Another summer means more than just the arrival of warm weather — it also means the arrival of a new crop of college graduates to the workforce. And now that we’ve finally started to understand what makes millennial employees tick, this year we have a new generation in the workforce: welcome Generation Z.

Gen-Z, generally defined as those born between the mid-90s and the early aughts, join an already diverse, multigenerational workforce that includes millennials, Gen-Xers and baby boomers — employees from different backgrounds and experiences working together to solve problems.

See also:

When I look at the employee population at Businessolver, I’m continually struck by the value of generational diversity; we have industry veterans working side-by-side newcomers, and the result is a community where everyone is constantly learning and our clients are getting the very best of what we have to offer.

There are, however, challenges for managing employees of different ages, specifically for HR managers who need to understand the motivations, concerns and benefits priorities of four generations. Now, more than ever, companies need to exercise empathy around benefits offerings. How can HR managers and benefits decision-makers put this into practice in an age-diverse workplace? The answers lie in employees’ financial wellness.

See also:

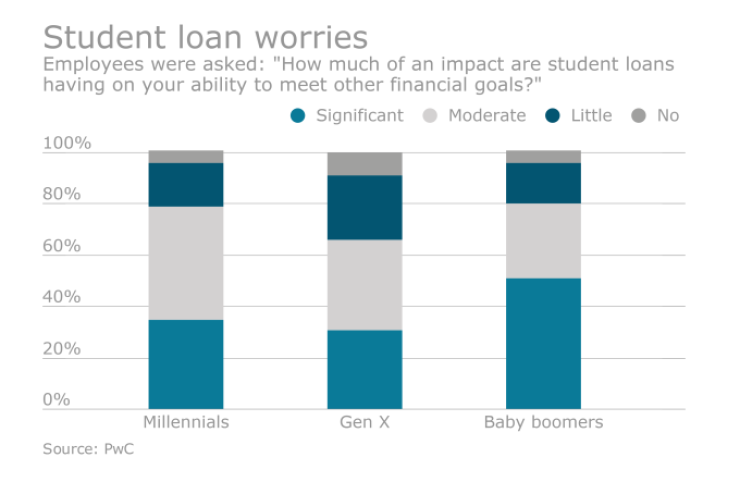

Increasingly, employees across all age groups are looking for their benefits to help them stabilize and manage finances; however, empathy comes into play as employers offer specific programs related to workers’ unique needs and life stages. For a Gen-Z employee, student debt is a far bigger concern than retirement planning. According to a 2015 study from Adecco Staffing USA, 21% of Gen Zers said student debt is their top concern after graduating. For a boomer, it’s the exact opposite.

See also:

Transamerica finds that 41% of boomers expect their current standard of living to decrease in retirement, compared to 20% of millennials who feel the same.

HR pros prioritize these differences when designing financial benefits. With that said, here are four tips to guide your approach to financial benefits planning:

· Take the time to listen. As HR pros, we know the to-do list is a mile long, with little time to complete the tasks. While we mean well, often times the easiest path is recommending benefits that we think employees want, without actually validating it. With multi-generational workforces, it’s more important than ever to hold focus groups, look at data and research benefits use and cost. Use this knowledge to inform your choices based on what employees really want.

· Know what your employees care about. As I mentioned, different age groups in the workplace are going to be concerned and motivated by different things when it comes to finances. Trying to provide blanket benefits for each generation will, without fail, disenfranchise one or more groups of employees. By understanding employees’ motivations first, you can develop a financial benefits program that will encourage engagement outside of just open enrollment.

· Be wary of generalizing. Many people would be surprised to know that younger generations are concerned about saving money, but according to recent Bankrate.com study, millennials are saving more fervently than before — and in some situations saving more than older generations. Don’t make assumptions based on age, and make sure you’re addressing the employees’ true concerns.

· Know thyself. It’s important to not lose sight of your organization’s culture when developing a benefits package. However, if financial wellness related to your multi-generational workplace has not been addressed before, you can set things in motion in a way that’s true to your organization’s vision, priorities and goals.