-

From robo-advisers to virtual benefit counselors, employers today have an array of solutions to meet the needs of their tech-savvy workforces.

June 17 -

A recent report from the Bipartisan Policy Center suggests that companies with at least 50 workers should be required to enroll them in some type of retirement plan.

June 16 -

In recent years, the number of employees who’ve started contributing to their 401(k) plans or increased their deferrals has grown significantly, suggesting employers’ messages are getting through.

June 15 -

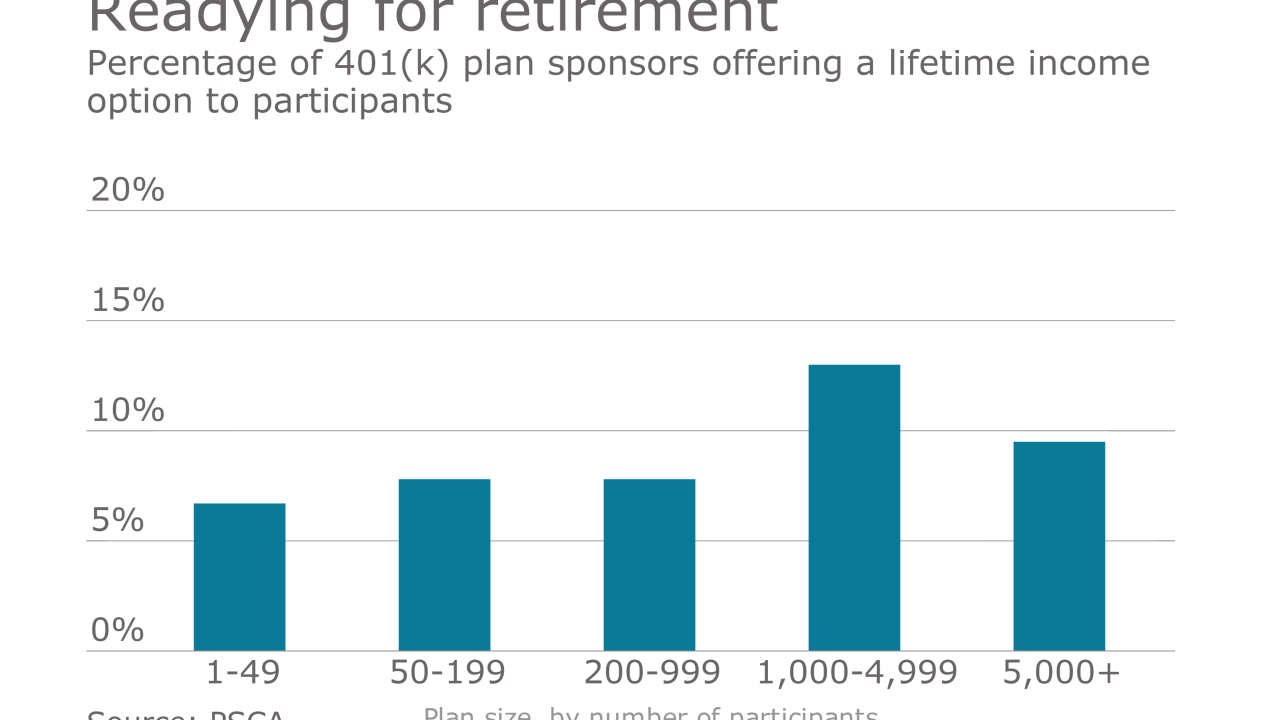

Employers need to offer a broad range of investment options in their 401(k) plans, including asset classes that may do reasonably well in a low interest rate environment, according to TIAA’s Roger Ferguson.

June 14 -

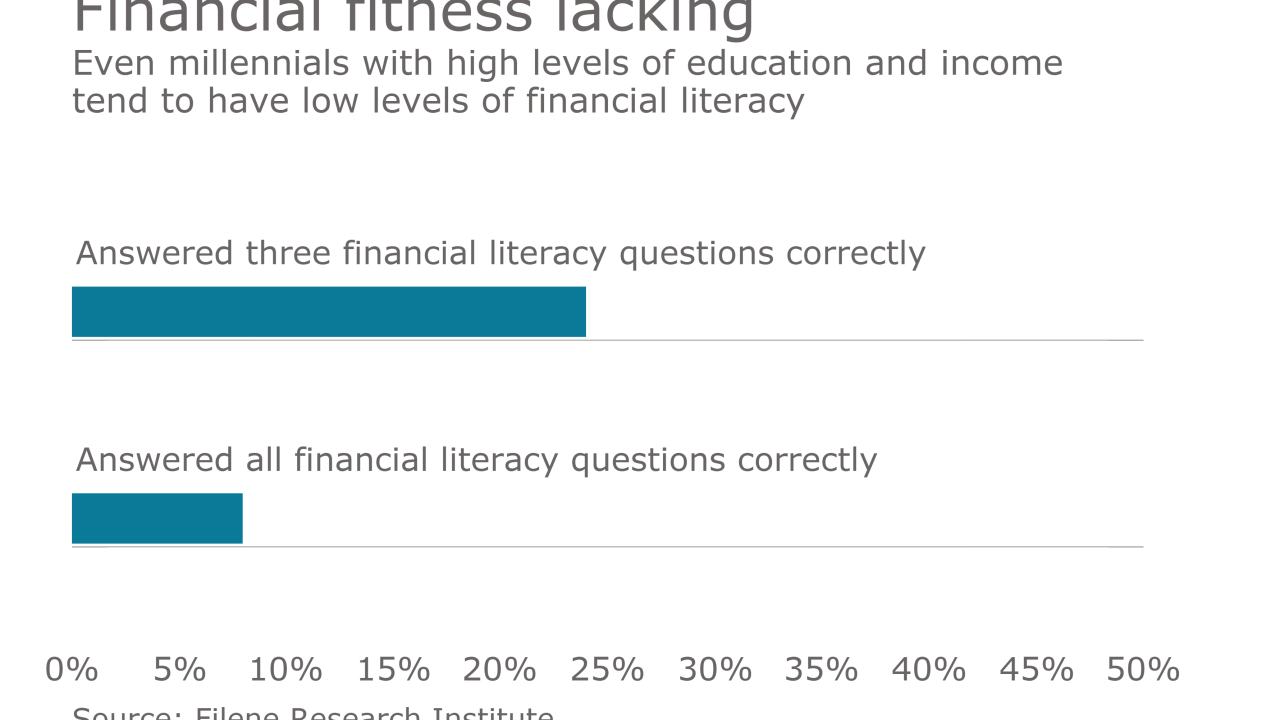

This group tends to have low levels of financial literacy, even among those with high levels of education and income, finds a report from Principal Global Investors.

June 14 -

With retirement accounts being affected by the upcoming fiduciary rule, many advisers aren’t sure what their first step should be.

June 14 -

Firm targets younger employees and those without a traditional desk job with online, on-the-go application.

June 13 -

The bipartisan bill from by Sen. Elizabeth Warren and Sen. Mike Lee would allow these students to save their fellowship and stipend compensation in an individual retirement account.

June 13 -

When employees change jobs and cash out their plan balance, they often do it over a period of years rather than all at once, according to Retirement Clearinghouse’s Spencer Williams.

June 13 Portability Services Network and Retirement Clearinghouse

Portability Services Network and Retirement Clearinghouse -

In recent years, the number of employees who’ve started contributing to their 401(k) plans or increased their deferrals has grown significantly, suggesting employers’ messages are getting through.

June 13