-

Getting employees to understand and participate in their financial future is all about the language, say industry experts at this week's NAPA 401(k) Summit in Nashville.

April 18 -

Three strategies to consider when helping employers structure workplace programs that offer employees financial tools for their future.

April 18Lincoln Financial Group -

Health insurance and retirement accounts can require a substantial amount of specialized knowledge and research, which can sometimes lead to decisions about them being put on the back burner indefinitely, according to Captain401’s Roger Lee.

April 15 Captain401

Captain401 -

As defined in the new rule, investment advice includes recommendations to an employee benefit plan, plan fiduciary, participant or beneficiary, or an IRA, HSA, or education savings account owner.

April 14 Ascensus

Ascensus -

As defined in the new rule, investment advice includes providing investment or investment management recommendations to an employee benefit plan, plan fiduciary, participant or beneficiary, or an IRA, health savings account, or education savings account owner.

April 12 Ascensus

Ascensus -

As employers structure their workplace programs, here are three strategies to consider that can better equip employees with the tools they need to succeed.

April 12Lincoln Financial Group -

Despite the efforts of the retirement industry, many baby boomers haven't taken to the variety of savings products available, according to the latest research.

April 12 -

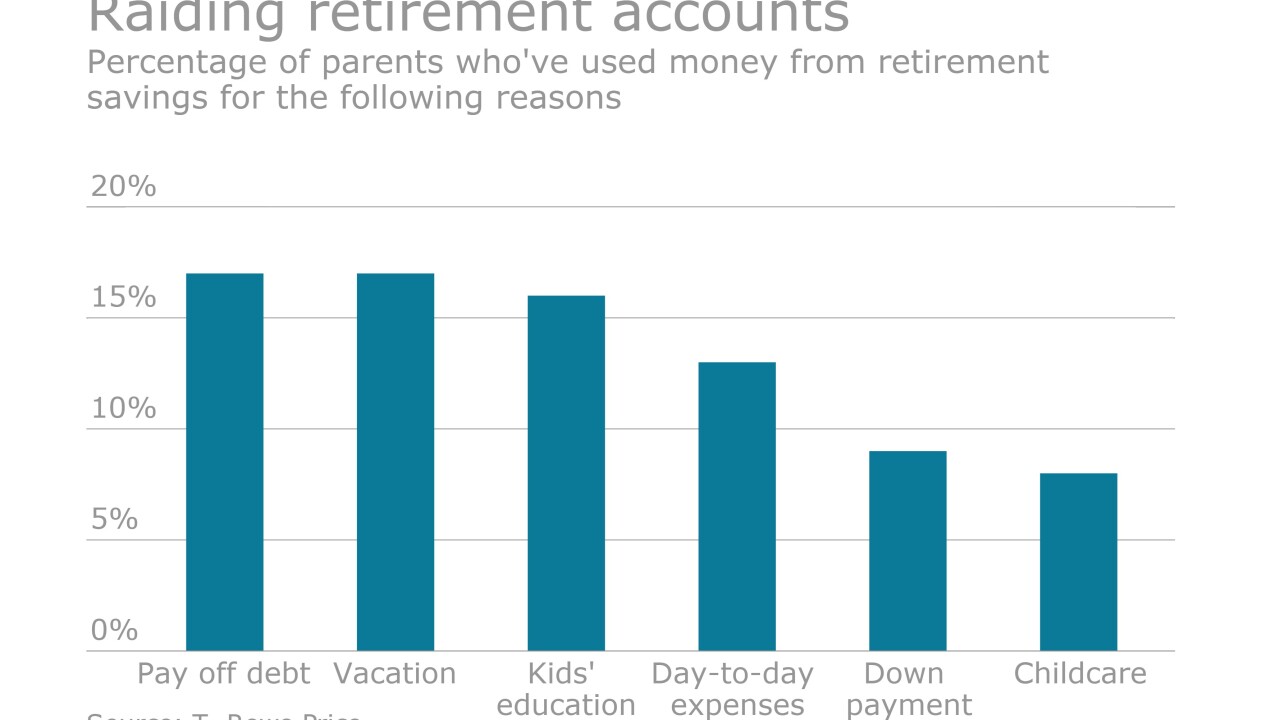

Employers and advisers are urged to increase financial education so employees understand the pros and cons of tapping into their 401(k) plans for purposes such as paying off credit card or student loan debt.

April 8 -

Volatility fears are one reason many members of this generation haven’t taken to the variety of retirement savings products available.

April 8 -

Plan sponsors and advisers are still able to provide generic facts about retirement savings and 401(k) plans without being subject to the DOL’s new rule.

April 7