Medical inflation stubbornly continues at almost 7% a year, while general inflation hovers at close to 1%. How should advisers help their clients contend with these soaring costs?

When informed individuals participate in the development of their own options and decisions with regard to healthcare, we call it consumerism. I call it “employerism” when businesses become active participants in healthcare strategy and design, using insights from the actual health status of their employees, instead of just looking in the rear-view mirror at the company’s claims history.

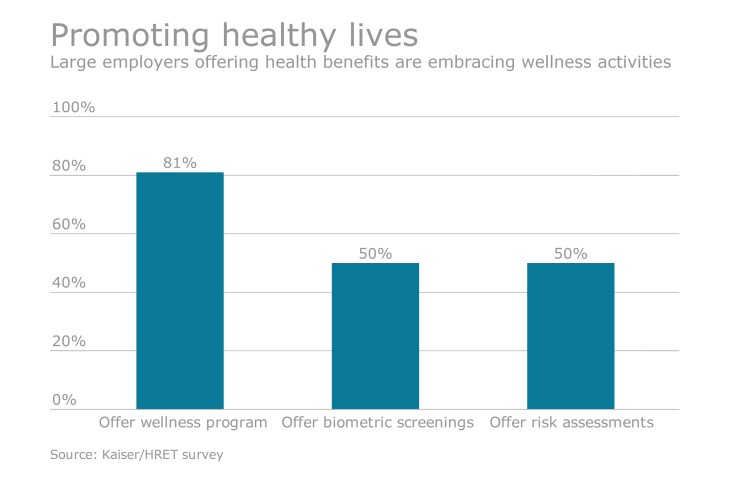

This forward-thinking view of employee healthcare is taking root. Why? Because the old model for healthcare management isn’t working, as evidenced by the 61% increase in total premium costs from 2005 to 2015, according to the Kaiser Family Foundation/Health Research & Educational Trust (HRET)

Immediate results

If an adviser’s clients are fully engaged with a comprehensive wellness program and use that to inform their insurance decisions, they’ll see immediate results in the way in which their employees manage their health and access to healthcare improves. The impact can be measured through improved productivity, less absenteeism, and fewer claims for short-term disability and recordable injuries.

For example, we know that more than 10% of the population is at risk for pre-diabetes and that left untreated the progression from pre-diabetes to diabetes is virtually 100%. Once an individual crosses over to diabetes, they will have it forever, including the $10,000-plus price tag to manage this condition. Yet more than half of those with diabetes don’t even know they have it. With an effective wellness program, more than 30% of those individuals identified as pre-diabetic will return to a healthy state within one year.

The actionable insights that an effective wellness program provides include:

· In-depth information about how many employees are suffering from – or are at-risk for – high-cost, yet addressable, chronic health issues

· Employee health benchmark data adjusted for industry, size, gender, age and geography

· The areas of greatest return for which an employer can offer preventive care to its workforce

· Ways to measure the effectiveness of that preventive care

At Interactive Health, we have completely embraced employerism. We used wellness data from our internal program last year, as we made the transition to self-insurance from fully insured and shaped our own health plan design.

By taking advantage of our wellness program, we saved money year over year, even though it was our first year as a self-insured company. It was incredibly rewarding to strike a balance between the health needs of our employees and our bottom line, and this enabled us to extend coverage to a broader segment of our employee population. For example, we offered a “zero-dollar” monthly premium option for those participating in our wellness program and saw significantly increased enrollments in our plan offerings overall.

Whether an employer uncovers positive news or concerning insights about its workforce, data about their employees’ health status can be a catalyst to take action and design a health plan that offers more access, more options and lower cost.

When a company truly understands its employees’ health risks, it is able to act on them, which is why employerism will continue to be a powerful trend. Advisors who recognize this can help their clients recover from sky high medical costs and take control of the health of their business.