-

Instead of offsetting current healthcare costs, some employees are using these accounts for their post-work medical expenses.

October 9 -

Nearly two-thirds of future and recent retirees are worried there will be cuts to the program under the Trump administration. And an even greater percentage think that it needs to change.

October 4 -

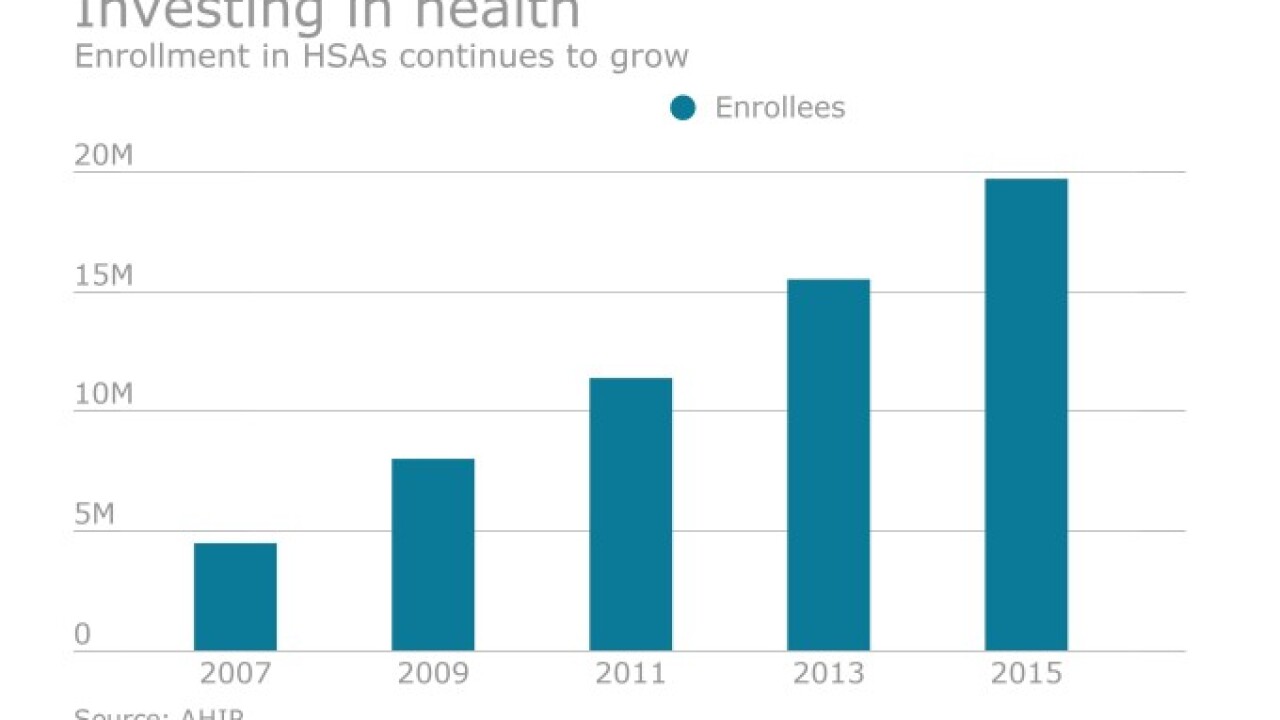

In addition to being triple tax-free, health savings accounts can make a significant difference for workers’ retirement planning.

October 2 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

In the wake of the GOP’s latest failure to pass health reform, Big ‘I,’ NAIFA, NAHU and others target repeal of Cadillac tax, increasing use of HSAs.

October 1 -

In the wake of the GOP’s latest failure to pass health reform, Big ‘I,’ NAIFA, NAHU and others target repeal of Cadillac tax, increasing use of HSAs.

September 27 -

Some say the changes could make the Federal Housing Administration's program less attractive to borrowers, but they could also improve the market.

September 25 -

Some say the changes could make the Federal Housing Administration's program less attractive to borrowers, but they could also improve the market.

September 25 -

UBA data show these companies exhibit superior cost-containment relative to larger counterparts.

September 22 -

Retirees can open health savings accounts, which offer tax breaks on contributions and qualified distributions, and tax-free growth on investments.

September 19 -

Those who left the workforce can open HSAs, which offer tax breaks on contributions and qualified distributions, and tax-free growth on investments.

September 19