-

While loyalty and engagement is a complex matter, employers must find the right balance of perks that workers want and will use.

September 27 Thomsons Online Benefits

Thomsons Online Benefits -

Investors have an average of 25 funds to choose from in their 401(k) plans, but some financial advisors suggest that the best approach is to pick a small number of very broad funds.

September 27 -

Benefits leaders from Estée Lauder and Options Clearing Corporation say the perk doesn’t have a lot of overhead and has huge payoffs.

September 27 -

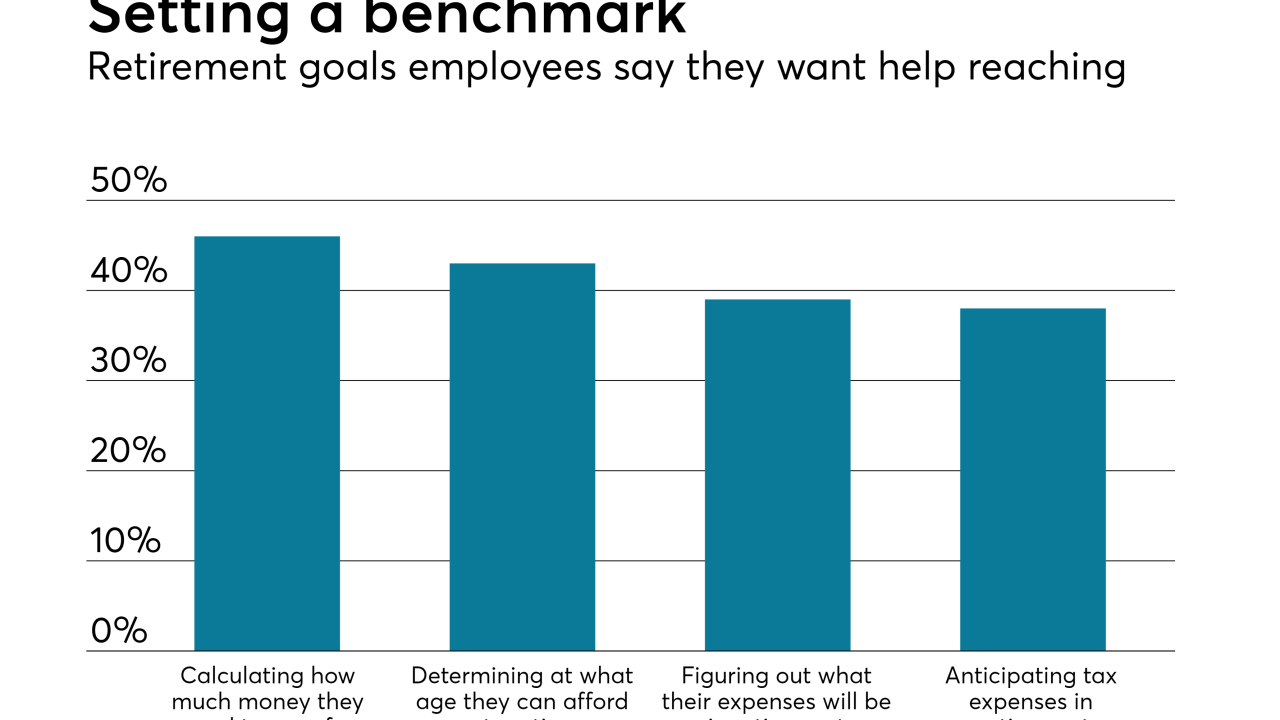

Employers must hit the throttle by providing employees with personalized retirement readiness scores, deeper metrics.

September 27 -

Other groups, such as those who used to itemize tax deductions but will now use the high standard deduction, are also advised to check their withholding taxes.

September 26 -

Benefits leaders from Estée Lauder and Options Clearing Corp. say the perk doesn’t have a lot of overhead and has huge payoffs.

September 26 -

Keep the initiatives confidential and offer incentives, said SunTrust’s financial well-being executive.

September 25 -

Couldn't make it to the Benefits Forum & Expo? Find out how benefits professionals from Facebook, Activision Blizzard, Purdue University and Optanix are not only shaping their respective companies — they’re reinventing the industry.

September 24 -

High-net-worth clients can bump into income limits when it comes to making Roth IRA contributions, but they can find other tax-saving strategies to save for retirement.

September 24 -

The Principal’s Kirk Wolf notes that a properly designed nonqualified deferred compensation plan offers enough flexibility to fix the issues that plague most employers

September 24