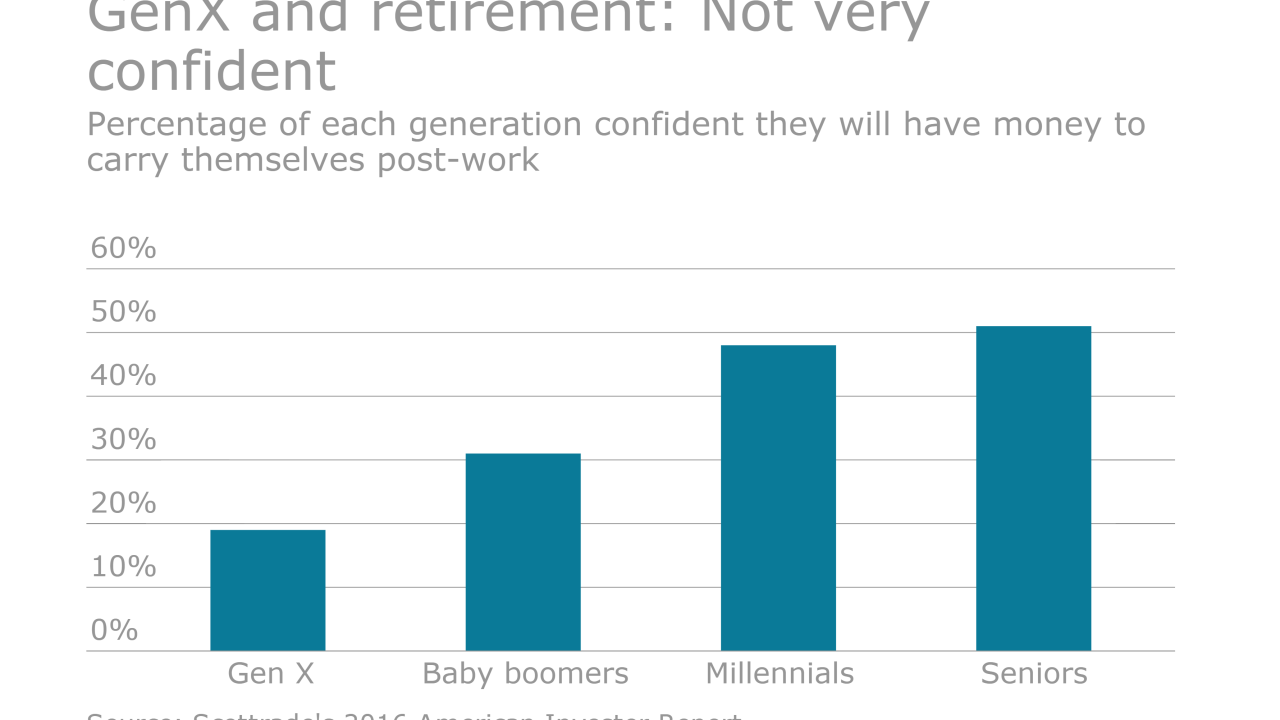

New research from the Insured Retirement Institute reveals that many workers in this age group aren’t feeling very confident about their financial prospects.

April 1