Personal finances are stressful enough without a global epidemic. But having the right financial wellness benefits in place will help employees tackle unforeseen obstacles, and drive productivity.

“Financial health is known to be a great cause of stress,” says Adam Hills, senior vice president of institutional client businesses at Ayco — the financial planning arm of Goldman Sachs. “Employers who offer financial wellness are addressing emotional and physical health — they just need to know what [benefit] to offer.”

Financial worries are the leading cause of stress in 60% of American workers, according to a PwC study. This preoccupation with finances costs employers billions in lost productivity and increased healthcare costs.

Of course, while none of these figures take into account how the COVID-19 epidemic is affecting stress and productivity, employers can help guide their employees towards financial wellness through their benefits plans, Hills said. He shared best practices for determining which financial wellness offerings best suit their workforce in a recent interview.

Why should employers prioritize financial wellness programs?

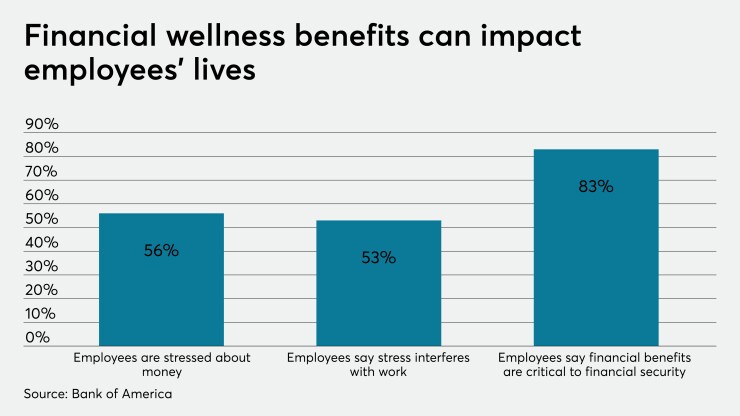

Financial wellness gives employers a direct ROI by reducing absenteeism and medical costs resulting from stress. Employees who feel their needs are being met are more likely to be productive and loyal to their employer.

But with so many financial wellness offerings on the market, the challenge for employers is deciding on what programs they want to introduce into their workforce. Many make the mistake of trying to boil the ocean — they do too many things all at once.

How do employers determine which financial wellness benefit is best for their workers?

Employers need to take a surgical approach to determine which areas they want to address with their employees. Do they want employees contributing more to their HSAs or 401(k)s? Do they have a lot of employees with student debt? Do they have emergency savings? Do they need help with tax planning? Once they’re able to determine what their workers are concerned about, or what their goals are, they’ll be able to build a more effective financial wellness package.

Then [employers] need to think about whether they want to offer a low or a high touch offering. Low touch means offering a digital approach, and it can include programs like wage advances and incentives (like employer contributions) for saving. These are more generalized offerings, but they’re quickly utilized if they’re easy to use. High touch offerings are direct financial coaching through access to a financial advisor.

I think for an employer who’s looking to fill a void on retirement advice, a low touch offering would work. An employer who wants to provide their workforce with financial wellness solutions will include both high and low touch offerings for a comprehensive, holistic package.

Are there any financial issues employees should be concerned about amid COVID-19?

I think in regards to COVID-19, employers should help their employees appropriately pay attention, but not panic.

Common questions we get from clients are investment centric. They’re worried about their 401(k) and other investments; our position is telling clients not to react emotionally and focus on long-term goals. We’re also getting a lot of questions about refinancing mortgages and loans. Because we’re seeing historically low rates right now, it might be a good time to discuss bringing a 30-year fixed mortgage into a 15 fixed-year. That’s something employers can communicate to their workforce, among other financial wellness topics.

Personally, since I’ve been working from home I’ve been doing less discretionary spending; it’s a great time to encourage employees to look at their budget. For those that don’t have a savings account, the next few months are a good chance to start.

Employers can also offer webinars and articles on financial wellness; now is certainly a good time to sit down and learn.