Overview:

1. After age 65, you can withdraw money from your HSA for any type of purchase (not just medical expenses) without penalty similar to a traditional IRA.

2. You can invest your HSA dollars.

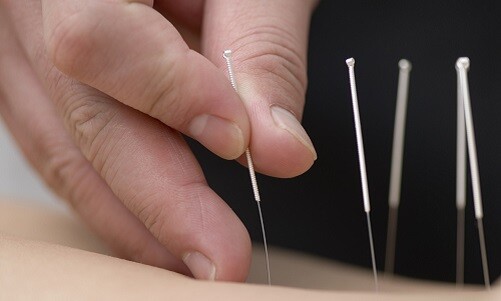

3. You can use HSA dollars to pay for things that arent covered by your insurance plan, such as acupuncture, dental, vision, chiropractic fees, travel costs (for medical care) and certain operations such as Lasik eye surgery.

4. You can make tax-deductible contributions to an HSA until April 15 (tax deadline) for the previous year.

5. You can pay now, cash in later. HSA members can hold onto their qualified health care expense receipts, and cash them in for a tax-free payout any time in the future.

6. If you dont use it, you wont lose it (as is the case with many FSAs).