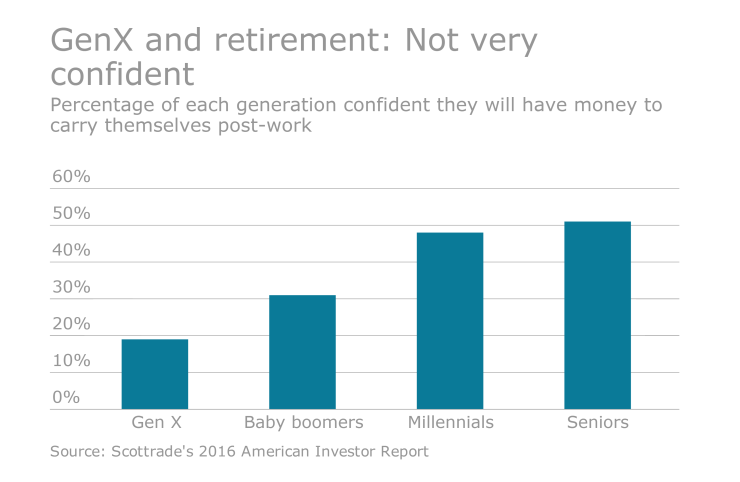

When discussing the precarious savings habits of American workers, most often experts are talking about younger millennials and the Gen-Y crowd. But a new study shows the middle age GenX crowd is having their own difficulties that deserve advisers’ attention, as well.

The Insured Retirement Institute (IRI) says only 24% of GenXers are highly confident they will have enough money to support themselves throughout retirement. Also, only 8% have saved enough to support themselves in retirement.

“Yes the data looks grim,” says Kelly MacRae, a certified financial planner and vice president of strategic and financial planning with Beacon Pointe Advisors. “We advise our clients to just start saving and we want to give them hope that the majority of people save the most in their fifties and sixties,” when discretionary income goes up, she says.

She understands that younger people in their forties are still dealing with kids and mortgages more so than their older counterparts and have a hard time saving.

She also explains that while kids can get loans for college, their parents cannot get loans for retirement. So encouraging more self-sufficiency for the kids of GenXers is another tip she passes along to clients looking to find more available resources and funds for retirement.

Frank O’Conner, vice president of research and outreach with IRI, says GenXers are under-saved and under-planned. Although there are many reasons for this, one important one, notes O’Connor “comes from a lack of knowledge, in general, about how to turn savings into income and how much savings mean in relation to income.”

“We advise our clients to just start saving and we want to give them hope that the majority of people save the most in their fifties and sixties."

What this means for the adviser is opportunity. “It’s an opportunity to get them more information about how increased savings can improve that ultimate retirement income they are able to generate,” explains O’Connor.

Because there is a lack of cash (and knowledge), according to MacRae, she says planners and advisers can help with budgets and spending plans to help GenXers understand the goals required to increase savings. She agrees that advisers need to reach out more to clients or potential clients and offer education like worksite presentations, lunch and learns and email-blasts.

“One of the biggest lessons we can teach is the power of compounded growth. So, even if they don’t save until their late forties, they still have 25 years to put funds away,” she adds.

There is some good news from the report, including that 64% of GenXers have money saved for retirement, the same as in 2013 but down from 72% from 2011. Of those with retirement savings, 77% have added to retirement savings in the past 12 months, equivalent to prior years. Unfortunately, only 8% of GenXers have $250,000 or more saved for retirement, says the report.

O’Connor says planners have a role to play. When advisers are involved, GenXers are more likely to have a plan in place and save for retirement.

“That’s an opportunity for advisers to ensure that GenXers are maximizing the value they have available to them and making sure they are contributing enough in order to not only save enough but do it in a tax-deferred manner,” he says.