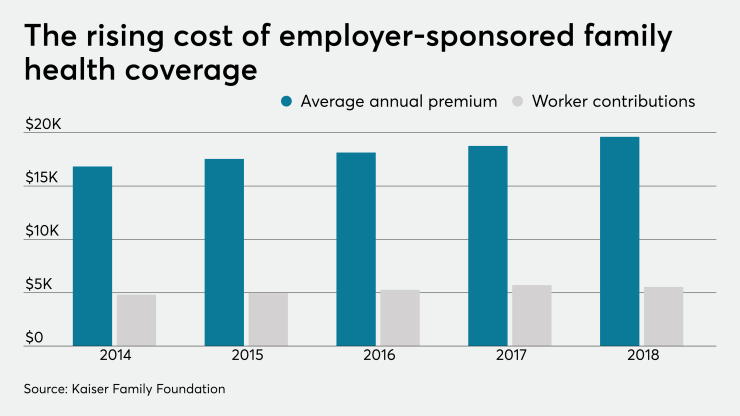

The insurance carrier-led status quo in employee benefits has produced an abysmal record of failure, with two decades of annual

Innovative advisers are driving two disruptive benefits trends that both improve the quality of care and

Disintermediate the carrier: Disintermediation — eliminating the middleman — is necessary when the middleman is extracting, not adding, value to the supply chain. In benefits, the record of the health insurance carriers clearly shows that they have failed to control healthcare costs. This failure should be no surprise since rising healthcare costs justify increased premiums, which raise carrier revenue.

With a fixed profit margin due to the ACA’s Medical Loss Ratio requirements, increasing revenue is the only way carriers can make more profit. In just five years, from 2014 to 2018, as annual healthcare costs drove premiums higher every year, the big five carriers (Anthem, UHC, Cigna, Aetna, Humana) averaged more than 250% growth in their stock value, according to Morningstar and FactSet data. So expecting the carriers to control or lower healthcare costs would require them to act against their financial interests.

Read more:

With carrier incentives so misaligned with employers and faced with such poor carrier results, disintermediation of the carrier — moving to a self-funded plan when feasible using an independent third-party administrator (TPA) — is the only way to gain control of the employer’s healthcare spend and begin to control and lower costs.

No, self-funding isn’t new and doesn’t itself lower healthcare costs, but it’s the necessary first step to managing the healthcare supply chain, which is the only way to control and lower costs.

Manage the healthcare supply chain: Employers manage the quality and cost of every purchase their company makes — except with the healthcare their employees purchase. Employers previously delegated this critical responsibility to the carrier in either a fully insured plan or administrative services only (ASO) arrangement, with the same bad results due to the carriers’ misaligned incentives that keep them from actually working to control and lower the cost of healthcare.

In a

While benefits advisers across the country have been using these twin trends of carrier disintermediation and healthcare supply chain management for several years to grow their business, I predict that 2021 will see these trends metastasize. Smart brokers and advisers who want to outpace their competition will learn the basics of self-funding and the mechanics of healthcare supply chain management to improve the quality and lower the cost of healthcare.