Employees are being forced into an early retirement, due to nation-wide layoffs and workers opting to leave the workforce to care for themselves or others during COVID-19.

According to a recent survey by Allianz Life, more than two-thirds of respondents said they retired earlier than expected, up significantly from the 50% of employees who left the workforce for early retirement last year.

Even before COVID-19, health-related issues were the foremost cause for employees leaving the workforce before retirement age. But the pandemic has only made matters worse: of those who had to retire for reasons outside of their control, 33% cited healthcare issues — up from 25% in 2020, the survey found.

Read More:

Employees are also concerned with their ability to re-enter the workforce after being laid off during the pandemic, says Kelly LaVigne, vice president of consumer insights at Allianz. As vaccinations continue to roll out, it’s very likely that younger workers will benefit from

“Many of the older individuals who have been laid off feel like once we start going back to a semblance of normalcy, they will be the last ones to be re-hired,” LaVigne says. “Early retirement is their only option.”

Read more:

One out of every ten U.S. workers will likely be

For those who find themselves in that demographic, however, his best piece of advice is to not panic.

“The worst thing that's going to happen is that people panic and they do the wrong thing,” LaVigne says. “They don't get everything in order and say, ‘I've got to just cash everything in my plan or I've got to roll all my assets out of the plan.’”

Instead, early retirees should consult with an advisor as soon as they can and build a new retirement plan. A new plan could include strategies to curb spending, to more in-depth work like looking into portfolio diversifications.

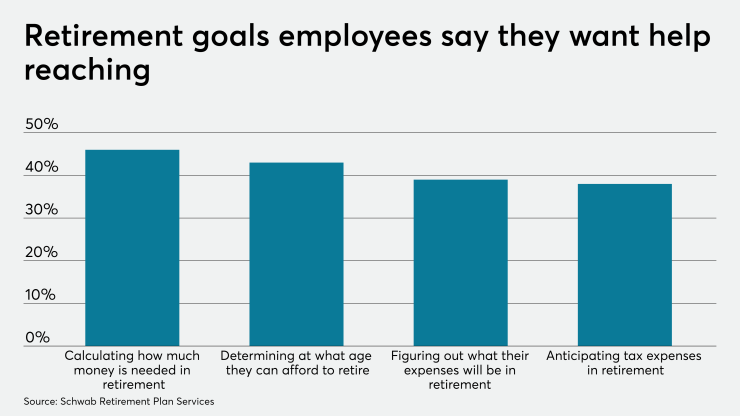

Employers can also play a significant role in helping all employees be better prepared for retirement. Companies have begun employing strategies such as reinforcing and enabling financial wellness, allowing them to use student loans to save for retirement and equity compensation.

Read more:

While the pandemic has presented financial challenges, almost two-thirds of respondents said they are now paying more attention to what they are saving and spending and 58% have cut back on their spending, the Allianz survey found

“It's driving people to plan more and to think more about their retirement,” LaVigne says. “It’s a positive out of all the scary.”