-

Young employees highly value financial advice but are not receiving enough of it, according to Corporate Insight.

March 28 Corporate Insight

Corporate Insight -

A Roth IRA would come ahead of a traditional IRA if clients move to a higher tax bracket in retirement.

March 28 -

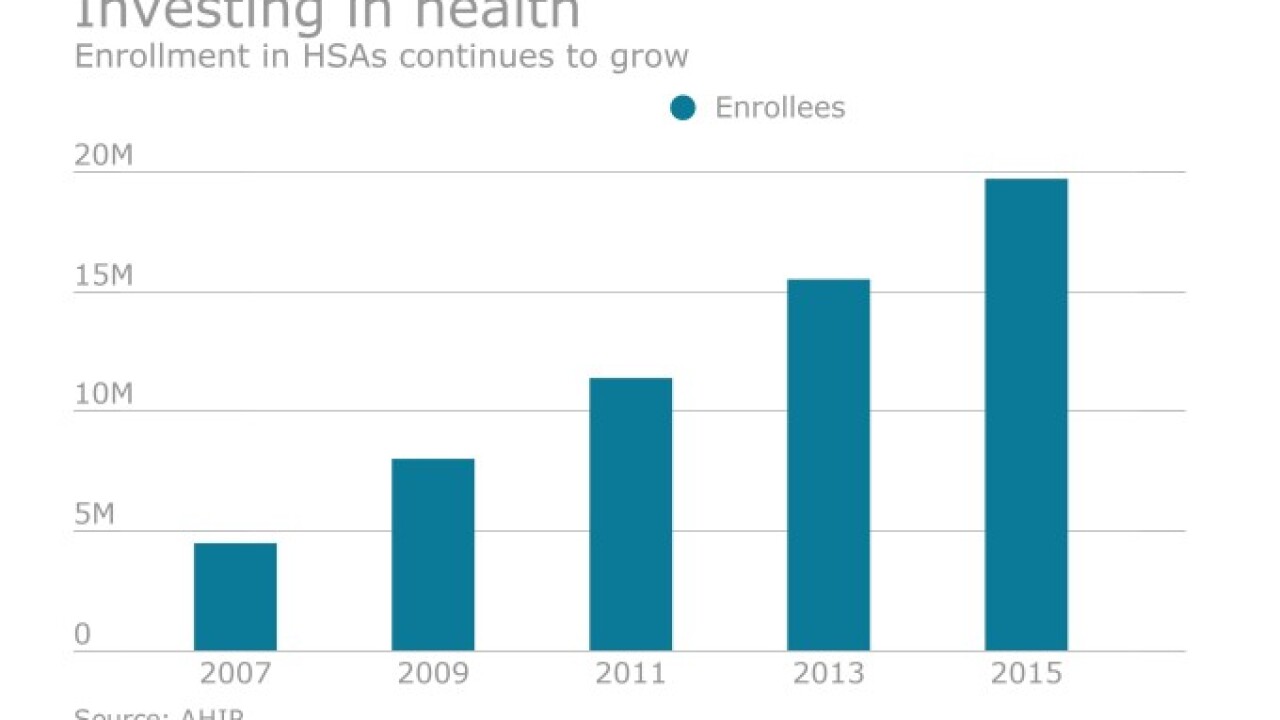

Health savings accounts are becoming vastly more important for employees because they not only help with medical savings, but put workers on a better track for retirement, experts say.

March 28 -

Brokers must bridge the gap between prepping clients for retirement and keeping them satisfied for the years after employment.

March 27 -

Here’s how to decide whether your client should select the traditional or Roth IRA to put away for retirement and boost their savings.

March 27 -

More workers are participating in financial wellness programs and running post-work projections — and seeing results because of it, according to a new report.

March 26 -

Each plan has pros and cons: Clients who own a Roth IRA for at least 5 years are entitled to penalty-free withdrawals for education expenses, but they'll owe income taxes on those earnings.

March 24 -

Longer lives and growing inflation are just two realities that employers must remember when formulating a post-work plan, urges Jamie McIntyre.

March 24 MAC Financial

MAC Financial -

Each plan has pros and cons: Clients who own a Roth IRA for at least 5 years are entitled to penalty-free withdrawals for education expenses, but they'll owe income taxes on those earnings.

March 24 -

Dubbed “allmymoney,” the mobile fiscal program will be powered by eMoney Advisor.

March 23