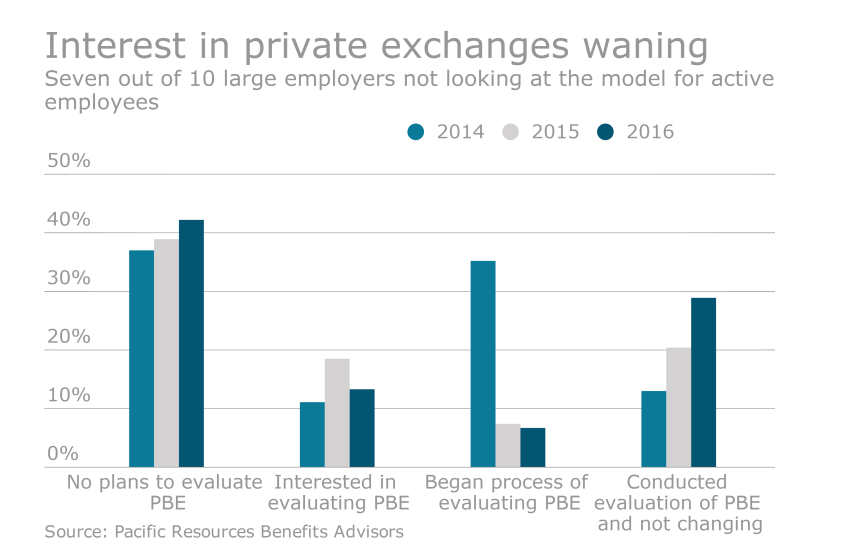

For the 2016 benefit plan year, Accenture estimates that 8 million people enrolled in a private exchange nationwide — a 35% increase over the prior year, but lower numbers than anticipated. The growth was fueled by midsize employers of 100 to 2,500 employees.

“Things have decelerated a little bit in terms of rapid growth, however 35% growth is significant,” Scott Brown, managing director at consultancy Accenture, says. “We continue to see interest from employers and continued investment by private benefit exchange operators and those that participate in the space.”

The Pacific Business Group on Health, a purchaser-only coalition representing 60 public and private organizations across the U.S that collectively spend $40 billion a year purchasing healthcare services for 10 million Americans, recently surveyed members on why they have not moved to a private exchange. Here, Emma Hoo, the group’s director, shares some insights.