Stress from

COVID-19 and the ups and downs of 2020 have made the problem more pronounced and for millions of people, the situation has clearly gotten worse with little relief in sight.

Nothing makes financial desperation more acute than an empty bank account. I have lived the experience of not having even a few hundred dollars to cover unexpected expenses like a broken dishwasher or a higher-than-average power bill.

Read More:

For millions of Americans, these types of micro-life events have been the source of sleepless nights and

After watching the devastating economic effects of COVID-19, Secure has set a mission to help people save for the unexpected and better navigate financial hardships. The best way to start doing that is through an employee benefit.

The concept of employer emergency savings accounts has been gaining traction quietly over the last few years. But in 2020, COVID delivered an inflection point that has brought dedicated emergency savings accounts, particularly as an employer benefit, to the mainstream.

Studies by Fidelity, SoFi and Willis Towers Watson show that emergency savings have rapidly become the most sought-after new benefit program.

Lack of emergency savings is an essential and highly impactful problem to solve., We feel a responsibility to make emergency savings accounts a mainstay amongst employers and employees.

Similar to how 401(k) plans and HSAs made radical progress towards saving for retirement and health-related expenses more accessible for tens of millions, we believe ESAs are the key to helping Americans better save for the unexpected and navigate financial hardships.

Read More:

Our research shows that up to 90% of employees would use an emergency savings program if their employer offered it. About 70% of employees say they would participate in an emergency savings program and 90% say they would participate if their employer had a $50 per year match.

Employees want to be able to balance short-term and long-term savings. They also like the full control and quick accessibility it brings to their lives. .

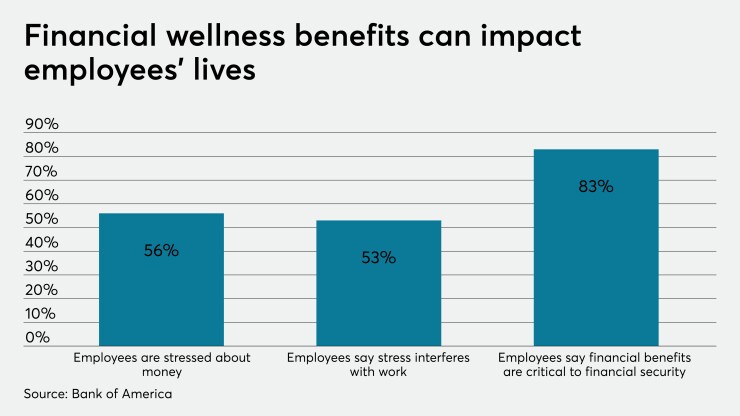

Besides the easy answers around recruiting and retaining employees, many employers recognize the positive message an emergency savings program can bring to reduce stress and strain on a workforce struggling to recover from the uncertainty of 2020.

Read More:

Many employers want to offer employees a choice to save beyond just a long-term solution such as a 401(k) and help drive higher overall participation and reduce things like hardship withdrawals and 401(k) loans. While a 401(k) is incredibly desirable, it is not a suitable emergency fund. It's intended to be a plan that will benefit only in the very distant future. On the other hand, an emergency fund works to provide for an immediate need and that is what millions need now. A lack of cash reserves is devastating.

Building an emergency fund is important to an employees' emotional well-being and creating financial stability, making for a happier employee.

Read More:

Over the next decade, emergency savings programs are likely to become a rapidly growing solution for Americans. Last year will be viewed as the inflection point that triggered this growth.

Employers stand to greatly benefit by reducing employee stress, increasing focus and productivity, helping employees more quickly recover from unexpected events, and building a better financial foundation and a path towards long-term savings.