-

During an M&A, figuring out what to do with the retirement plans can sometimes be an afterthought, but it doesn’t need to be, says State Street’s Nate Miles.

April 29 State Street Global Advisors

State Street Global Advisors -

Getting employees to understand and participate in their financial future is all about the language, say industry experts at this week’s 401(k) Summit.

April 20 -

The DOL’s rule is good news for plan sponsors, but many are still confused, says registered investment adviser Robert Lawton.

April 19 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

Getting employees to understand and participate in their financial future is all about the language, say industry experts at this week's NAPA 401(k) Summit in Nashville.

April 18 -

Lawmakers and industry authorities discuss at the National Retirement Planning Week conference some of the initiatives employers could implement to help workers with retirement readiness.

April 14 -

As defined in the new rule, investment advice includes recommendations to an employee benefit plan, plan fiduciary, participant or beneficiary, or an IRA, HSA, or education savings account owner.

April 14 Ascensus

Ascensus -

As defined in the new rule, investment advice includes providing investment or investment management recommendations to an employee benefit plan, plan fiduciary, participant or beneficiary, or an IRA, health savings account, or education savings account owner.

April 12 Ascensus

Ascensus -

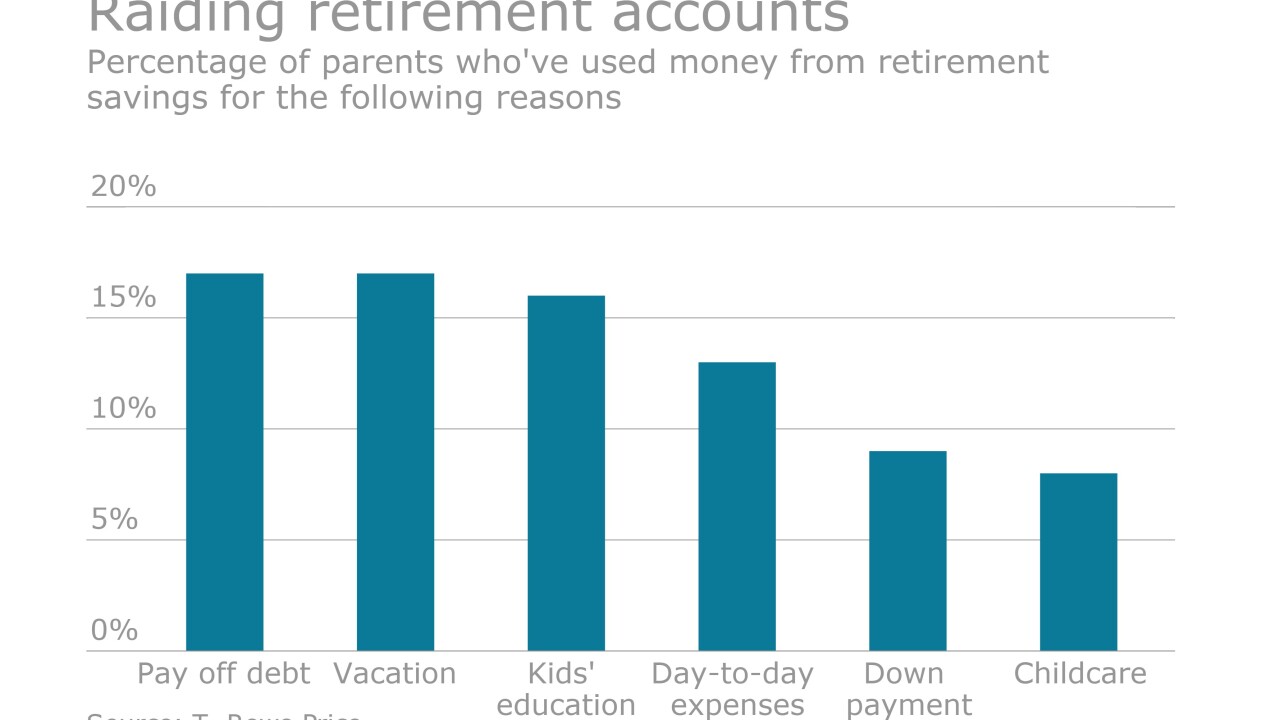

Employers and advisers are urged to increase financial education so employees understand the pros and cons of tapping into their 401(k) plans for purposes such as paying off credit card or student loan debt.

April 8 -

Plan sponsors are urged to increase financial education so employees understand the pros and cons of tapping into their 401(k) plans for purposes such as paying off credit card debt.

April 3 -

DB and DC plan sponsors that depend on these documents to remain in accordance with the tax code may face heightened compliance risks.

March 29