Traditional pensions and other defined-benefit plans might not be coming back, but as employers rethink their benefits mix amid growing concerns about

It turns out that many of the features that made defined-benefit plans so appealing — particularly the guarantee of predictable income with no expiration date — are prized by workers dealing with a highly uncertain economic picture amid the fallout from the COVID-19 pandemic.

And employers and policy makers are taking notice, according to Brendan Curran, managing director and head of U.S. DC investment strategy at State Street Global Advisors.

"With clear policy support, with interest from participants, more plan sponsors are pursuing retirement income," Curran said during an online presentation hosted by the Georgetown University Center for Retirement Initiatives. "You're not alone if you go down this path."

Congress took a significant step toward encouraging retirement-income benefits with last year's

Opinions

Seth Harris, former acting secretary and deputy secretary of labor, anticipates that the law will lend momentum to employer adoption of retirement income benefits, in the process maturing the market and making it easier for more employers to confidently offer such an option.

"One of the advantages of the SECURE Act opening this space up is we're going to have more experience in the employer plan market, so benchmarking will become a lot easier," Harris said. "Asset managers and employer plan sponsors and others will be able to provide better information about what's being offered in the market, and that will make the role of fiduciary easier as the market grows."

Harris also expects that process to see a gradual evolution of the retirement income products that are available, anticipating that a typical plan that an employer might offer will differ from the types of annuities that are available to individual investors. In any case, he observes that it won't be an overnight process.

"I think we need to be honest about what is going to happen in employer plans -- it's going to take a while," he said. "Part of that is because the products are going to be different. We're not just going to lift the products from the individual market and import them into the employer plan market. I think they'll be designed differently."

Experts advise employers to begin talking with their employees about their retirement options, and, if they are rolling out a retirement income benefit, to launch an education and outreach program to help employees understand how the plan works.

"That's a piece I feel that really needs to go alongside the plan design and some of the technical aspects," said Tamiko Toland, head of annuity research at CANNEX USA, a data firm that supports banking and annuity providers.

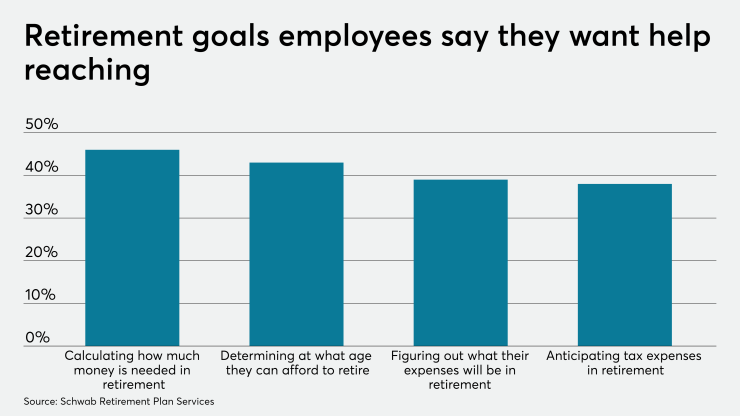

Harris stresses that any decision a company makes to update its retirement benefits should be informed by the needs of its workforce. Canvasing employees about what they would like to see in a retirement plan can help employers shape their benefits mix, and, in an emerging area like retirement income, employers can use that information to secure a tailored plan from their provider.

"I think the best thing a plan sponsor can do is talk to participants about what it is they're looking for," Harris said.

"Help them to understand what's possible, what can be achieved and then try to understand from them what they're looking for, what will help them with their retirement planning most," he added. "My sense is that there's a lot of flexibility in the provider market and there's a willingness to try to adopt and adapt products to fit the demand that's going to grow up, so let's have a demand-driven process and let's hear what participants have to say."