Benefits managers are taking a hard look at the adequacy of their programs to meet the needs of the changing workforce and the post-pandemic workplace, while supporting business imperatives at the same time.

A good place to start is addressing employees’ financial stress, an issue that the coronavirus pandemic only aggravated. The impact that employee financial stress has on employers makes programs that address this problem a top priority on the employee benefits agenda.

Read More:

How financial distress exacts shared costs

The issue is well-documented. The growing American wealth disparity combined with systemic obstacles to the economic security of many population segments were worsened with the instability and uncertainty of jobs and pay during the pandemic.

Today, just thinking about the state of their finances stresses out 60% of employees. What in particular? Start with the cost of staying physically healthy, which one survey found has led over half of respondents to skip or delay care. Student loan debt (at $1.7 trillion) burdens 45 million Americans who carry an average load of $28,000. They struggle to save, including for retirement. Among all U.S. adults that have retirement accounts, the median savings is $60,000. But about 25% have no retirement accounts at all.

Read More:

Those and other financial stressors have a big impact on the long-term health of employers in myriad ways. Start with productivity losses of some 47 hours per worker per year, a function of absenteeism and presenteeism when they take their money worries to work with them. Retirement readiness also pressures employers. When retirement is put off for financial reasons, the employer’s costs for healthcare and workers’ compensation costs escalate. And there are “lost opportunity” costs with fewer openings for next generations of workers. Overall, each year added to their average retirement age pushes their workforce cost up 1% to 1.5%.

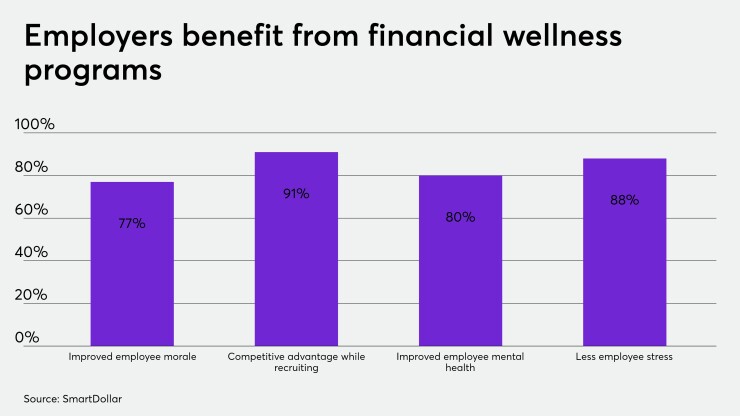

In the face of these trends, financial wellness programs have gotten increasing traction among employers. The mounting pressures during the pandemic accelerated the pace; by late 2020 66% of employers had initiated financial literacy programs, up 12% from 2019. But there’s still room for improvement.

Read More:

Setting – or resetting – financial wellness strategies

The pandemic has provided a big opportunity for employee benefits teams to rethink their financial wellness strategies.

The typical approach today really centers on financial literacy programs, with a focus on coaching and investment advice geared to retirement savings and 401(k) plans. That’s fine, because employees say those are big needs: an increased employer contribution to their retirement savings would be great, but what employees really want is guidance on how to save smarter.

Better yet would be a more holistic focus on the workforce and its needs, as clearly, there’s more to an employee’s financial stress than retirement savings shortfalls. There’s a wealth of solutions to sponsor, many at a low, or no cost, and some may already be available, just hidden within the current employee benefits lineup.

Read More:

It does take rigor, utilization of employee analytics, and follow-through, though, to create financial wellness programs that respond to the particular needs of employee segments. The best starting point is through a task force for the re-set that brings together employeeandretirement benefits specialists and whose work is clearly championed by company leadership.

HR should concentrate its efforts on three areas for optimal results:

Dig deep into employee needs

A one-size fits all approach to benefits will leave them underutilized. Employee analytics will help uncover specific financial pain points and which employee segments are feeling them; the issue is which data sources will be used to inform the strategy and guide the choice of relevant solutions. Utilization trends for current benefits can be one avenue, along with patterns for sick and vacation day usage. Retirement plan contribution and borrowing patterns also help. Confidential employee surveys are useful. And consider employee persona analysis for insights that go much deeper than generational segmentation. Analytics will be invaluable for pointing the way to financial solutions that matter to employees.

Explore the possibilities — what’s needed and will be used

The level of financial illiteracy in America is shocking. It’s not just learning how to save for retirement, but how to invest and how to dig out from debt — and avoid it altogether that employees would value. Employee assistance programs may well have related services, which should be promoted in the program. The current benefits lineup likely has other services like legal benefits with financial wellness resources included that have been overlooked and should be promoted. It’s worthwhile to do an audit to uncover them even as new services are added. An industry has been built around student loan debt solutions; direct contributions by employers are optional (though there are tax benefits for doing so). Paycheck advance or early wage access programs can also help employees avoid the usurious costs of payday loans. To a significant extent, just the act of providing these services under the employer’s umbrella is a boon as they likely would have otherwise been inaccessible.

Get the word out and build engagement

Design a campaign to promote programs facets and benefits. The best results will come when promotional messages are aligned with solutions for the employee segments that need them the most. Optimal exposure and utilization of the financial wellness solutions will hinge on communications that are clear and concise, sent regularly and through channels that are relevant to specific employee groups. Another must-have is an engagement strategy to drive awareness and enrollment.