Andrew Welsch is a former managing editor of Financial Planning.

-

As the spread of coronavirus disrupts operations, it’s a precarious moment for advisers who have been planning big career changes for months.

March 23 -

Where some see unacceptable risk, others are eyeing bargain airplane tickets.

March 13 -

From travel bans to working remotely, here is how firms including Wells Fargo, Edelman, RBC and others are preparing for a possible pandemic.

March 4 -

Asset reserves are projected to become depleted in 2035, a year later than previously estimated.

April 22 -

“The industry has not done any favors to young advisors,” says independent advisor Douglas Boneparth.

August 8 -

With the rescue attempt's failure, all eyes now turn to the SEC which is considering its own proposal for raising financial advisor standards of conduct.

May 4 -

The regulator's proposal is set to remake compliance standards for brokers and advisors.

May 3 -

The regulator's proposal is set to remake compliance standards for brokers and advisors.

May 2 -

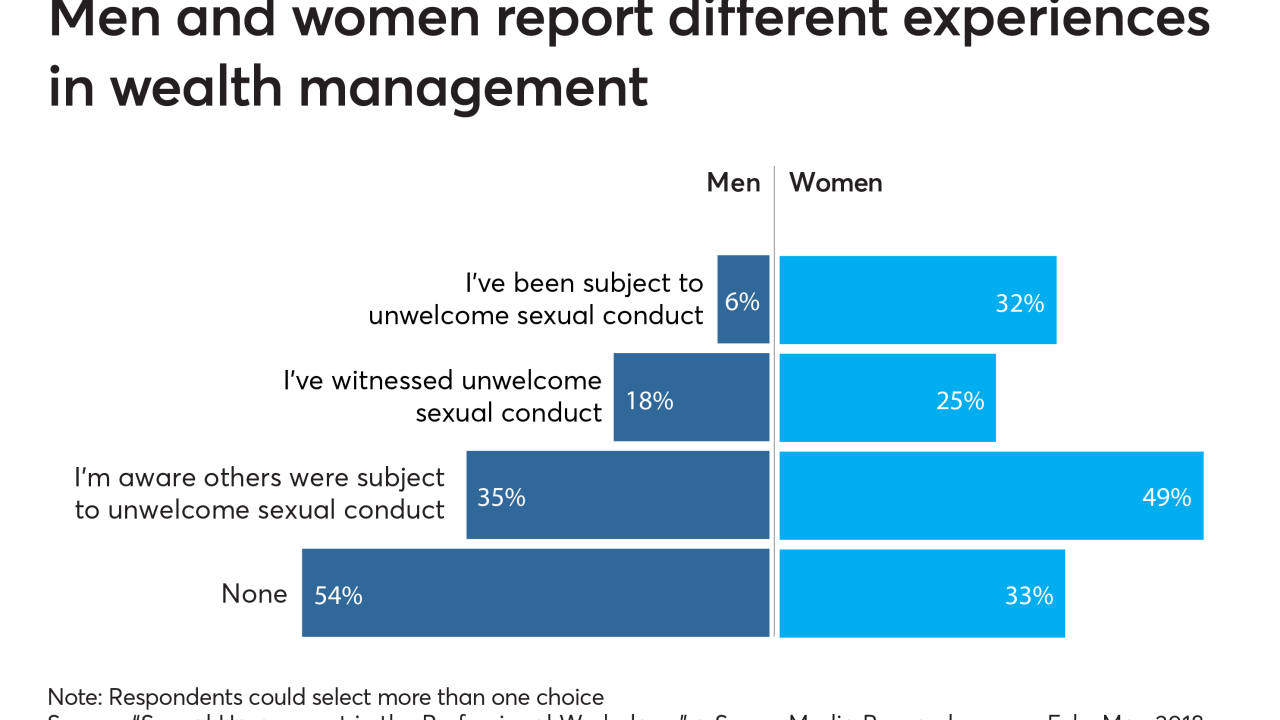

It’s tough enough to grapple with sexual harassment in the workplace. It’s more complex when clients are involved.

March 28 -

Focus turns to the SEC as it considers creating its own higher standard of client care.

March 15 -

From inappropriate touching to belittling comments, women advisors confront workplace environments that are far from welcoming.

March 12 -

The regulation's enforcement provisions will not take effect until July 1, 2019, the Labor Department said.

November 27 -

The department's proposal furthers efforts to undo the controversial regulation.

November 2 -

Moves by Nevada and others threaten to create compliance confusion.

September 21 -

The Office of Management and Budget concluded its review of the proposal, a key step in the administrative process, which puts a freeze on further implementing the regulation.

August 30 -

There is "no principled legal basis" to do so, Labor Secretary Acosta says.

May 23 -

Alexander Acosta must reckon with a June 9 deadline amid a tense political debate.

April 27 -

The Labor Department will now conduct a review with an eye toward amending or rescinding it.

April 4 -

Hope is dimming, but top Democrats like Sen. Elizabeth Warren and investor advocates are unlikely to relent in their efforts to preserve the regulation.

March 6 -

The decision landed just hours after the Department of Labor asked for the decision to be postponed while it complies with a Trump order to review the regulation.

February 8