A lot can happen to a client's long-term plan over the course of three decades. For millennial investors, steady gains made in global equities last year provided the boost needed to fuel healthy returns to their target-date fund holdings.

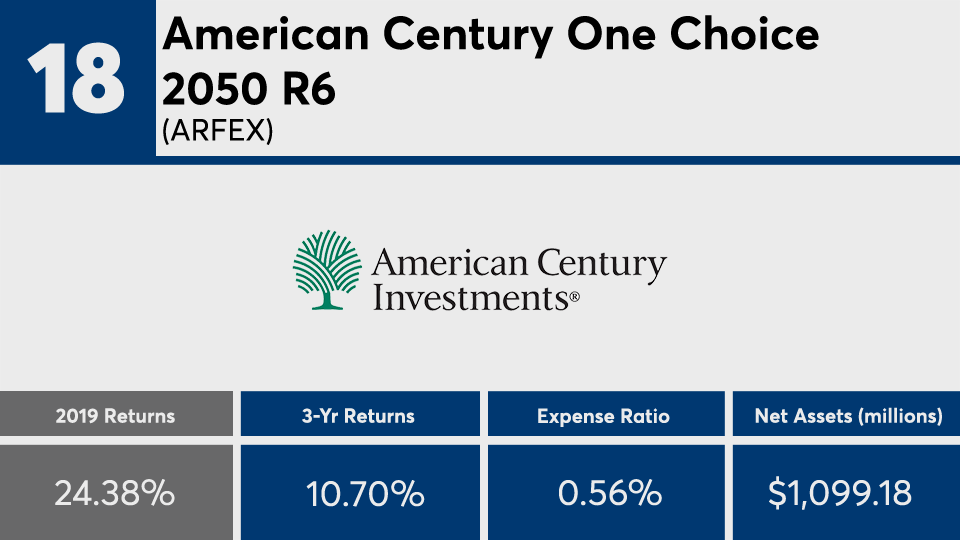

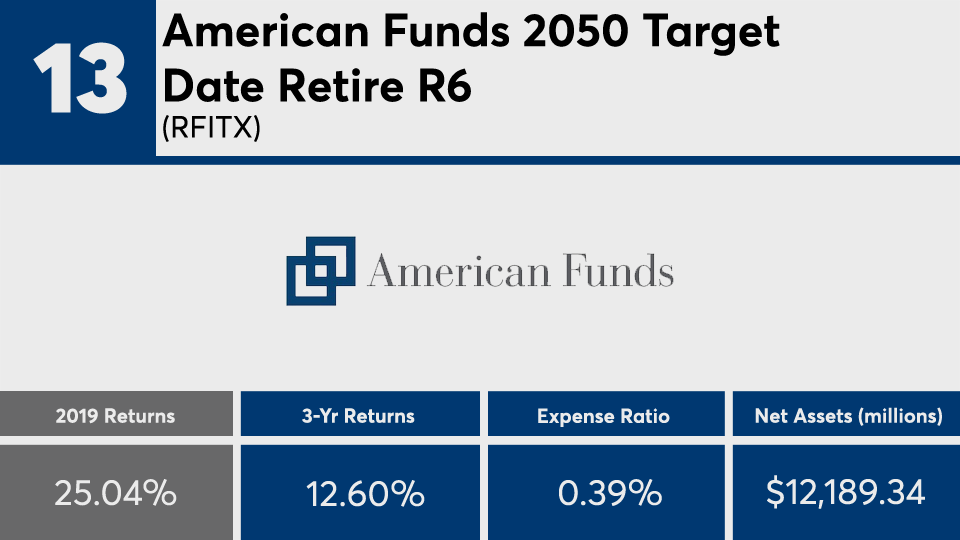

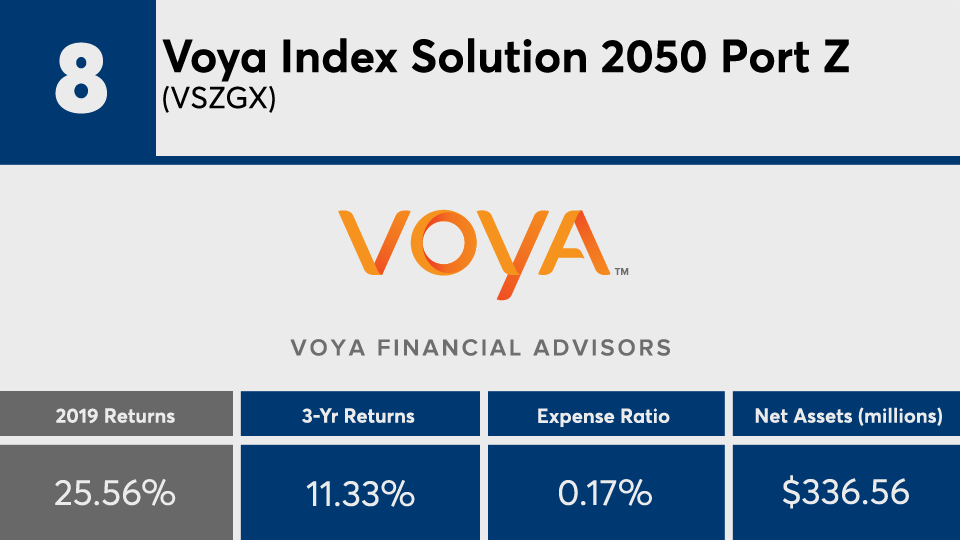

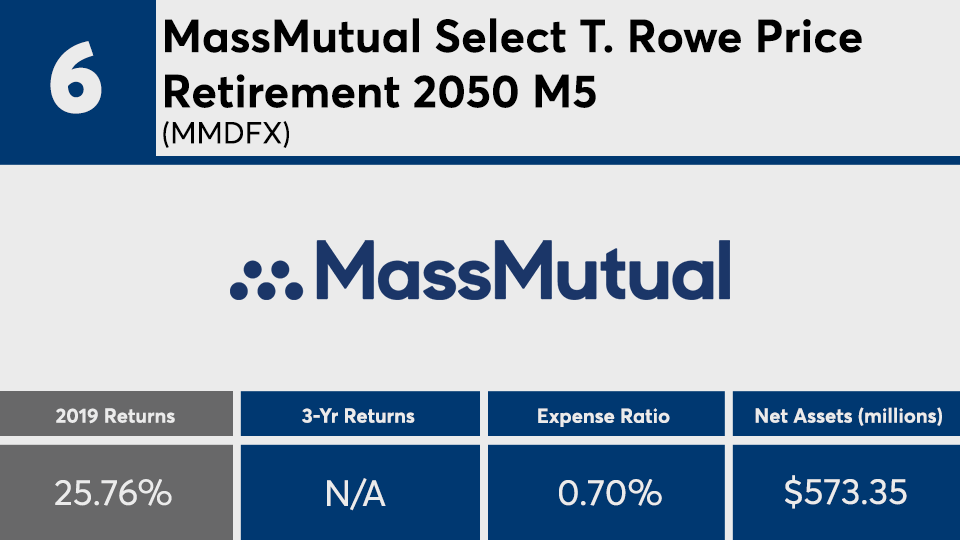

The 20 top-performing 2050 target-date funds of 2019, which have a combined $60.7 billion in assets under management, managed to capture much of the S&P 500’s 31.22% gain, as measured by the SPDR S&P 500 ETF Trust (SPY), and the Dow’s 25.01% gain, as measured by SPDR Dow Jones Industrial Average ETF Trust (DIA), over the same period, according to Morningstar Direct.

“The strong rally in equity markets in 2019 was clearly a tailwind for these funds,” says Jason Kephart, a senior manager research analyst at Morningstar.

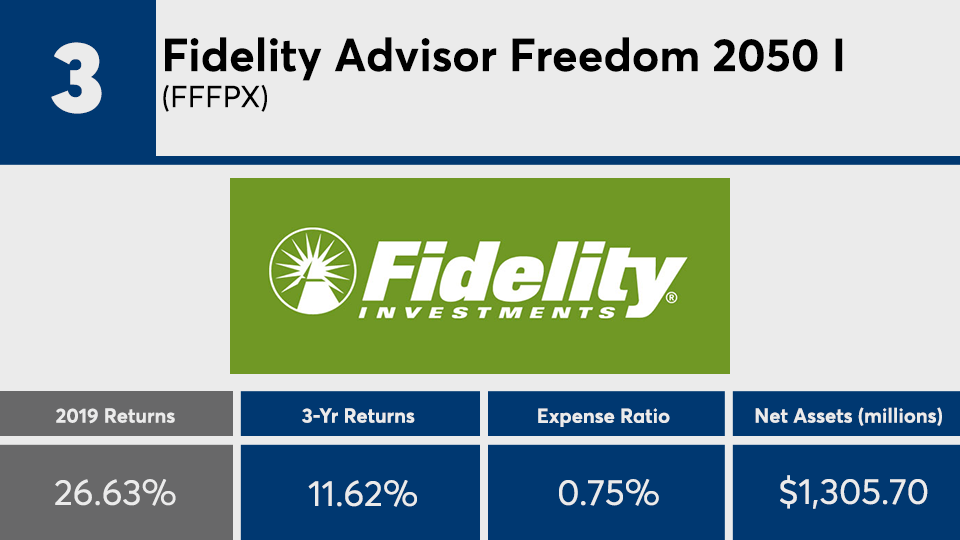

While they underperformed broader equity markets, these funds did outpace comparable benchmarks like the S&P Target Date 2050, which gained 24.35%; and only slightly underperformed the MFS Lifetime 2050 I (MFFIX), which had a 26.77% over the same period, data show.

“The average 2050 target-date fund has about 88% invested in equities,” Kephart says. “Since equity funds generally have higher expense ratios than bond funds; that tends to make further-dated target-date funds more expensive than those closer to retirement.”

At 54 basis points, fees among the leaders were slightly higher than the broader industry. Investors were charged 0.48%, on average, for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

The largest target-date 2050 fund, the $21.3 billion Vanguard Target Retirement 2050 Investor Shares (VFIFX), had a 0.15% expense ratio and 24.98% gain in 2019, data show. By contrast, the Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX) — the biggest overall fund at $897.7 billion — had a 0.04% expense ratio and a 30.8% return over the same period.

While this ranking shows each funds’ primary share class, Kephart notes there are caveats. “Minimum investments are generally waived for 401(k) participants and that’s where the majority of 401(k) assets are,” he says. “The Fidelity K shares included, for example, don’t have a minimum investment but no one can access them outside of a 401(k) plan.”

Scroll through to see the 20 target-date 2050 category funds with the best returns as of 2019. Funds with less than $100 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each, as well as three-year net flows and year-to-date returns, are also listed. All data from Morningstar Direct.