-

Advisers can help employers pay close attention to these items to avoid catching the eye of the DOL.

April 4 -

While benchmarking 401(k) plan investments and fees is important, new research suggests employers and their advisers aren’t doing enough to measure workers’ retirement readiness.

April 4 -

Plan sponsors should stand their ground to discourage plaintiffs from pursuing more lawsuits, says one expert.

April 3 -

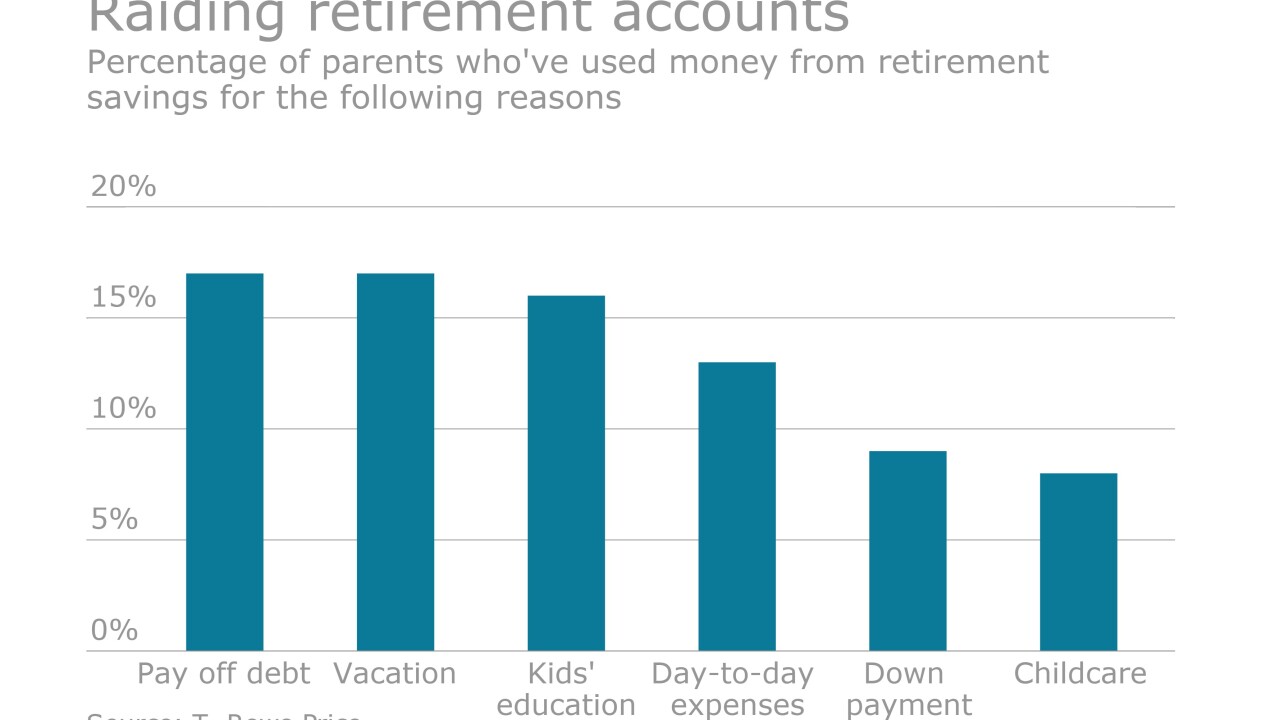

Plan sponsors are urged to increase financial education so employees understand the pros and cons of tapping into their 401(k) plans for purposes such as paying off credit card debt.

April 3 -

Lawsuits can’t be avoided, so advisers should focus on helping clients improve their processes, one expert says.

April 1 -

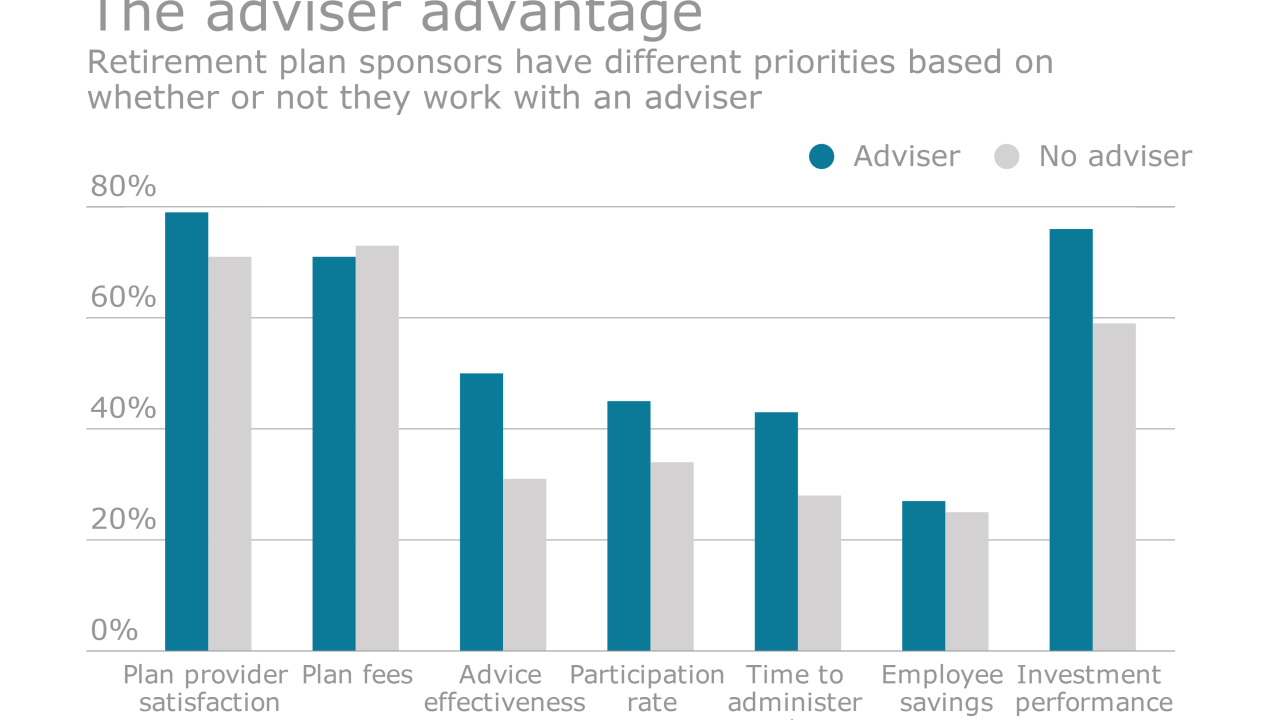

The DOL’s impending fiduciary rule will accelerate employers’ move toward vetting for experienced brokers, one expert says, adding that a formal process would help plan sponsors better spot suitable firms.

March 31 -

Regardless of what the final Department of Labor regulations say about fiduciary responsibility, sponsors should not hire or continue to work with an adviser who will not sign on to the plan as a fiduciary.

March 30 Lawton Retirement Plan Consultants

Lawton Retirement Plan Consultants -

While benchmarking 401(k) plan investments and fees is important, new research suggests employers and their advisers aren’t doing enough to measure workers’ retirement readiness.

March 30 -

The DOL’s impending fiduciary rule will accelerate employers’ move toward vetting for experienced brokers, one expert says, adding that a formal process would help plan sponsors better spot suitable firms.

March 30 -

Ted Benna, who was instrumental in designing early 401(k) plans, comes out of retirement to help small and mid-sized businesses determine whether they’re getting their money’s worth from plan charges.

March 23