-

From expected changes to the ACA, to the embrace of wellness programs to the launch of new private exchanges, it’s been a busy 12 months.

December 28 -

Employers in 2016 were eager to learn ways to boost wellness program engagement and how the election cycle would play out in the benefit industry. Over the course of the year, these were some of the most popular slideshows compiled at EBN.

December 28 -

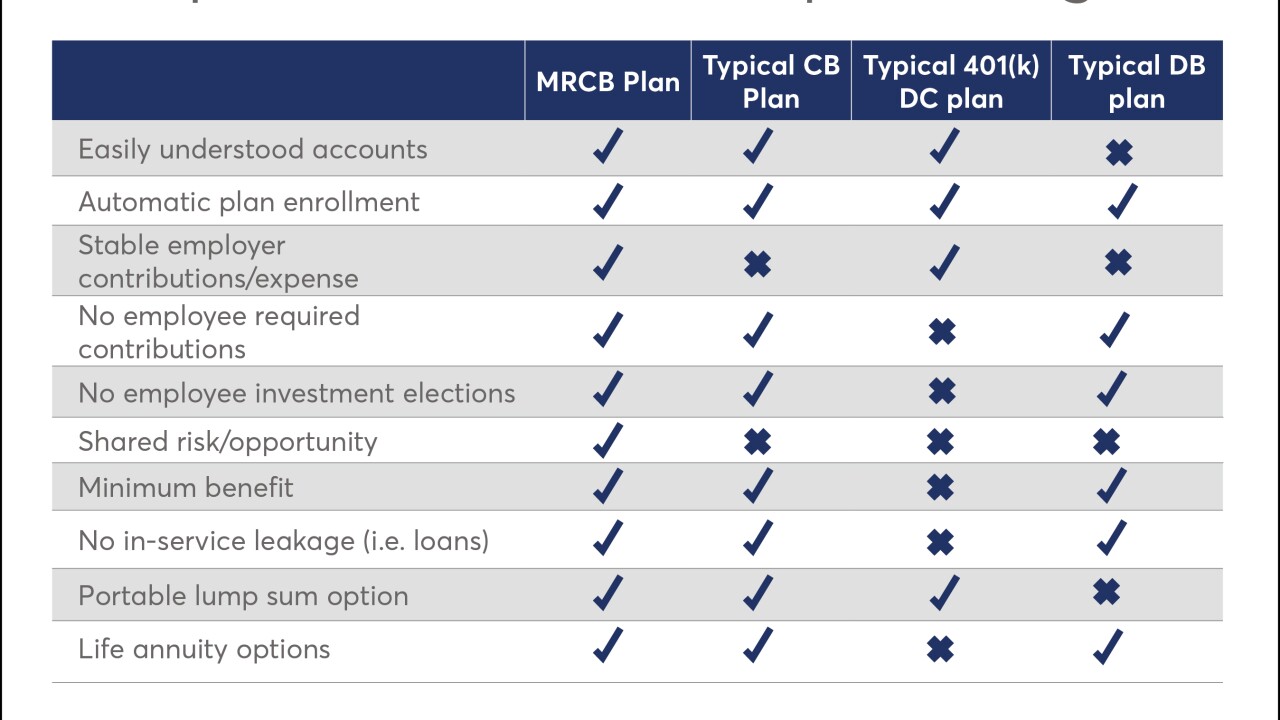

Market-return plans bear closer resemblance to DC model than their first-generation predecessor. But are they a realistic answer?

December 28 -

Employer role in these retirement savings plans is growing, says attorney Christine P. Roberts.

December 27 Mullen & Henzell LLP

Mullen & Henzell LLP -

Many pension plans are facing financial woes, with many of them reducing pension payouts to their beneficiaries.

December 27 -

Increased financial wellness efforts, greater automation and recordkeeper consolidation should be on benefits professionals’ radar.

December 23 -

The state is already paying $5.38 billion to the California Public Employees’ Retirement System this year, and in fiscal year 2018 the state will need to add at least $200 million more.

December 23 -

Plan providers must find ways to differentiate their services to be part of advisers’ go-to lists.

December 23 -

Underestimating longevity is one of the blunders that clients should sidestep when preparing for retirement.

December 23 -

Clients should consider switching to a Roth IRA or Roth 401(k) as investment growth and distributions are not subject to tax.

December 22